Which paper should I take for the HKSI?

The Hong Kong Securities and Futures Practitioners Qualification Exam (HKSI LE) is one of the most popular exams in the Hong Kong financial market, mainly testing individuals' professional knowledge and capabilities in securities and investments in order to obtain a practice license in the securities and investment industry.

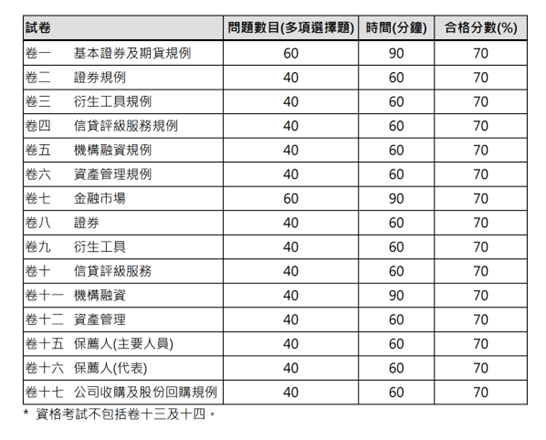

The HKSI LE exam currently has 15 different papers, divided into regulatory papers, application papers, and sponsor papers.

Candidates usually need to pass the regulatory papers plus the application/sponsor papers in order to participate in the SFC-regulated activities.

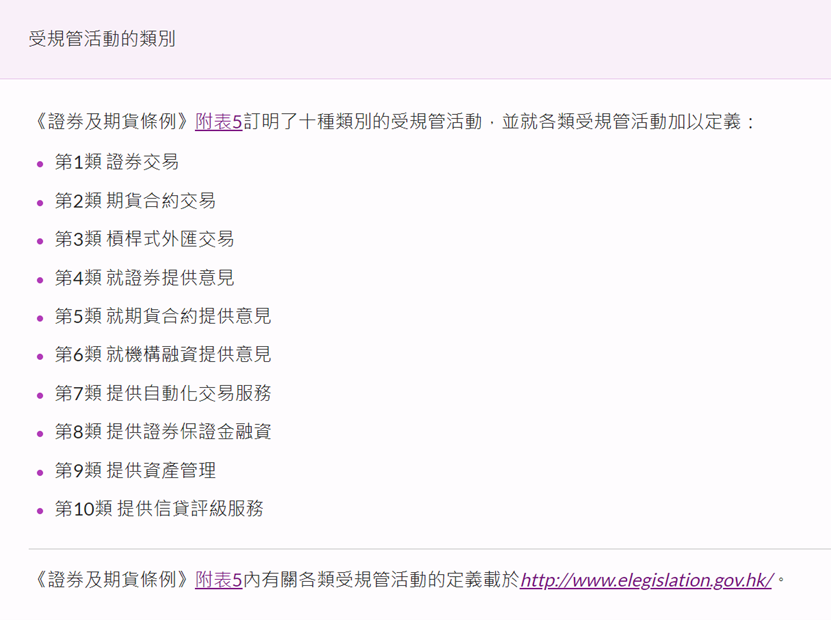

Schedule 5 of the Securities and Futures Ordinance specifies ten categories of regulated activities:

To participate in various regulated activities, you need to pass different combinations of HKSI exam papers. The required papers may vary depending on the category of the licensed individual (licensed representative, responsible officer).

Therefore, first of all, you need to know that the paper number and the category of regulated activities do not have a one-to-one correspondence! So, you cannot simply take the paper with the same number as the desired activity category.

Secondly, you can also check if you are eligible for exemptions. For information on exemptions, you can refer to "How to Obtain Exemptions for HKSI Securities and Futures Practitioners Exam."

So, which papers should I take if I want to buy and sell stocks and other securities for clients and earn commissions?

Engaging in securities trading at brokerage firms or banks, collecting clients' commissions for buying or selling securities, including stocks in Hong Kong, the United States, Japan, Taiwan, and mainland China markets, and bonds such as inflation-linked bonds (iBonds), require a Type 1 license (Type 1) for licensed individuals to conduct.

If you have no industry experience and cannot be exempted, and want to engage in Type 1 activities, you need to take HKSI LE Papers 1, 7, and 8 to become a Licensed Representative (LR). If you want to become a Type 1 Responsible Officer (RO), you also need to take HKSI LE Paper 2.

If you want to buy and sell futures and options contracts for clients and earn commissions, which papers should you take?

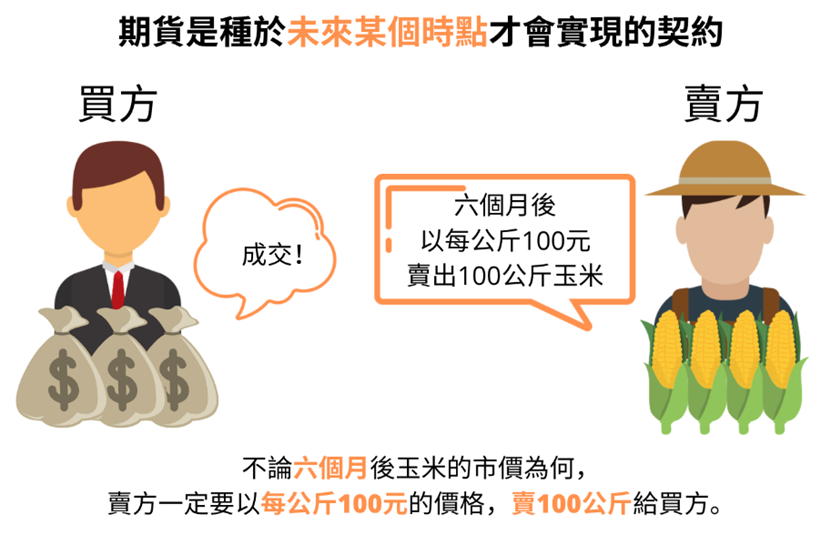

Buying and selling futures contracts, options, and other derivative instruments for clients, including agricultural futures, metal futures, Hang Seng Index futures, interest rate futures, stock futures, foreign exchange futures, stock call or put options, etc., fall under Type 2 regulated activities. To engage in these activities, you need to be a licensed representative with a Type 2 license.

If you have no industry experience and cannot be exempted, and you wish to engage in Type 2 activities, you need to take the HKSI LE Papers 1, 7, and 9 to become a licensed representative (LR). If you want to become a responsible officer (RO) for Type 2 activities, you also need to take HKSI LE Paper 3.

If you want to buy and sell leveraged foreign exchange for clients and earn commissions, which papers should you take?

Buying and selling leveraged foreign exchange products for clients and earning commissions fall under Type 3 regulated activities. To engage in these activities, you need to be a licensed representative with a Type 3 license. To engage in Type 3 regulated activities, you don't need to take any HKSI LE papers; instead, you need to take a leveraged foreign exchange exam.

If you want to provide advice on buying and selling securities (such as stocks) to clients, which paper should you take?

Providing advice on buying and selling securities (such as stocks and bonds) to clients and charging fees for it falls under Type 4 regulated activities. You need to be a licensed representative with a Type 4 license to engage in these activities. If you have no industry experience and cannot be exempted, but want to become a licensed representative (LR) to engage in Type 4 activities, you need to take HKSI LE Papers 1, 7, and 8. If you want to become a Type 4 Responsible Officer (RO), you also need to take HKSI LE Paper 2.

If you want to provide advice on buying and selling futures and options to clients for a fee, which paper should you take?

Providing advice to clients on trading futures and options contracts and charging fees for such activities falls under Type 5 regulated activity, which requires Type 5 license holders to engage in. If you have no industry experience and cannot be exempted, but wish to become a licensed representative (LR) and engage in Type 5 activities, you need to take HKSI LE Papers 1, 7, and 9. If you want to become a responsible officer (RO) for Type 5, you also need to take HKSI LE Paper 3.

If you wish to provide financing services for institutions (raising funds), you should take which exam paper?

If you wish to engage in Type 6 regulated activity, which involves designing different ways for corporations to raise capital, you need to hold a Type 6 license. If you have no industry experience and cannot be exempted, and want to become a licensed representative (LR) for Type 6 activities, you need to pass HKSI LE Papers 1, 7, and 11. If you want to become a responsible officer (RO) for Type 6, you also need to pass HKSI LE Paper 5.

If you wish to operate automated trading (such as dark pools and virtual currencies), which type of exam should you take?

Engaged in dark pool trading or operating an online trading platform in Hong Kong with a license issued by the SFC, and providing trading services for one or more virtual assets that meet the SFC's definition of "securities" on the platform, also known as "cryptocurrencies", "cryptographic assets", "virtual currencies" or "digital tokens", belongs to the Type 7 regulated activity. If you only want to engage in Type 7 activities, you do not need to take any HKSI LE Paper.

What exam should I take if I want to provide securities margin financing (margin trading)?

If you provide clients with securities margin financing (commonly known as "margin trading"), unless it is wholly incidental to other activities, you should apply to be licensed as a Type 8 regulated activity. If you do not have industry experience and cannot be exempted, but wish to engage in Type 8 activities as a licensed representative (LR), you need to pass HKSI LE Papers 1, 7, and 8.

If you want to become a Type 8 responsible officer (RO), you also need to pass HKSI LE Paper 2.

If you wish to engage in asset management business (such as managing funds or discretionary accounts), which paper should you take?

If you wish to engage in asset management business, such as managing the investment portfolios of funds or discretionary accounts, you should apply to be licensed as a Type 9 regulated activity.

How can we help?

2CExam provides HKSI LE, IIQE, EAQE and SQE related exam preparation materials. We sell mock question banks for HKSI LE Papers 1, 2, 3, 5, 6, 7, 8, 9, 12 in Chinese and English; and bibles for HKSI LE Papers 1, 2, 6, 7, 8 in Chinese. We also offer 1 on 1 tutorial services. Besides, we have also made free tutorial videos for HKSI LE Papers 1, 2, 6, 7, 8, 12 and posted on public channels such as Youtube/ Bilibili/ Tencent/ Iqiyi. 2CExam has been an exam training expert for years. Should you need any help please visit www.2cexam.com or contact us through:

Phone +852 2110 9644 Email: [email protected] Wechat: hk2cexam WhatsApp: +852 9347 2064

Please support us by leaving comments and likes if you think this article helps you!

You can scan or click on the QR codes to visit our social media.

Latest Article

Categories

過往文章

Contact US

-

Phone:

+852 2110 9644

-

Email:

-

WhatsApp

+852 9347 2064

-

WeChat

hk2cexam

Interesting Articles

Which license is required for bank employees engaged in securities business?

Should Hong Kong bank employees apply for an HKMA license or an SFC license? According to the licensing requirements for real estate practitioners, passing relevant qualification exams is a necessary condition for obtaining a real estate agent (individual) license or a salesperson license. The Hong Kong Securities and Futures Practitioners Qualification Exam (HKSI LE) is…

What is the difference between an SFC license and HKMA registration in Hong Kong?

What is the difference between an SFC license and HKMA registration in Hong Kong? In Hong Kong, the statutory organization responsible for regulating the securities and futures markets is the Securities and Futures Commission (SFC). The Securities and Futures Ordinance, which came into effect on April 1, 2003, grants the SFC regulatory authority over the…

What is an HKSI certificate?

What is an HKSI certificate? What is the use of an HKSI exam transcript? What is an HKSI certificate? Do I need an HKSI exam transcript or an HKSI certificate when applying for SFC registration? To work in the securities industry in Hong Kong, passing the Hong Kong Securities and Futures Commission (SFC) Licensing Exam…

How to obtain an exemption for the HKSI LE Securities and Futures Practitioners Qualification Examination?

How to obtain an exemption for the HKSI LE Securities and Futures Practitioners Qualification Examination? In the previous issue, we talked about how if someone wants to work in the securities industry in Hong Kong, they must first pass the Hong Kong Securities and Investment Institute’s (HKSI) Licensing Examination for Securities and Futures Intermediaries. Are…

Where can I register for securities exams in Hong Kong?

Where can I register for securities exams in Hong Kong? If you want to work in the securities industry in Hong Kong, you must pass the Securities and Futures Commission (SFC) Licensing Exam LE. The organization that conducts the Licensing Exam LE in Hong Kong is the Hong Kong Securities and Investment Institute (HKSI). The Hong…

Often hear the beautiful ladies and handsome gentlemen in the Hong Kong financial sector talking about the “178 license” they need to obtain. What exactly is it?

What is the Hong Kong 178 license? In fact, the 178 license is not a real license but refers to a combination of examination papers that need to be taken. It consists of the Hong Kong Securities and Futures Practitioners Qualification Examination Paper 1, Paper 7, and Paper 8. In Hong Kong, activities related to…

What is the SFC license in Hong Kong?

What is the SFC license in Hong Kong? The Securities and Futures Commission (SFC) of Hong Kong was established in 1989 as an independent statutory body responsible for regulating the securities and futures markets in Hong Kong. The Securities and Futures Ordinance and its subsidiary legislation grant the SFC the power to investigate, correct, and…

Why do people still buy materials from 2CExam while HKSI provides free study notes?

In addition to organizing LE exams, the HKSI will also provide students who take the LE exam with the exam coverage called the Study Note. It depicts what is covered in the exam with hundreds of pages and full of paragraphs. It is lengthy and contains a lot of data and examples that will not…

EAQE/ SQE Real Estate Agency Exam Coverage/ Scope for Revision

Many students are clueless about the exam coverage / scope for doing revision on the Estate Agent Qualifying Examination (EAQE) and Salesperson Qualifying Examination (SQE). VTC’s PEAK does not have any notes available for candidates to download. In fact, the scope of the exam is quite extensive. Some of the coverage can be downloaded from…

Is success an Unattainable Ideal in the Real Estate Industry? 10 Benefits of Being in the Real Estate Industry Can Stimulate Your Capacity

Is it difficult to succeed in the real estate industry? Living space is one of the indispensable elements in life. From the wealthy speculating and selling flats to ordinary people looking for a place to live, most Hong Kong people have the demand to rent or even invest in the real estate market. Hong Kong’s…