“Buy insurance when you have money, and sell insurance when you don’t have money.”

In the past, insurance agents were often viewed as salespeople with a lack of professionalism and skills. As insurance becomes an increasingly integral part of our lives, more and more highly-educated and professional individuals are entering the insurance industry.

These high-quality insurance agents possess rich professional knowledge and experience, not only providing clients with better insurance solutions but also offering more comprehensive financial services. They help clients plan their finances reasonably, achieve financial freedom, and ensure family security. At the same time, they also create a better life for themselves and their families through their hard work and dedication.

Do you know that in Hong Kong, before you can sell insurance, you need to pass at least 2 Insurance Intermediaries Qualifying Examinations (IIQE) and apply for a license from the Insurance Authority within the valid period of your exam results?

Where can you register for the Hong Kong insurance exam?

The Insurance Intermediaries Qualifying Examination (IIQE) in Hong Kong is organized by the PEAK Institute of the Vocational Training Council (VTC) of Hong Kong.

Insurance Intermediaries Qualifying Examination registration website: https://www.peak.edu.hk/exam/econline/zh/

Insurance Intermediaries Qualifying Examination study manual download website: https://www.peak.edu.hk/exam/tc/studynotes

How many papers are there in the Hong Kong insurance exam?

The Hong Kong Insurance Intermediaries Qualifying Examination (IIQE) has a total of 5 papers, which are:

| The name of the exam is the Insurance Intermediaries Qualifying Examination (IIQE) | Number of questions | Exam time | Passing score |

| IIQE Paper 1: Insurance Principles and Practice | 75 questions | 120mins | 53 questions |

| IIQE Paper 2: General Insurance | 50 questions | 75mins | 35 questions |

| IIQE Paper 3: Long Term Insurance | 50 questions | 75mins | 35 questions |

| IIQE Paper 5: Investment-linked Long Term Insurance | 80 questions | 120mins | 56 questions |

| IIQE Paper 6: Travel Insurance Agent Examination | 80 questions | 120mins | 56 questions |

Please note that the Mandatory Provident Fund (MPF) exam is not part of the qualification exam for insurance intermediaries.

The Mandatory Provident Fund (MPF) exam can be registered at both the Vocational Training Council PEAK (Professional Education And Knowledge) Exam Centre and the Hong Kong Securities and Investment Institute (HKSI).

Registration links are:

PEAK Exam Centre: https://www.peak.edu.hk/exam/econline/zh/

HKSI: https://oes.hksi.org/enrol/listActivity?activity_type=X&category=MPF%20Intermediaries%20Examination

The study guide for the MPF exam can be downloaded from this website: https://www1.mpfa.org.hk/tch/supervision/mpf_intermediaries/intermediaries_examination/Study_Notes_9th_Chi.pdf

What is the validity period of the IIQE exam results for Hong Kong insurance intermediaries? How long until they expire?

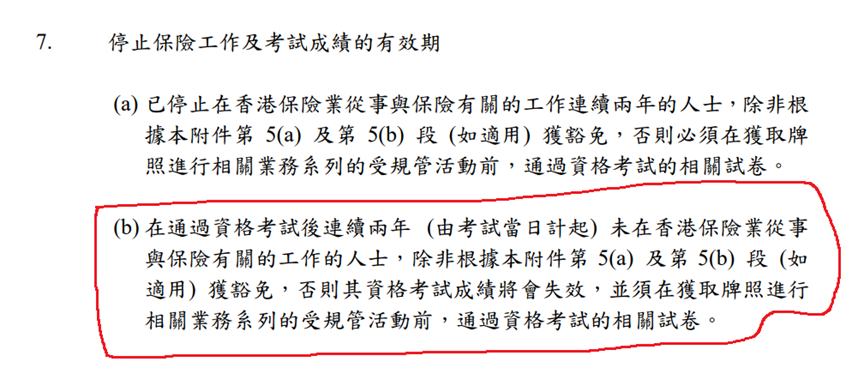

According to the Insurance Authority’s “Insurance Ordinance” (Chapter 41) and the Guidelines on “Fit and Proper Criteria” for Licensed Intermediaries, Annex 1 – Insurance Intermediaries Examination, the validity period for IIQE exam results for insurance intermediaries in Hong Kong is 2 years.

If an individual passes the relevant exam, the validity period starts from the date of the exam. If the person fails to obtain a license within two years, the qualification exam results will expire. If the individual still intends to enter the industry, he or she will need to pass the relevant exam of the qualification exam again.

What if someone needs to take more than one exam, how is the validity period of the exam results calculated?

If you need to take more than one exam to obtain a license, you need to be aware that all exams passed should be within the 2-year validity period on the day of the license application. If the exam results are more than 2 years old, you will need to retake the exam for the expired papers.

For example, if you need to take IIQE Paper 1 and Paper 3 to obtain a Long Term Insurance license, and you take and pass Paper 1 on January 1, 2023, you will need to pass Paper 3 and submit the license application before January 1, 2025, so that your Paper 1 exam will not be in vain. Please note that the results of the IIQE written exam will be announced at the earliest after 7 days, but the 2-year validity period starts from the day of the exam, not the date of the result announcement. So be careful not to get confused!

What exams do I need to take to become an insurance intermediary in Hong Kong?

It depends on the type of insurance business you will be conducting, in other words, what types of insurance products you plan to sell.

If you plan to sell long-term insurance such as whole life, critical illness, medical and health insurance, etc., you will need to pass Paper 1 and Paper 3 of the IIQE exam.

If you plan to sell general insurance such as home protection, travel insurance, personal accident insurance, group insurance, motor insurance, employee compensation insurance, etc., you will need to pass Paper 1 and Paper 2 of the IIQE exam.

如果你不仅想销售长期保险,还想销售客户可以自选基金和投资比例的投资相连寿险,就需考卷1、卷3和卷5。

If you need to sell travel insurance policies, you can choose to take IIQE Papers 6 or IIQE Papers 1+2.

Does passing the insurance exam in Hong Kong mean you can start working directly in the industry?

The answer is no!

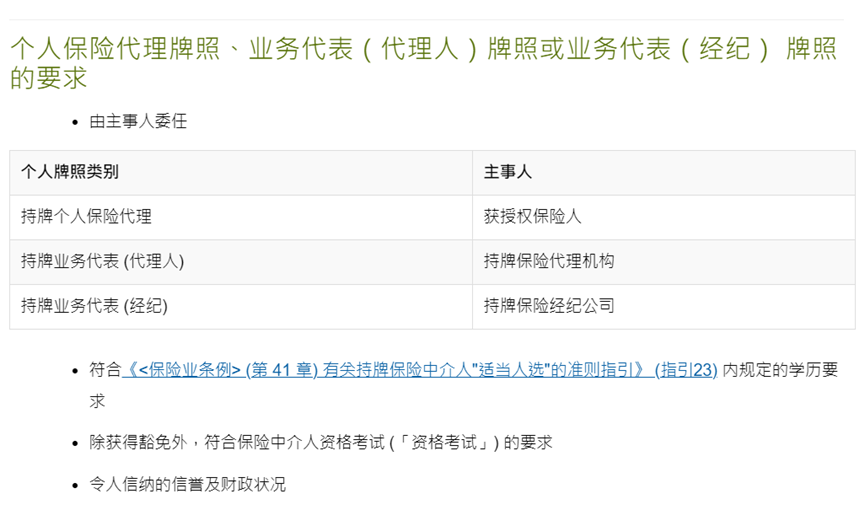

In Hong Kong, you need to be licensed to work in the insurance industry.

This means you must first obtain an insurance license from the Insurance Authority in Hong Kong before conducting any insurance business.

The IIQE insurance intermediary qualification exam in Hong Kong is an important test to ensure the quality of insurance industry practitioners, and it is also one of the important conditions for insurance professionals to obtain a license or registration.

In addition to passing the exam, you also need to meet other requirements, such as educational qualifications, professional qualifications, work experience, reputation, character, financial status, solvency, criminal records, and other requirements related to “fit and proper persons,” before you can apply for a license.

Therefore, passing the exam only fulfills one of the requirements for obtaining a license, and the exam results notification itself is not a license.

Where can I apply for an insurance intermediary license in Hong Kong?

According to the Insurance Ordinance (Chapter 41), one of the main functions of the Insurance Authority (IA) is to regulate and supervise the insurance industry, and through the licensing system, regulate the conduct of insurance intermediaries.

Therefore, individuals who want to enter the insurance industry need to apply for a license from the IA after passing the insurance intermediary exam. Since the IA does not hold exams itself, the insurance intermediary entrance exam in Hong Kong must be taken at the PEAK Institute of Vocational Training Council (VTC) in Hong Kong.

VTC PEAK is only responsible for organizing the exam and is not responsible for licensing matters.

Location, types of exams, validity period, and how to apply for a license for the IIQE insurance intermediary examination in Hong Kong.

What should be noted when taking the IIQE insurance intermediary examination in Hong Kong?

How can we help?

2CExam provides HKSI LE, IIQE, EAQE and SQE related exam preparation materials. We sell mock question banks for HKSI LE Papers 1, 2, 3, 5, 6, 7, 8, 9, 12 in Chinese and English; and bibles for HKSI LE Papers 1, 2, 6, 7, 8 in Chinese. We also offer 1 on 1 tutorial services. Besides, we have also made free tutorial videos for HKSI LE Papers 1, 2, 6, 7, 8, 12 and posted on public channels such as Youtube/ Bilibili/ Tencent/ Iqiyi. 2CExam has been an exam training expert for years. Should you need any help please visit www.2cexam.com or contact us through:

Phone +852 2110 9644 Email: [email protected] Wechat: hk2cexam WhatsApp: +852 9347 2064

Please support us by leaving comments and likes if you think this article helps you!

You can scan or click on the QR codes to visit our social media.

Latest Article

Categories

過往文章

Contact US

-

Phone:

+852 2110 9644

-

Email:

-

WhatsApp

+852 9347 2064

-

WeChat

hk2cexam

Interesting Articles

Which license is required for bank employees engaged in securities business?

Should Hong Kong bank employees apply for an HKMA license or an SFC license? According to the licensing requirements for real estate practitioners, passing relevant qualification exams is a necessary condition for obtaining a real estate agent (individual) license or a salesperson license. The Hong Kong Securities and Futures Practitioners Qualification Exam (HKSI LE) is…

What is the difference between an SFC license and HKMA registration in Hong Kong?

What is the difference between an SFC license and HKMA registration in Hong Kong? In Hong Kong, the statutory organization responsible for regulating the securities and futures markets is the Securities and Futures Commission (SFC). The Securities and Futures Ordinance, which came into effect on April 1, 2003, grants the SFC regulatory authority over the…

What is an HKSI certificate?

What is an HKSI certificate? What is the use of an HKSI exam transcript? What is an HKSI certificate? Do I need an HKSI exam transcript or an HKSI certificate when applying for SFC registration? To work in the securities industry in Hong Kong, passing the Hong Kong Securities and Futures Commission (SFC) Licensing Exam…

How to obtain an exemption for the HKSI LE Securities and Futures Practitioners Qualification Examination?

How to obtain an exemption for the HKSI LE Securities and Futures Practitioners Qualification Examination? In the previous issue, we talked about how if someone wants to work in the securities industry in Hong Kong, they must first pass the Hong Kong Securities and Investment Institute’s (HKSI) Licensing Examination for Securities and Futures Intermediaries. Are…

Where can I register for securities exams in Hong Kong?

Where can I register for securities exams in Hong Kong? If you want to work in the securities industry in Hong Kong, you must pass the Securities and Futures Commission (SFC) Licensing Exam LE. The organization that conducts the Licensing Exam LE in Hong Kong is the Hong Kong Securities and Investment Institute (HKSI). The Hong…

Often hear the beautiful ladies and handsome gentlemen in the Hong Kong financial sector talking about the “178 license” they need to obtain. What exactly is it?

What is the Hong Kong 178 license? In fact, the 178 license is not a real license but refers to a combination of examination papers that need to be taken. It consists of the Hong Kong Securities and Futures Practitioners Qualification Examination Paper 1, Paper 7, and Paper 8. In Hong Kong, activities related to…

What is the SFC license in Hong Kong?

What is the SFC license in Hong Kong? The Securities and Futures Commission (SFC) of Hong Kong was established in 1989 as an independent statutory body responsible for regulating the securities and futures markets in Hong Kong. The Securities and Futures Ordinance and its subsidiary legislation grant the SFC the power to investigate, correct, and…

Why do people still buy materials from 2CExam while HKSI provides free study notes?

In addition to organizing LE exams, the HKSI will also provide students who take the LE exam with the exam coverage called the Study Note. It depicts what is covered in the exam with hundreds of pages and full of paragraphs. It is lengthy and contains a lot of data and examples that will not…

EAQE/ SQE Real Estate Agency Exam Coverage/ Scope for Revision

Many students are clueless about the exam coverage / scope for doing revision on the Estate Agent Qualifying Examination (EAQE) and Salesperson Qualifying Examination (SQE). VTC’s PEAK does not have any notes available for candidates to download. In fact, the scope of the exam is quite extensive. Some of the coverage can be downloaded from…

Is success an Unattainable Ideal in the Real Estate Industry? 10 Benefits of Being in the Real Estate Industry Can Stimulate Your Capacity

Is it difficult to succeed in the real estate industry? Living space is one of the indispensable elements in life. From the wealthy speculating and selling flats to ordinary people looking for a place to live, most Hong Kong people have the demand to rent or even invest in the real estate market. Hong Kong’s…