What is the difference between an SFC license and HKMA registration in Hong Kong?

In Hong Kong, the statutory organization responsible for regulating the securities and futures markets is the Securities and Futures Commission (SFC).

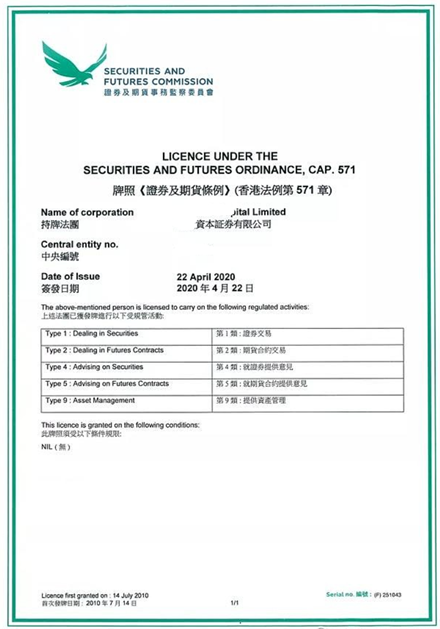

The Securities and Futures Ordinance, which came into effect on April 1, 2003, grants the SFC regulatory authority over the securities and futures markets in Hong Kong, including the important function of "licensing and regulating intermediaries engaged in regulated activities". According to the Securities and Futures Ordinance, unless exempted, anyone who carries on a regulated activity in the securities and futures markets or in the non-bank retail leveraged foreign exchange market in Hong Kong, or who holds themselves out as carrying on such activities, must obtain a license or registration from the SFC in accordance with the relevant provisions of the Securities and Futures Ordinance, or they will be committing a serious offense.

Schedule 5 of the Securities and Futures Ordinance specifies ten categories of regulated activities.

In brief, if a company or individual wants to engage in regulated activities such as securities trading, futures contracts trading, or asset management, they must obtain the qualifications from the SFC to conduct such regulated activities.

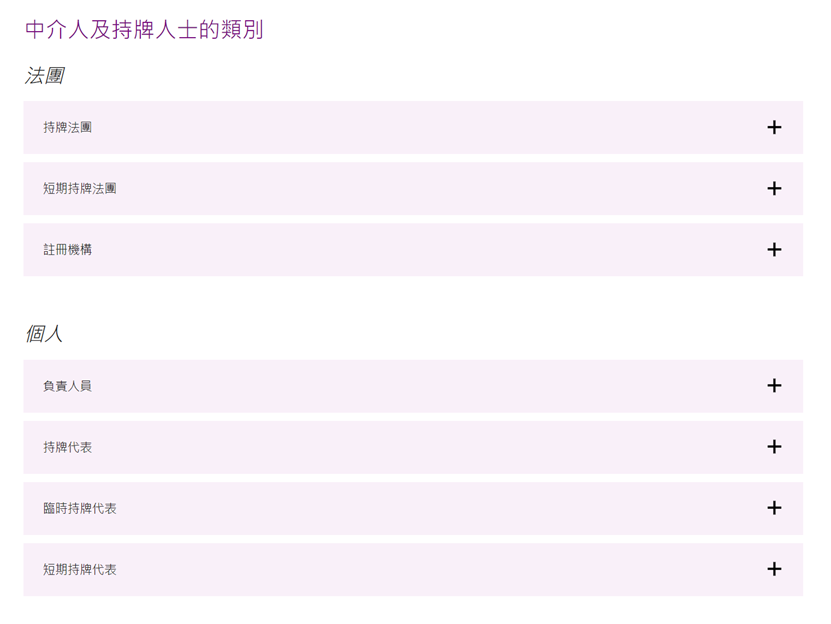

This qualification is divided into two types:

Obtaining an SFC license to become a licensed corporation or licensed person;

Registering to become a registered institution or registered person, that is, obtaining the so-called HKMA license in the industry.

So how do you determine which type of license to apply for?

According to sections 116 and 117 of the Securities and Futures Ordinance, non-licensed financial institutions become licensed corporations (LCs) once they apply for and obtain a license from the SFC.

Individuals who are engaged in regulated activities under a licensed corporation are known as licensed representatives (LRs) after obtaining a license issued by the Securities and Futures Commission (SFC).

After being approved by the SFC, the licensed representative becomes a responsible officer (RO) responsible for supervising regulated activities.

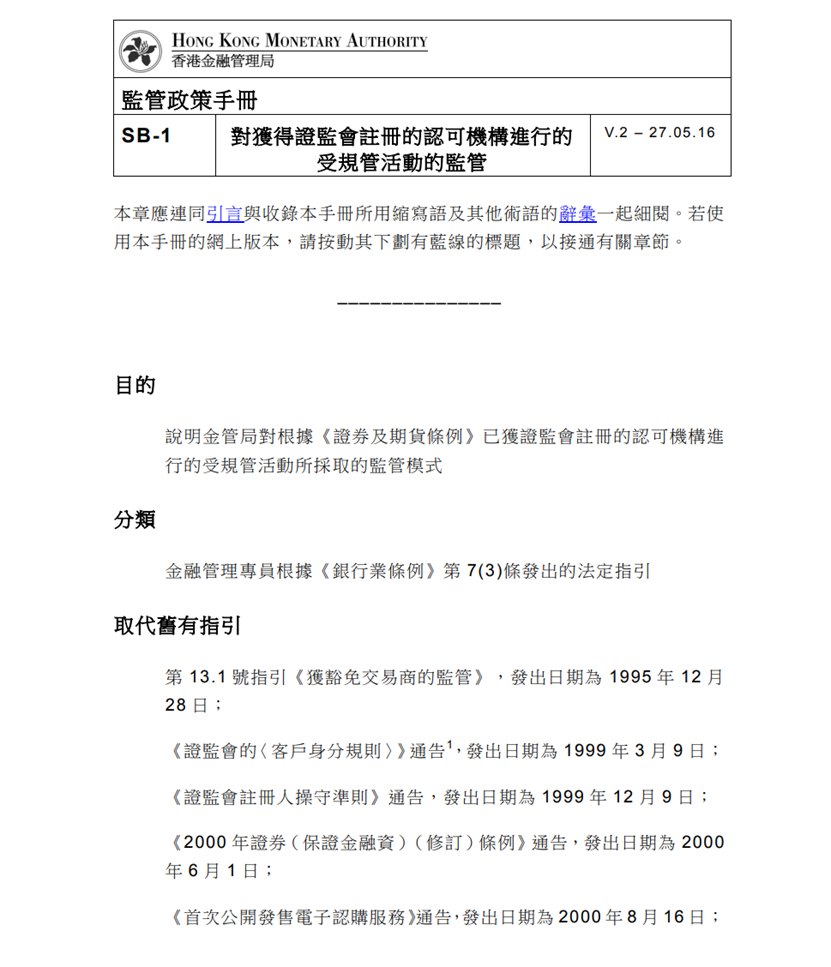

According to section 119 of the Securities and Futures Ordinance, a recognized financial institution that has been registered with the SFC is referred to as a registered institution (RI).

Employees of registered institutions who engage in regulated activities and whose names are entered in the Securities Industry Record of the Hong Kong Monetary Authority (HKMA) are referred to as relevant individuals (ReI).

A licensed representative or relevant person affiliated with a registered institution, who has applied to and received approval from the Monetary Authority to serve as the executive officer (EO) of the registered institution.

The main difference between SFC and HKMA licenses is whether the corporation or affiliated corporation is a recognized financial institution.

So, what is a recognized institution?

A recognized institution refers to licensed banks, restricted-license banks, and deposit-taking companies.

In simple terms, it refers to banks. Companies registered in Hong Kong or overseas companies registered with the Hong Kong Companies Registry are considered non-recognized institutions.

Why are recognized institutions registered with the SFC instead of applying for a license?

According to the Banking Ordinance, the Hong Kong Monetary Authority (HKMA), also known as the Monetary Authority, is responsible for granting, suspending, and revoking the recognition status of recognized institutions. It has general discretionary powers to decide whether to approve or reject applications for recognition to conduct banking or deposit-taking business in Hong Kong.

The HKMA is the statutory regulatory body for the banking industry in Hong Kong, while the Securities and Futures Commission (SFC) is the primary regulatory body for the securities industry in Hong Kong. Therefore, if a bank wishes to engage in securities business regulated by the SFC, it needs to register with the SFC. The registration process involves the bank submitting application materials to the HKMA, which then reviews and forwards them to the SFC for registration. Banks engaged in securities business regulated by the SFC are jointly supervised by the HKMA and the SFC, with the HKMA remaining the frontline regulatory body.

Therefore, banks conducting securities business register with the SFC as registered institutions, rather than being directly regulated and licensed by the SFC as licensed corporations.

The differences between the two can be summarized in the table below:

| Corporate Category | SFC Qualification Category | Employee License Category | Regulatory Authority |

| Non-Recognized Institution | Licensed Corporation | Licensed Individual | SFC |

| Recognized Institution | Registered Institution | Relevant Individual | HKMA and SFC |

Lastly, complaints against a licensed corporation or licensed individual are handled by the SFC. Complaints against registered institutions or relevant individuals are the responsibility of the HKMA.

How can we help?

2CExam provides HKSI LE, IIQE, EAQE and SQE related exam preparation materials. We sell mock question banks for HKSI LE Papers 1, 2, 3, 5, 6, 7, 8, 9, 12 in Chinese and English; and bibles for HKSI LE Papers 1, 2, 6, 7, 8 in Chinese. We also offer 1 on 1 tutorial services. Besides, we have also made free tutorial videos for HKSI LE Papers 1, 2, 6, 7, 8, 12 and posted on public channels such as Youtube/ Bilibili/ Tencent/ Iqiyi. 2CExam has been an exam training expert for years. Should you need any help please visit www.2cexam.com or contact us through:Phone +852 2110 9644 Email: [email protected] Wechat: hk2cexam WhatsApp: +852 9347 2064

Please support us by leaving comments and likes if you think this article helps you!

You can scan or click on the QR codes to visit our social media.

Latest Article

Categories

過往文章

Contact US

-

Phone:

+852 2110 9644

-

Email:

-

WhatsApp

+852 9347 2064

-

WeChat

hk2cexam

Interesting Articles

Why is it a disadvantage for foreigners to take the HKSI LE securities exam?

The HKSI LE exam provides two languages, Chinese and English, and both are provided during the exam. Some students who have taken the exams several times may pay attention to both the Chinese and English questions simultaneously, they will find that the content of the questions in Chinese or English exams is actually…

Which IIQE exam is easier? The English version or the Chinese version?

From time to time, students who purchase mock questions will ask us whether it is better to take the IIQE exam in Chinese or English? Some students who have taken the exams several times may pay attention to both the Chinese and English questions simultaneously. They will find that the content of the…

Is the HKSI LE exam easier to take in English? Or in Chinese?

From time to time, students who purchase mock questions will ask us whether it is better to take the HKSI LE exam in Chinese or English? If you have taken the exams several times and have paid attention to both the Chinese and English questions, you will find that the content of the…

Can I obtain an insurance license from the Insurance Authority (IA) without taking any examination if I have a foreign professional qualification?

Does the IA recognize insurance-related work experience gained outside of Hong Kong? Some students will ask us what kind of work experience is considered as insurance related industry experience, because their academic qualifications do not meet the requirements. Some people might have the misconception, thinking that without a license, how can one have industry…

Can I apply for a real estate license from the EAA Estate Agent Authority if I have a criminal record?

To apply for a real estate business license, you need to meet the “fit and proper” guidelines issued by the Estate Agent Authority (EAA). Estate Agent Authority will explore your past criminal records including but not limited to rigging, fraud or other dishonest acts, such as theft, handling stolen goods, using false documents, leaving…

Can I apply for an insurance license from the Insurance Authority if I have criminal records?

To apply for an insurance license, you need to meet the “Fit and Proper” Guidelines issued by the Insurance Authority (IA). The IA will look into your past criminal records, the Monetary Authority / Securities and Futures Commission / MPFA / other relevant agencies’ sanction records, as well as whether there are any places…

If I have a criminal record, can I still apply for the SFC’s securities license?

To apply for a securities license, you need to meet the Guidelines on Competence issued by the Securities and Futures Commission. Among them, the SFC will explore your past criminal records, whether you have ever had disciplinary actions, known frauds, misrepresentations, etc. in other licensed corporations in the past. In other words, past…

What is counted as relevant industry experience under the IA license transition arrangements?

One of the most repercussive reforms after the Insurance Authority took over the supervision of the insurance industry is the change of the minimum academic qualification requirement from Secondary school form 5 level to passing 5 subjects in the Hong Kong Certificate of Education Examination (HKCEE) / Hong Kong Diploma of Secondary Education (HKDSE),…

Minimum academic requirements for applying for an EAA license

Is there a minimum education requirement for the real estate industry? The conditions for the licensing of the real estate industry are included in the “Fit and proper person to hold a licence” guidelines issued by the Estate Agent Authority (EAA). All real estate agents and salespersons who wish to be licensed must…

Minimum academic requirements for applying for an IA license

Is there a minimum education requirement for the insurance industry? The conditions for licensing in the insurance industry are included in the “Fit and Proper” Guidelines (GL23/Guideline 23) issued by the Insurance Authority. All intermediaries who wish to be licensed must abide by this guideline. IA listed the educational requirements for intermediaries…