Question: Currently holding a Hong Kong Type 1 regulated activity (1st license – Securities Trading) licensed representative license and having several years of experience. Now passed the Hong Kong Securities and Futures Practitioners Qualification Exam Paper 6 (HKSI LE Paper 6). Can they become a Responsible Officer (RO) for Type 1 regulated activity (1st license – Securities Trading) and Type 9 regulated activity (9th license – Asset Management)?

Answer:

This question can actually be divided into two questions:

Can they become a Responsible Officer (RO) for Type 1 regulated activity (1st license – Securities Trading)?

Can they become a Responsible Officer (RO) for Type 9 regulated activity (9th license – Asset Management)?

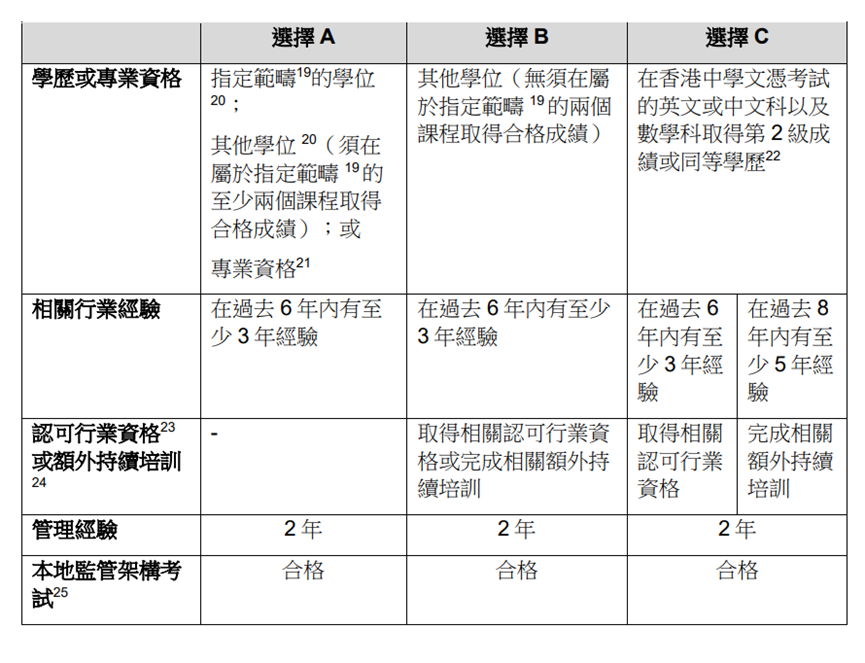

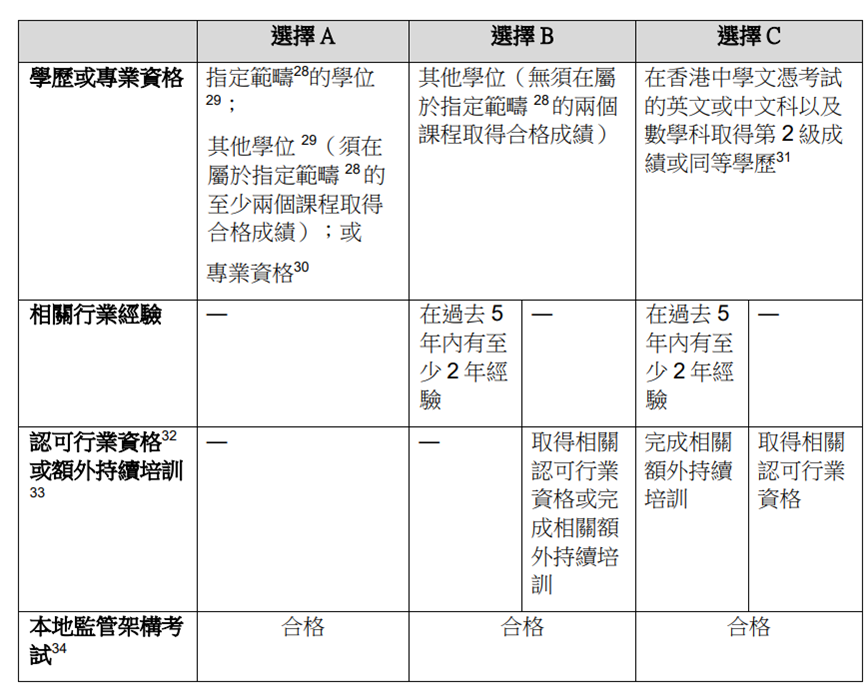

According to the SFC’s “Guidelines on Competence,” to become a Responsible Officer (RO), one must meet the following four requirements:

1.Education/Professional Qualification

The requirements for education for Responsible Officers (ROs) and licensed representatives are the same. If the applicant currently holds an SFC Type 1 license, their education level should at least be a Level 2, or Grade E or above, in English/Chinese and Mathematics in the Hong Kong Diploma of Secondary Education Examination, which meets the license application requirements for ROs.

2.Relevant Industry Experience

If the applicant has 3 years of relevant securities industry experience within the 6 years immediately preceding the application date, they can meet this requirement.

According to the SFC’s Circular on Clarifying Competence Requirements for Existing Licensees Intending to Provide Asset Management Services, the SFC will consider the applicant’s accumulated work experience in the financial industry when assessing whether they meet the experience requirements.

For example, if a Type 1 licensee is currently permitted to conduct asset management activities that are wholly incidental to their trading activities (such as discretionary account management), the SFC will consider the relevant experience when assessing the individual’s application to become a Responsible Officer for Type 9 regulated activities.

The SFC will also recognize other industry experience, such as research, private equity, and proprietary trading, as relevant experience.

Please note that the so-called industry experience does not only refer to the applicant’s license record and work experience in Hong Kong, experience accumulated in other countries or regions can also be taken into account.

3.Management Experience

Within the past 3 years of industry experience, the applicant for Responsible Officer also needs to have 2 years of management experience. Management experience refers to the experience of leading subordinates, and generally speaking, managing more than one subordinate is considered management experience.

4.Passing Local Regulatory Framework Examinations

For individuals applying to become Responsible Officers, the prescribed local regulatory framework examinations are related to each type of regulated activity.

For example, if one wants to engage in Type 9 regulated activity (Asset Management), they need to pass the Hong Kong Securities and Futures Practitioners Qualification Exam Paper 6 (HKSI LE Paper 6);

If one wants to engage in Type 1 regulated activity (Securities Trading) or Type 4 regulated activity (Advising on Securities), they need to pass the Hong Kong Securities and Futures Practitioners Qualification Exam Paper 2 (HKSI LE Paper 2).

Local regulatory framework examinations usually cannot be exempted.

Therefore, if the above RO applicant:

- Has more than 3 years of securities industry experience + 2 years of experience managing subordinates in their many years of work as a licensed representative,

- Has passed the Hong Kong Securities and Futures Practitioners Qualification Exam Paper 2 / HKSI LE Paper 2, they can apply to become a Responsible Officer for Type 1 regulated activity (1st license – Securities Trading).

Whether they can apply to become a Responsible Officer for Type 9 regulated activity (9th license – Asset Management) depends on whether they have relevant industry experience in asset management.

That is, if they engaged in related asset management activities while conducting Type 1 regulated activities, the SFC may consider the relevant asset management experience as experience for Type 9 regulated activities when applying for RO.

In this case, if the above RO applicant has more than 3 years of asset management industry experience + 2 years of experience managing subordinates in their many years of work as a licensed representative, and their passing of the Hong Kong Securities and Futures Practitioners Qualification Exam Paper 6 (HKSI LE Paper 6) is still within the 3-year validity period when applying for the license, they can also apply to become a Responsible Officer for Type 9 regulated activity (9th license – Asset Management).

However, if the applicant did not engage in any asset management-related activities while conducting Type 1 regulated activities and has no asset management experience at all, it is recommended to gain relevant industry experience before applying for the RO of Type 9 regulated activities.

Relevant industry experience can be obtained by becoming a licensed representative for Type 9 regulated activities or by engaging in any asset management activities.

In summary, the more prudent course of action for this applicant would be to first determine whether their work experience includes 3 years of asset management experience and then decide whether to take the HKSI LE Paper 6 exam.

How can we help?

2CExam provides HKSI LE, IIQE, EAQE and SQE related exam preparation materials. We sell mock question banks for HKSI LE Papers 1, 2, 3, 5, 6, 7, 8, 9, 12 in Chinese and English; and bibles for HKSI LE Papers 1, 2, 6, 7, 8 in Chinese. We also offer 1 on 1 tutorial services. Besides, we have also made free tutorial videos for HKSI LE Papers 1, 2, 6, 7, 8, 12 and posted on public channels such as Youtube/ Bilibili/ Tencent/ Iqiyi. 2CExam has been an exam training expert for years. Should you need any help please visit www.2cexam.com or contact us through:

Phone +852 2110 9644 Email: [email protected] Wechat: hk2cexam WhatsApp: +852 9347 2064

Please support us by leaving comments and likes if you think this article helps you!

You can scan or click on the QR codes to visit our social media.

Latest Article

Categories

過往文章

Contact US

-

Phone:

+852 2110 9644

-

Email:

-

WhatsApp

+852 9347 2064

-

WeChat

hk2cexam

Interesting Articles

10 Pros and Cons of Using the HKSI Official Study Notes

The HKSI LE study note has long been infamous amongst candidates. Its disadvantages include Too many words, too many typos, it takes a lot of time to read A lot of data will not actually appear in the exam The text is long, difficult to understand and dull The wording is vague and ambiguous. Some…

Numerous Celebrities, Including the Founder of KFC, Also Once Joined the Insurance Business Before Opening the Fried Chicken Shop!

Many well-known celebrities have worked in the insurance industry in their careers. Jack Ma, Asia’s richest man and chairman of the Alibaba Group, once said: “The mission of insurance is to give people a sense of security. Our lives are full of various risks and accidents, and insurance is to make people feel safe.” Let’s…

Why can’t you learn the practise questions by rote when studying for the IIQE Insurance Exam?

Students who have taken/ who are going to take the IIQE should know the study note is a several-hundred pages, paragraph form booklet illustrating the exam coverage. Not to mention the length of the text, the expression of concepts requires readers’ intense concentration. So some candidates think that doing only the practise questions should be…

Why can’t you learn the practise questions by rote when studying for the HKSI Licensing Examination (LE)?

Students who have taken/ who are going to take the HKSI LE should know the HKSI study note is a several-hundred pages, paragraph form booklet illustrating the exam coverage. Not to mention the length of the text, the expression of concepts requires readers’ intense concentration. So some candidates think that doing only the practise questions…

How to register for the IIQE Insurance Intermediary Qualifying Examination?

The IIQE exam should be registered at PEAK instead of the Insurance Regulatory Bureau. The IIQE exam places are quite sought-after. If students have an urgent need to take the exam, students should decide to register as soon as possible. The test period will be issued on a day between the 12th to 17th of…

How to register for the HKSI LE Securities and Futures Practitioner?

The HKSI LE exam must be registered at HKSI, but not the SFC. There are two methods for registration. The most popular one is online registration, followed by in-person registration. How to register for HKSI exam Register online: 1. To register for the exam, you must first register as a member of HKSI 2. Click…

Losing Friends and Family Is Inevitable Once Joined the Insurance Industry? 10 Benefits of Working in The Insurance Industry That Can Overturn Your Stereotypes

Must people in the insurance industry lose their friends and family? NO! It is not that you won’t have friends when you join the insurance industry. In fact, it depends on whether you use the correct method to sell. When you only care about commissions and don’t care about the needs of your customers, selling…

What kind of jobs can I get after I pass the IIQE Hong Kong Insurance Exam?

After passing the IIQE (Insurance Intermediary Qualifying Examination) in Hong Kong, students can start looking for jobs. What job options are there? Bank Relationship Manager (RM) / General Banking Officer (GBO) / Personal Banking Officer / Assistant Relationship Manager (ARM) Some sales positions in the bank, including Relationship Manager (RM) and their assistant – Assistant…

What job opportunities can I get in Hong Kong after passing the HKSI LE securities exam?

First, I would like to clarify that some people do not take the HKSI Licensing Examination (also known as LE exam) to find a job, but just to learn more about the financial/ securities market and equip themselves with the necessary knowledge in a compact and more organised way. This article will not cover information…

10 Benefits of Working in the Securities Industry Which Can Bring You a Whole New Perspective

Is there an insufficient supply of positions in the securities industry? There are contradictory opinions on the internet. Some say that the financial industry is in demand for talents; others say that the financial industry has burst, and there are too many monks with only a little porridge. From my experience in the recruitment industry…