What is a Hong Kong Insurance Intermediary?

In Hong Kong, the business of selling, advising, and servicing insurance products is regulated by the Insurance Authority (IA).

According to section 64G of the Insurance Ordinance, no person may carry on a regulated activity in the course of his business or employment, or hold himself out as carrying on a regulated activity, for remuneration, unless the person is a licensed insurance intermediary or an exempt person under the Insurance Ordinance. Any person who contravenes section 64G of the Insurance Ordinance commits an offence.“

Therefore, in Hong Kong, anyone must obtain a license from the IA to become a licensed insurance intermediary in order to engage in insurance sales and promotion activities.

A Licensed Insurance Intermediary refers to professionals in Hong Kong who are engaged in selling, advising, and servicing insurance products. Their main duties include understanding customer needs, selling insurance products, providing after-sales services, and coordinating with insurance companies.

Individual licensed insurance intermediaries are divided into three categories: Licensed Individual Insurance Agents, Licensed Business Representatives (Agents), and Licensed Business Representatives (Brokers).

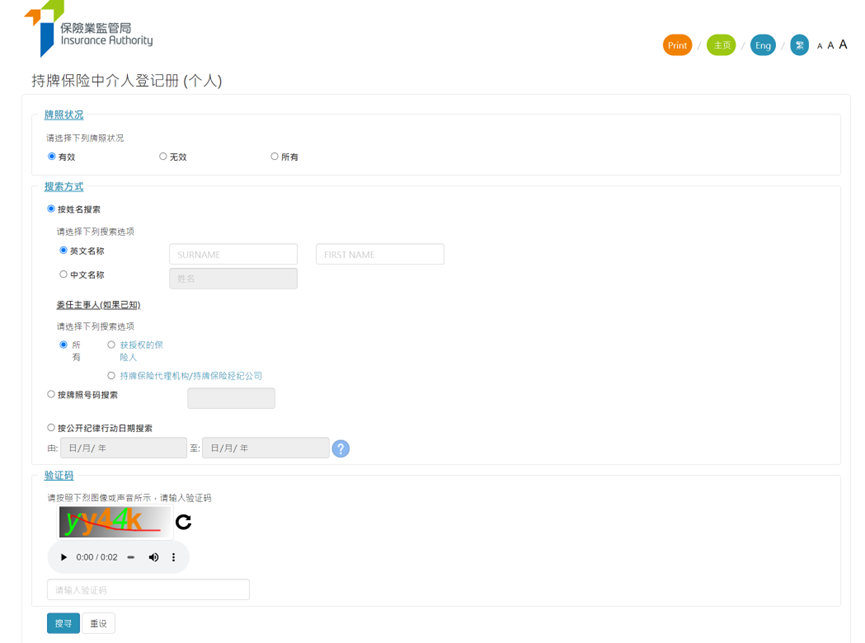

The information of licensed insurance intermediaries can be checked in the Register of Licensed Insurance Intermediaries of the IA.

How to become a Licensed Insurance Intermediary in Hong Kong?

The IA stipulates that whether it is a Licensed Individual Insurance Agent, Licensed Business Representative (Agent), or Licensed Business Representative (Broker), the applicant must:

- Meet the educational requirements specified in the Guidelines on the “Fit and Proper” Criteria for Licensed Insurance Intermediaries under the Insurance Ordinance (Cap. 41) (Guideline 23);

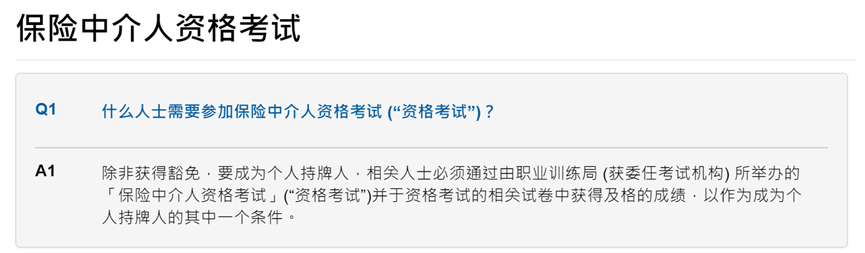

- Unless exempted, meet the requirements of the insurance intermediary qualification examination;

- Have a creditable reputation and financial status.

Therefore, if you want to enter the Hong Kong insurance industry, you must pass the insurance intermediary qualification examination and apply for a corresponding license from the IA within the validity period of the score to become a licensed insurance intermediary before you can officially start insurance business.

What is the Hong Kong Insurance Intermediary Qualification Examination?

The Insurance Intermediaries Qualifying Examination (IIQE), is a test stipulated by the Insurance Authority of Hong Kong to ensure that insurance intermediaries have the necessary professional knowledge and abilities, thereby protecting consumers’ interests and maintaining the stability and fairness of the insurance market.

Passing the IIQE is a necessary condition for Hong Kong insurance intermediaries to obtain a license, and it is also one of the thresholds for entering the Hong Kong insurance industry.

What is the minimum educational requirement to apply to become a licensed insurance intermediary?

According to the Insurance Ordinance, a licensed insurance intermediary must be a fit and proper person.

According to the Guidelines on the “Fit and Proper” Criteria for Licensed Insurance Intermediaries under the Insurance Ordinance (Cap. 41) (“Guideline 23”), an applicant for an individual licensed insurance intermediary (i.e., a licensed individual insurance agent, a licensed business representative (agent), or a licensed business representative (broker)) must have one of the following educational or professional qualifications:

- Hong Kong Diploma of Secondary Education (“DSE”) or Hong Kong Certificate of Education Examination (“HKCEE”) – Passes in five subjects, including Chinese Language / English Language and Mathematics;

- International Baccalaureate;

- Yi Jin Diploma – Applicants should take Extended Mathematics as an elective;

- For Mainland China’s Gaokao, the score in the relevant province / city must be at or above the “Second Class Line”; or the scores in Chinese / English and Mathematics must be 50% or above; and the total score in Gaokao must be 50% or above; and an official certification of the Gaokao score must be obtained from the “XueXin Network”.

How many papers are there in the Hong Kong Insurance Intermediary Qualification Examination?

The Insurance Intermediaries Qualifying Examination consists of five papers:

• Principles and Practice of Insurance Paper (Paper I, IIQE Paper 1)

• General Insurance Paper (Paper II, IIQE Paper 2)

• Long Term (Life) Insurance Paper (Paper III, IIQE Paper 3)

• Investment-linked Long Term (Life) Insurance Paper (Paper V, IIQE Paper 5)

• Travel Insurance Agents Examination Paper (Paper VI, IIQE Paper 6)

Unless exempted, those intending to engage in:

- General insurance intermediary business must pass the Principles and Practice of Insurance Examination (Paper I, IIQE Paper 1) and the General Insurance Examination (Paper II, IIQE Paper 2).

- Long-term insurance (excluding linked long-term insurance) intermediary business must pass the Principles and Practice of Insurance Examination (Paper I, IIQE Paper 1) and the Long Term (Life) Insurance Examination (Paper III, IIQE Paper 3).

- Long-term insurance (including linked long-term insurance) intermediary business must pass the Principles and Practice of Insurance Examination (Paper I, IIQE Paper 1), the Long Term (Life) Insurance Examination (Paper III, IIQE Paper 3), and the Investment-linked Long Term (Life) Insurance Examination (Paper V, IIQE Paper 5).

- Composite insurance (excluding linked long-term insurance) intermediary business must pass the Principles and Practice of Insurance Examination (Paper I, IIQE Paper 1), the General Insurance Examination (Paper II, IIQE Paper 2), and the Long Term (Life) Insurance Examination (Paper III, IIQE Paper 3).

- Composite insurance (including linked long-term insurance) intermediary business must pass the Principles and Practice of Insurance Examination (Paper I, IIQE Paper 1), the General Insurance Examination (Paper II, IIQE Paper 2), the Long Term (Life) Insurance Examination (Paper III, IIQE Paper 3), and the Investment-linked Long Term (Life) Insurance Examination (Paper V, IIQE Paper 5).

- Travel insurance agency business must pass the Travel Insurance Agents Examination (Paper VI, IIQE Paper 6).

| Exam PaperBusiness category | I | II | III | V | VI |

| General Insurance | ✓ | ✓ | |||

| Long Term Insurance (excluding linked) | ✓ | ✓ | |||

| Long Term Insurance (including linked) | ✓ | ✓ | ✓ | ||

| Composite Insurance (excluding linked) | ✓ | ✓ | ✓ | ||

| Composite Insurance (including linked) | ✓ | ✓ | ✓ | ✓ | |

| Travel Insurance Agent | ✓ |

Where can I take the exam for Qualification Examination for Insurance Intermediaries – Paper V: Investment-Linked Long Term Insurance?

The Insurance Intermediaries Qualifying Examination IIQE Paper 5, “Investment-linked Long Term Insurance”, is administered by the Professional Education and Knowledge (PEAK) division of the Vocational Training Council (VTC) in Hong Kong. The exam can be taken as a written test, computer test, or a remote examination.

Exam format: Multiple-choice questions

Language: Bilingual (Chinese and English)

Number of questions: 80 questions

Duration: 2 hours

Fee: Computer Test $250; Written Test $185; Remote Examination $850

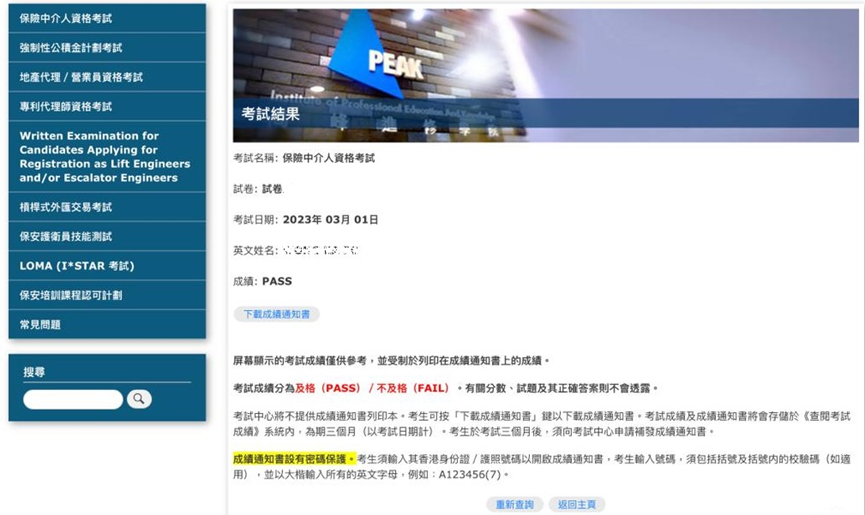

Exam Result: “Pass” or “Fail”

The passing score is 70%, and candidates must answer 56 questions correctly to achieve a passing grade. The result notification will not show the specific score, nor will it publish the questions and their correct answers.

The examination syllabus for the Insurance Intermediaries Qualifying Examination IIQE Paper 5 “Investment-linked Long Term Insurance” in Hong Kong is as follows:

| Chapter & Title | Weightage |

| Chapter 1 Introduction to Investment-linked Long Term Policies | 2.5% |

| Chapter 2 Investments | 20% |

| Chapter 3 Investment Assets | 35% |

| Chapter 4 Investment-linked Long Term Policies | 32.5% |

| Chapter 5 Regulatory Framework in Hong Kong | 10% |

| Total | 100% |

The registration link for the “Investment-linked Long Term Insurance” exam organized by the PEAK of VTC, the Vocational Training Council, is as follows: https://www.peak.edu.hk/exam/econline/zh/

Please note that candidates who pass the remote examination will need to within 18 months from the date of the exam:

1. Complete the special training course for the relevant qualifying examination paper operated by the Vocational Training Council (part of the continuing professional training hours can be obtained after the completion of the course); or

2.Take the relevant paper of the original qualifying exam and pass it.

Otherwise, the license will expire at the end of the 18-month period.

How to get the score notice?

For candidates taking the “Investment-linked Long Term Insurance” exam at the PEAK Exam Center of the Vocational Training Council:

1.For candidates taking the “Investment-linked Long Term Insurance” exam at the PEAK Exam Center of the Vocational Training Council:

2.Computer Exam

The computer exam results will be displayed on the computer screen immediately after the exam.

Candidates can download and print the score notice from the “Check Exam Results” system on the exam center webpage one hour after the specified end time of the exam.

3.Remote Exam

The remote exam results will be displayed on the computer screen of the exam device immediately after the exam.

Candidates can view, download, and print the score notice from the “Check Exam Results” system on the exam center webpage starting from the third complete working day after the exam.

Please note that the exam center does not provide printed copies of the score notice. The exam results and score notices will only be stored in the “Check Exam Results” system for a period of three months (calculated from the date of the exam).

Where to find free study materials for the Insurance Intermediaries Qualifying Examination Paper V “Investment-linked Long Term Insurance”?

1.Official Study Manual

The IA has prepared the “Investment-linked Long Term Insurance Exam Study Manual” to assist candidates in their exam preparation. Candidates can download it for free from the IA and PEAK websites.

IA free download link:

PEAK free download link:

2.Free teaching videos on Youtube

3.Free exercises

It’s worth noting that the “Investment-linked Long Term Insurance Exam Study Manual” has a total of 339 pages and covers a broad range of topics. Short-term memory can be relatively unreliable, and it can be challenging to remember so many concepts that have not been understood through rote memorization. There’s a good chance that by the time you finish the whole book, you would have forgotten most of what was in the first half.

Also, the questions that are selected for each exam may not be the same, and there can be a significant element of luck.

Therefore, when preparing for the IIQE exam, you should make sure you fully understand the syllabus and requirements, formulate an appropriate study plan, and actively participate in mock exams to improve your test-taking abilities.

Therefore, our suggested revision method is:

1.First read a chapter of the study manual/free instructional video

2.Complete the practice exercises for a chapter of the mock test.

This is to reinforce the understanding and memorization of knowledge repeatedly.

Lastly, good luck with your exam! We hope you pass with flying colors!

How can we help?

2CExam provides HKSI LE, IIQE, EAQE and SQE related exam preparation materials. We sell mock question banks for HKSI LE Papers 1, 2, 3, 5, 6, 7, 8, 9, 12 in Chinese and English; and bibles for HKSI LE Papers 1, 2, 6, 7, 8 in Chinese. We also offer 1 on 1 tutorial services. Besides, we have also made free tutorial videos for HKSI LE Papers 1, 2, 6, 7, 8, 12 and posted on public channels such as Youtube/ Bilibili/ Tencent/ Iqiyi. 2CExam has been an exam training expert for years. Should you need any help please visit www.2cexam.com or contact us through:

Phone +852 2110 9644 Email: [email protected] Wechat: hk2cexam WhatsApp: +852 9347 2064

Please support us by leaving comments and likes if you think this article helps you!

You can scan or click on the QR codes to visit our social media.

Latest Article

Categories

過往文章

Contact US

-

Phone:

+852 2110 9644

-

Email:

-

WhatsApp

+852 9347 2064

-

WeChat

hk2cexam

Interesting Articles

Why would it be a disadvantage for foreigners to take the IIQE exam?

Some students who have taken the exams several times may pay attention to both the Chinese and English questions simultaneously, they will find that the content of the questions in Chinese or English exam is actually the same. Sometimes the topics are more difficult to understand in Chinese, and some topics are more difficult…

Why is it a disadvantage for foreigners to take the HKSI LE securities exam?

The HKSI LE exam provides two languages, Chinese and English, and both are provided during the exam. Some students who have taken the exams several times may pay attention to both the Chinese and English questions simultaneously, they will find that the content of the questions in Chinese or English exams is actually…

Which IIQE exam is easier? The English version or the Chinese version?

From time to time, students who purchase mock questions will ask us whether it is better to take the IIQE exam in Chinese or English? Some students who have taken the exams several times may pay attention to both the Chinese and English questions simultaneously. They will find that the content of the…

Is the HKSI LE exam easier to take in English? Or in Chinese?

From time to time, students who purchase mock questions will ask us whether it is better to take the HKSI LE exam in Chinese or English? If you have taken the exams several times and have paid attention to both the Chinese and English questions, you will find that the content of the…

Can I obtain an insurance license from the Insurance Authority (IA) without taking any examination if I have a foreign professional qualification?

Does the IA recognize insurance-related work experience gained outside of Hong Kong? Some students will ask us what kind of work experience is considered as insurance related industry experience, because their academic qualifications do not meet the requirements. Some people might have the misconception, thinking that without a license, how can one have industry…

Can I apply for a real estate license from the EAA Estate Agent Authority if I have a criminal record?

To apply for a real estate business license, you need to meet the “fit and proper” guidelines issued by the Estate Agent Authority (EAA). Estate Agent Authority will explore your past criminal records including but not limited to rigging, fraud or other dishonest acts, such as theft, handling stolen goods, using false documents, leaving…

Can I apply for an insurance license from the Insurance Authority if I have criminal records?

To apply for an insurance license, you need to meet the “Fit and Proper” Guidelines issued by the Insurance Authority (IA). The IA will look into your past criminal records, the Monetary Authority / Securities and Futures Commission / MPFA / other relevant agencies’ sanction records, as well as whether there are any places…

If I have a criminal record, can I still apply for the SFC’s securities license?

To apply for a securities license, you need to meet the Guidelines on Competence issued by the Securities and Futures Commission. Among them, the SFC will explore your past criminal records, whether you have ever had disciplinary actions, known frauds, misrepresentations, etc. in other licensed corporations in the past. In other words, past…

What is counted as relevant industry experience under the IA license transition arrangements?

One of the most repercussive reforms after the Insurance Authority took over the supervision of the insurance industry is the change of the minimum academic qualification requirement from Secondary school form 5 level to passing 5 subjects in the Hong Kong Certificate of Education Examination (HKCEE) / Hong Kong Diploma of Secondary Education (HKDSE),…

Minimum academic requirements for applying for an EAA license

Is there a minimum education requirement for the real estate industry? The conditions for the licensing of the real estate industry are included in the “Fit and proper person to hold a licence” guidelines issued by the Estate Agent Authority (EAA). All real estate agents and salespersons who wish to be licensed must…