If you want to work in the front line of the insurance industry, you have a good chance of needing to take the Insurance Intermediaries Qualifying Examination (IIQE). As for what exam papers you need to take, first you can check whether you meet certain conditions to be exempted from specific exam paper combinations of IIQE. For IIQE exemption, please refer to Exemption from Insurance Intermediary Qualification Examination (IIQE)

Will the exam papers for insurance agents and insurance brokers be different?

If you want to know the difference between the two, please refer to What is the difference between an insurance agent and an insurance broker?

The combination of exam papers for insurance agents and insurance brokers are the same. In other words, if you want to change from an insurance agent to a broker, as long as the license has not expired, you do not need to retake any exams, and vice versa.

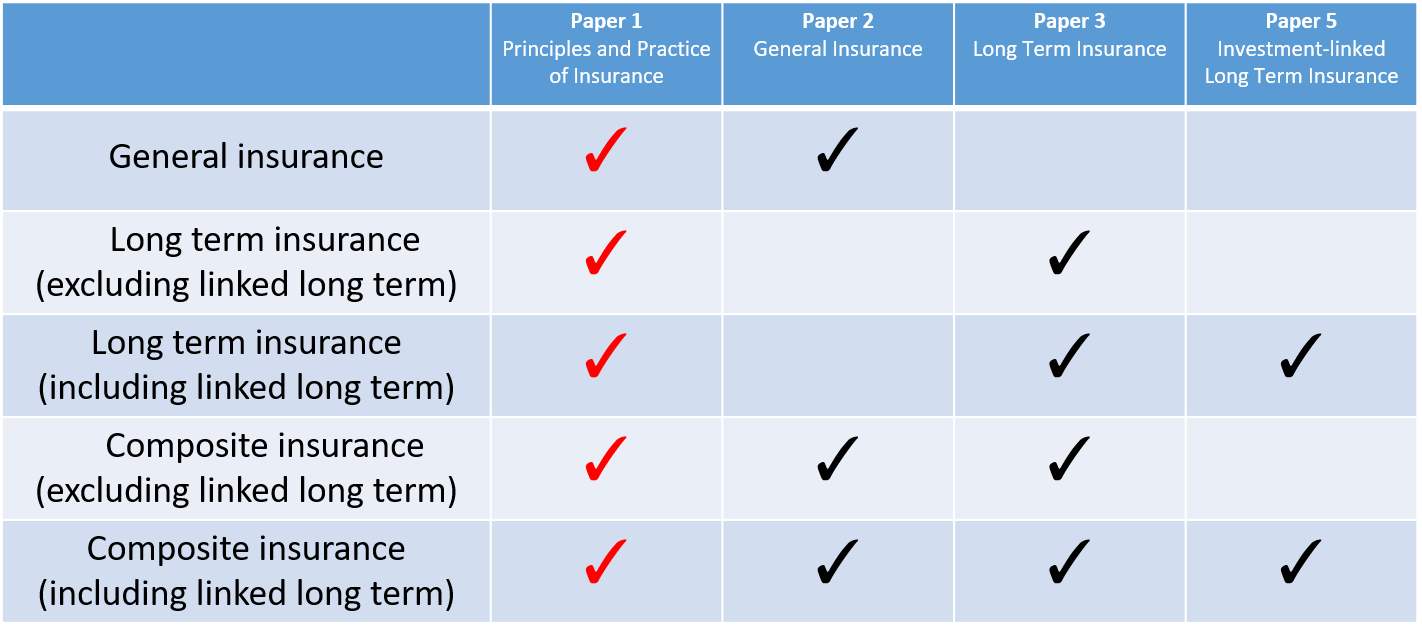

What exam papers do I need to take if I want to sell general insurance?

If you want to sell some general business insurance policies, such as car insurance, personal accident and sickness insurance, fire insurance, money insurance, director and senior officer liability insurance, product liability insurance, public liability insurance, marine insurance, etc., you need to take the IIQE paper 1 Principles and Practices of Insurance and paper 2 General Insurance.

A container ship arriving in port on a very calm day.

What exam papers do I need to take if I want to sell long-term insurance?

If you want to sell long-term business insurance policies, such as savings life insurance, term life insurance, universal life insurance, whole life insurance, annuities and other life-related policies, you need to take the IIQE paper 1 Insurance – Principles and Practices and Paper 3- Long Term Insurance.

What exam paper do I need to take if I want to sell investment-linked long-term insurance?

To sell long-term insurance policies that are directly related to investment products, not only do you need to partake in paper 1 and paper 3 exams, but you also need to partake in IIQE paper 5-investment-linked long-term insurance exam. If one did not partake in paper 5 exam, but only partake in paper 1 and 3 exams, one cannot sell investment-linked insurance policies.

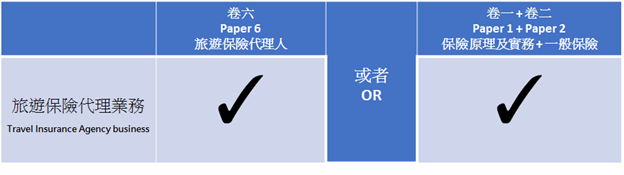

What exam paper do I need to take if I want to sell travel insurance?

If you work in a travel agency and only need to sell travel insurance without considering selling other types of insurance, you can choose to take the IIQE Paper 6 – Travel Insurance Agent exam. However if you also want to consider the practicality of the exam, you can also take IIQE Paper 1 and Paper 2 instead to learn about other general insurance knowledge.

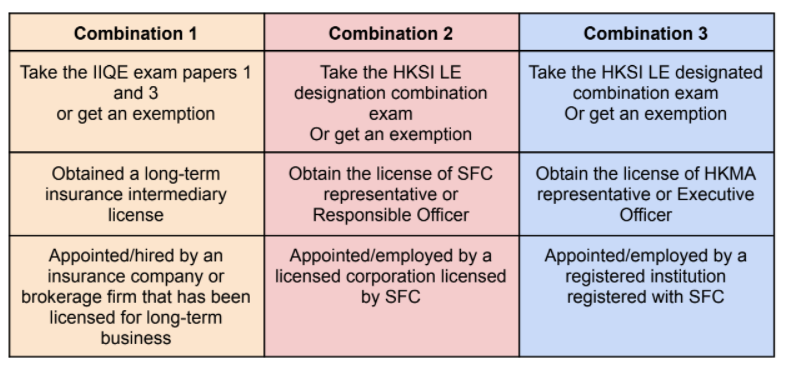

What exam paper should I take if I want to sell MPF?

The MPF examination paper was formerly called IIQE Paper 4, but it has now been separated from the Insurance Intermediary Qualifying Examination and has been renamed the Mandatory Provident Fund Schemes Examination (MPFE). However, if you want to obtain a license to become an MPF intermediary, you must first meet any of the following combination conditions that is indicated vertically in the table below.

Therefore, it is necessary to partake in more than one exam if you wish to sell MPF.

All in all, if you want to become an insurance intermediary and you do not have any professional qualifications or industry experience, you generally need to take more than one exam paper.

How can we help?

2CExam provides HKSI LE, IIQE, EAQE and SQE related exam preparation materials. We sell mock question banks for IIQE Papers 1, 2, 3, 5 and MPFE in Chinese and English; and bibles for IIQE Papers 1, 2, 3, MPFE in Chinese. We also offer 1 on 1 tutorial services. Besides, we have also made free tutorial videos for IIQE Papers 1, 2, 3 and MPFE and posted on public channels such as Youtube/ Bilibili/ Tencent/ Iqiyi. 2CExam has been an exam training expert for years. Should you need any help please visit www.2cexam.com or contact us through:

Phone +852 2110 9644 Email: [email protected] Wechat: hk2cexam WhatsApp: +852 9347 2064

Please support us by leaving comments and likes if you think this article helps you!

You can scan or click on the QR codes to visit our social media.

Latest Article

Categories

過往文章

Contact US

-

Phone:

+852 2110 9644

-

Email:

-

WhatsApp

+852 9347 2064

-

WeChat

hk2cexam

Interesting Articles

Is the IIQE paper based exam or computer based exam easier? Which exam is better to partake in?

Many people are curious about the differences between the IIQE’s computer-based exam and the paper-based exam. As per the two exams’ content, they are pretty much identical. The two exams use the same Study Guide, the exam questions are drawn in the same question bank. Some people say that they have taken a…

Is the HKSI paper-based exam or the computer-based exam easier? Which is better to partake in?

Many people are curious about the differences between the HKSI LE’s computer-based exam and the paper-based exam. As per the two exams’ content, they are pretty much identical. The two exams use the same Study Guide, the exam questions are drawn in the same question bank. Some people say that they have taken…

What are the differences between a computer-based and paper-based exam for the Estate Agents / Salespersons Qualifying Examinations?

There are differences between the computer-based exam and the paper-based exam? Some people say that the computer-based exam / paper-based exam will be easier? Many people are curious about the differences between the EAQE/SQE’s computer- based exam and the paper- based exam. As per the two exams’ content, they are pretty much…

What is the difference between the computer-based exam and the paper-based exam of the Insurance Intermediaries Qualifying Examination

Many people are curious about the difference between the IIQE’s computer-based exam and the paper-based exam. First of all, IIQE does not hold many paper-based examinations. In many cases, it will only hold paper-based examinations for Paper 1. If you have special needs, such as not being proficient with computers, or having a vision…

What are the differences between the computer-based exam and the paper-based exam of the Licensing Examination for Securities and Futures Intermediaries (LE)?

There are differences between the computer-based exam and the paper-based exam? Some people say that the computer-based exam / paper-based exam will be easier? Many people are curious about the differences between the HKSI LE’s computer-based exam and the paper-based exam. First of all, HKSI does not hold many paper-based examinations. In many…

Which Licensing Examination for Securities and Futures Intermediaries exam paper should I partake in?

If you want to work in the front line of the securities industry, you have a good chance of needing to take The Licensing Examination for Securities and Futures Intermediaries. As for what test papers you need to take, first of all, you need to know that the number of the exam paper has…

If I have an overseas professional qualification, can I obtain a SFC securities license simply by recognising my prior qualification

Some students have worked in the securities finance industry outside of Hong Kong, and now they also need to obtain a securities business license in Hong Kong. Can work experience in the securities industry abroad help you waive the exam and allows a candidate to directly apply for the securities license from the Securities…

In order to obtain exemption from the HKSI LE exam or SFC’s academic requirement, how is relevant industry experience considered?

After reading the “Competency Guidelines” issued by the Securities Regulatory Commission, some students may have a big question mark on “Relevant Industry Experience”, “have X years of experience in the past X years”, and then ask us what kind of experience are counted as industry experience so they can be exempted from the Licensing Examination…

The difference between IA Responsible Officer(RO) and technical representative (TR)

Regulatory Organisation Before explaining the difference between Responsible Officer and Technical Representative, you must first know that there is only one regulatory agency that regulates companies engaging in insurance business: the Insurance Authority (IA). All the powers concerning licensing matters, supervision tasks, sanctions and investigations of intermediaries of insurance intermediaries, insurance companies and insurance…

The differences between a SFC Responsible Officer (RO), HKMA Executive Officer (EO) and a Sale Representative (Rep)

The different regulatory agencies Before explaining the differences between a responsible officer (RO), HKMA’s executive officer (EO) and sales representative (Rep), you must first know that there are two regulatory agencies that regulates companies that are engaging in securities business: the Securities and Futures Commission (SFC) and Hong Kong Monetary Authority (HKMA).The regulatory…