Question: Currently holding a Hong Kong Type 1 regulated activity (1st license – Securities Trading) licensed representative license and having several years of experience. Now passed the Hong Kong Securities and Futures Practitioners Qualification Exam Paper 6 (HKSI LE Paper 6). Can they become a Responsible Officer (RO) for Type 1 regulated activity (1st license – Securities Trading) and Type 9 regulated activity (9th license – Asset Management)?

Answer:

This question can actually be divided into two questions:

Can they become a Responsible Officer (RO) for Type 1 regulated activity (1st license – Securities Trading)?

Can they become a Responsible Officer (RO) for Type 9 regulated activity (9th license – Asset Management)?

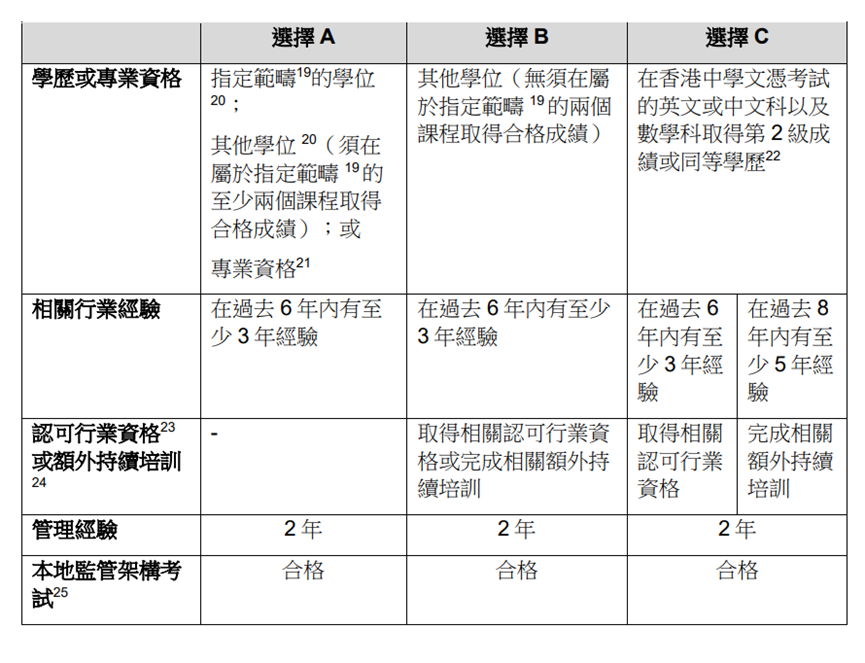

According to the SFC’s “Guidelines on Competence,” to become a Responsible Officer (RO), one must meet the following four requirements:

1.Education/Professional Qualification

The requirements for education for Responsible Officers (ROs) and licensed representatives are the same. If the applicant currently holds an SFC Type 1 license, their education level should at least be a Level 2, or Grade E or above, in English/Chinese and Mathematics in the Hong Kong Diploma of Secondary Education Examination, which meets the license application requirements for ROs.

2.Relevant Industry Experience

If the applicant has 3 years of relevant securities industry experience within the 6 years immediately preceding the application date, they can meet this requirement.

According to the SFC’s Circular on Clarifying Competence Requirements for Existing Licensees Intending to Provide Asset Management Services, the SFC will consider the applicant’s accumulated work experience in the financial industry when assessing whether they meet the experience requirements.

For example, if a Type 1 licensee is currently permitted to conduct asset management activities that are wholly incidental to their trading activities (such as discretionary account management), the SFC will consider the relevant experience when assessing the individual’s application to become a Responsible Officer for Type 9 regulated activities.

The SFC will also recognize other industry experience, such as research, private equity, and proprietary trading, as relevant experience.

Please note that the so-called industry experience does not only refer to the applicant’s license record and work experience in Hong Kong, experience accumulated in other countries or regions can also be taken into account.

3.Management Experience

Within the past 3 years of industry experience, the applicant for Responsible Officer also needs to have 2 years of management experience. Management experience refers to the experience of leading subordinates, and generally speaking, managing more than one subordinate is considered management experience.

4.Passing Local Regulatory Framework Examinations

For individuals applying to become Responsible Officers, the prescribed local regulatory framework examinations are related to each type of regulated activity.

For example, if one wants to engage in Type 9 regulated activity (Asset Management), they need to pass the Hong Kong Securities and Futures Practitioners Qualification Exam Paper 6 (HKSI LE Paper 6);

If one wants to engage in Type 1 regulated activity (Securities Trading) or Type 4 regulated activity (Advising on Securities), they need to pass the Hong Kong Securities and Futures Practitioners Qualification Exam Paper 2 (HKSI LE Paper 2).

Local regulatory framework examinations usually cannot be exempted.

Therefore, if the above RO applicant:

- Has more than 3 years of securities industry experience + 2 years of experience managing subordinates in their many years of work as a licensed representative,

- Has passed the Hong Kong Securities and Futures Practitioners Qualification Exam Paper 2 / HKSI LE Paper 2, they can apply to become a Responsible Officer for Type 1 regulated activity (1st license – Securities Trading).

Whether they can apply to become a Responsible Officer for Type 9 regulated activity (9th license – Asset Management) depends on whether they have relevant industry experience in asset management.

That is, if they engaged in related asset management activities while conducting Type 1 regulated activities, the SFC may consider the relevant asset management experience as experience for Type 9 regulated activities when applying for RO.

In this case, if the above RO applicant has more than 3 years of asset management industry experience + 2 years of experience managing subordinates in their many years of work as a licensed representative, and their passing of the Hong Kong Securities and Futures Practitioners Qualification Exam Paper 6 (HKSI LE Paper 6) is still within the 3-year validity period when applying for the license, they can also apply to become a Responsible Officer for Type 9 regulated activity (9th license – Asset Management).

However, if the applicant did not engage in any asset management-related activities while conducting Type 1 regulated activities and has no asset management experience at all, it is recommended to gain relevant industry experience before applying for the RO of Type 9 regulated activities.

Relevant industry experience can be obtained by becoming a licensed representative for Type 9 regulated activities or by engaging in any asset management activities.

In summary, the more prudent course of action for this applicant would be to first determine whether their work experience includes 3 years of asset management experience and then decide whether to take the HKSI LE Paper 6 exam.

How can we help?

2CExam provides HKSI LE, IIQE, EAQE and SQE related exam preparation materials. We sell mock question banks for HKSI LE Papers 1, 2, 3, 5, 6, 7, 8, 9, 12 in Chinese and English; and bibles for HKSI LE Papers 1, 2, 6, 7, 8 in Chinese. We also offer 1 on 1 tutorial services. Besides, we have also made free tutorial videos for HKSI LE Papers 1, 2, 6, 7, 8, 12 and posted on public channels such as Youtube/ Bilibili/ Tencent/ Iqiyi. 2CExam has been an exam training expert for years. Should you need any help please visit www.2cexam.com or contact us through:

Phone +852 2110 9644 Email: [email protected] Wechat: hk2cexam WhatsApp: +852 9347 2064

Please support us by leaving comments and likes if you think this article helps you!

You can scan or click on the QR codes to visit our social media.

Latest Article

Categories

過往文章

Contact US

-

Phone:

+852 2110 9644

-

Email:

-

WhatsApp

+852 9347 2064

-

WeChat

hk2cexam

Interesting Articles

Why would it be a disadvantage for foreigners to take the IIQE exam?

Some students who have taken the exams several times may pay attention to both the Chinese and English questions simultaneously, they will find that the content of the questions in Chinese or English exam is actually the same. Sometimes the topics are more difficult to understand in Chinese, and some topics are more difficult…

Why is it a disadvantage for foreigners to take the HKSI LE securities exam?

The HKSI LE exam provides two languages, Chinese and English, and both are provided during the exam. Some students who have taken the exams several times may pay attention to both the Chinese and English questions simultaneously, they will find that the content of the questions in Chinese or English exams is actually…

Which IIQE exam is easier? The English version or the Chinese version?

From time to time, students who purchase mock questions will ask us whether it is better to take the IIQE exam in Chinese or English? Some students who have taken the exams several times may pay attention to both the Chinese and English questions simultaneously. They will find that the content of the…

Is the HKSI LE exam easier to take in English? Or in Chinese?

From time to time, students who purchase mock questions will ask us whether it is better to take the HKSI LE exam in Chinese or English? If you have taken the exams several times and have paid attention to both the Chinese and English questions, you will find that the content of the…

Can I obtain an insurance license from the Insurance Authority (IA) without taking any examination if I have a foreign professional qualification?

Does the IA recognize insurance-related work experience gained outside of Hong Kong? Some students will ask us what kind of work experience is considered as insurance related industry experience, because their academic qualifications do not meet the requirements. Some people might have the misconception, thinking that without a license, how can one have industry…

Can I apply for a real estate license from the EAA Estate Agent Authority if I have a criminal record?

To apply for a real estate business license, you need to meet the “fit and proper” guidelines issued by the Estate Agent Authority (EAA). Estate Agent Authority will explore your past criminal records including but not limited to rigging, fraud or other dishonest acts, such as theft, handling stolen goods, using false documents, leaving…

Can I apply for an insurance license from the Insurance Authority if I have criminal records?

To apply for an insurance license, you need to meet the “Fit and Proper” Guidelines issued by the Insurance Authority (IA). The IA will look into your past criminal records, the Monetary Authority / Securities and Futures Commission / MPFA / other relevant agencies’ sanction records, as well as whether there are any places…

If I have a criminal record, can I still apply for the SFC’s securities license?

To apply for a securities license, you need to meet the Guidelines on Competence issued by the Securities and Futures Commission. Among them, the SFC will explore your past criminal records, whether you have ever had disciplinary actions, known frauds, misrepresentations, etc. in other licensed corporations in the past. In other words, past…

What is counted as relevant industry experience under the IA license transition arrangements?

One of the most repercussive reforms after the Insurance Authority took over the supervision of the insurance industry is the change of the minimum academic qualification requirement from Secondary school form 5 level to passing 5 subjects in the Hong Kong Certificate of Education Examination (HKCEE) / Hong Kong Diploma of Secondary Education (HKDSE),…

Minimum academic requirements for applying for an EAA license

Is there a minimum education requirement for the real estate industry? The conditions for the licensing of the real estate industry are included in the “Fit and proper person to hold a licence” guidelines issued by the Estate Agent Authority (EAA). All real estate agents and salespersons who wish to be licensed must…