Which paper should I take for the HKSI?

The Hong Kong Securities and Futures Practitioners Qualification Exam (HKSI LE) is one of the most popular exams in the Hong Kong financial market, mainly testing individuals' professional knowledge and capabilities in securities and investments in order to obtain a practice license in the securities and investment industry.

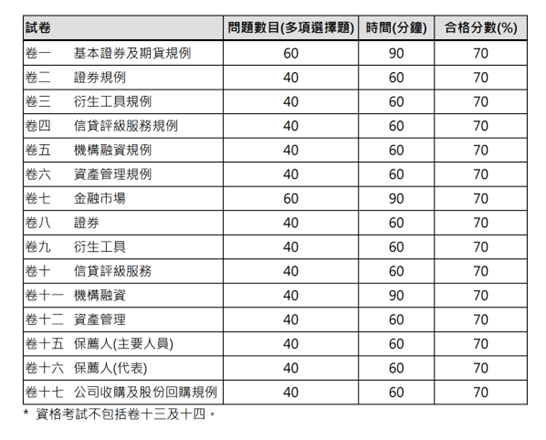

The HKSI LE exam currently has 15 different papers, divided into regulatory papers, application papers, and sponsor papers.

Candidates usually need to pass the regulatory papers plus the application/sponsor papers in order to participate in the SFC-regulated activities.

Schedule 5 of the Securities and Futures Ordinance specifies ten categories of regulated activities:

To participate in various regulated activities, you need to pass different combinations of HKSI exam papers. The required papers may vary depending on the category of the licensed individual (licensed representative, responsible officer).

Therefore, first of all, you need to know that the paper number and the category of regulated activities do not have a one-to-one correspondence! So, you cannot simply take the paper with the same number as the desired activity category.

Secondly, you can also check if you are eligible for exemptions. For information on exemptions, you can refer to "How to Obtain Exemptions for HKSI Securities and Futures Practitioners Exam."

So, which papers should I take if I want to buy and sell stocks and other securities for clients and earn commissions?

Engaging in securities trading at brokerage firms or banks, collecting clients' commissions for buying or selling securities, including stocks in Hong Kong, the United States, Japan, Taiwan, and mainland China markets, and bonds such as inflation-linked bonds (iBonds), require a Type 1 license (Type 1) for licensed individuals to conduct.

If you have no industry experience and cannot be exempted, and want to engage in Type 1 activities, you need to take HKSI LE Papers 1, 7, and 8 to become a Licensed Representative (LR). If you want to become a Type 1 Responsible Officer (RO), you also need to take HKSI LE Paper 2.

If you want to buy and sell futures and options contracts for clients and earn commissions, which papers should you take?

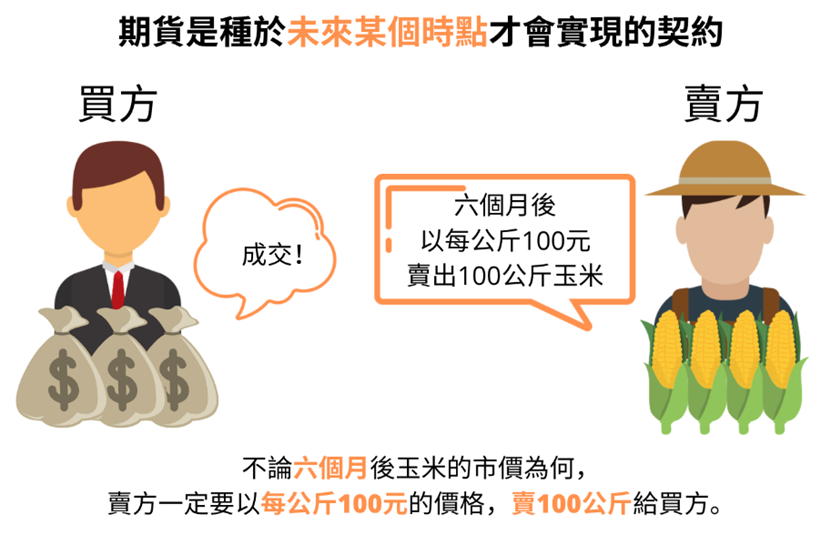

Buying and selling futures contracts, options, and other derivative instruments for clients, including agricultural futures, metal futures, Hang Seng Index futures, interest rate futures, stock futures, foreign exchange futures, stock call or put options, etc., fall under Type 2 regulated activities. To engage in these activities, you need to be a licensed representative with a Type 2 license.

If you have no industry experience and cannot be exempted, and you wish to engage in Type 2 activities, you need to take the HKSI LE Papers 1, 7, and 9 to become a licensed representative (LR). If you want to become a responsible officer (RO) for Type 2 activities, you also need to take HKSI LE Paper 3.

If you want to buy and sell leveraged foreign exchange for clients and earn commissions, which papers should you take?

Buying and selling leveraged foreign exchange products for clients and earning commissions fall under Type 3 regulated activities. To engage in these activities, you need to be a licensed representative with a Type 3 license. To engage in Type 3 regulated activities, you don't need to take any HKSI LE papers; instead, you need to take a leveraged foreign exchange exam.

If you want to provide advice on buying and selling securities (such as stocks) to clients, which paper should you take?

Providing advice on buying and selling securities (such as stocks and bonds) to clients and charging fees for it falls under Type 4 regulated activities. You need to be a licensed representative with a Type 4 license to engage in these activities. If you have no industry experience and cannot be exempted, but want to become a licensed representative (LR) to engage in Type 4 activities, you need to take HKSI LE Papers 1, 7, and 8. If you want to become a Type 4 Responsible Officer (RO), you also need to take HKSI LE Paper 2.

If you want to provide advice on buying and selling futures and options to clients for a fee, which paper should you take?

Providing advice to clients on trading futures and options contracts and charging fees for such activities falls under Type 5 regulated activity, which requires Type 5 license holders to engage in. If you have no industry experience and cannot be exempted, but wish to become a licensed representative (LR) and engage in Type 5 activities, you need to take HKSI LE Papers 1, 7, and 9. If you want to become a responsible officer (RO) for Type 5, you also need to take HKSI LE Paper 3.

If you wish to provide financing services for institutions (raising funds), you should take which exam paper?

If you wish to engage in Type 6 regulated activity, which involves designing different ways for corporations to raise capital, you need to hold a Type 6 license. If you have no industry experience and cannot be exempted, and want to become a licensed representative (LR) for Type 6 activities, you need to pass HKSI LE Papers 1, 7, and 11. If you want to become a responsible officer (RO) for Type 6, you also need to pass HKSI LE Paper 5.

If you wish to operate automated trading (such as dark pools and virtual currencies), which type of exam should you take?

Engaged in dark pool trading or operating an online trading platform in Hong Kong with a license issued by the SFC, and providing trading services for one or more virtual assets that meet the SFC's definition of "securities" on the platform, also known as "cryptocurrencies", "cryptographic assets", "virtual currencies" or "digital tokens", belongs to the Type 7 regulated activity. If you only want to engage in Type 7 activities, you do not need to take any HKSI LE Paper.

What exam should I take if I want to provide securities margin financing (margin trading)?

If you provide clients with securities margin financing (commonly known as "margin trading"), unless it is wholly incidental to other activities, you should apply to be licensed as a Type 8 regulated activity. If you do not have industry experience and cannot be exempted, but wish to engage in Type 8 activities as a licensed representative (LR), you need to pass HKSI LE Papers 1, 7, and 8.

If you want to become a Type 8 responsible officer (RO), you also need to pass HKSI LE Paper 2.

If you wish to engage in asset management business (such as managing funds or discretionary accounts), which paper should you take?

If you wish to engage in asset management business, such as managing the investment portfolios of funds or discretionary accounts, you should apply to be licensed as a Type 9 regulated activity.

How can we help?

2CExam provides HKSI LE, IIQE, EAQE and SQE related exam preparation materials. We sell mock question banks for HKSI LE Papers 1, 2, 3, 5, 6, 7, 8, 9, 12 in Chinese and English; and bibles for HKSI LE Papers 1, 2, 6, 7, 8 in Chinese. We also offer 1 on 1 tutorial services. Besides, we have also made free tutorial videos for HKSI LE Papers 1, 2, 6, 7, 8, 12 and posted on public channels such as Youtube/ Bilibili/ Tencent/ Iqiyi. 2CExam has been an exam training expert for years. Should you need any help please visit www.2cexam.com or contact us through:

Phone +852 2110 9644 Email: [email protected] Wechat: hk2cexam WhatsApp: +852 9347 2064

Please support us by leaving comments and likes if you think this article helps you!

You can scan or click on the QR codes to visit our social media.

Latest Article

Categories

過往文章

Contact US

-

Phone:

+852 2110 9644

-

Email:

-

WhatsApp

+852 9347 2064

-

WeChat

hk2cexam

Interesting Articles

Is the Securities, Insurance or Real Estate Industry Better? Comparing Incomes amongst Finance Industries

Securities and Banking According to statistics on the Internet and our experience, in Hong Kong, even for some common junior or middle-level positions in the financial/ securities industry, such as risk analyst, research analyst, and compliance officer, the average base salary is between HK$20,000 and 30,000 per month. Many people who have sufficient work experience…

What is updated in 2022 in IIQE Paper 1 Insurance Exam Study Manual? Is the 2017 or older version sufficient for the upcoming exams?

The 2021 version of IIQE Paper 1 was officially applicable to exams in 2022 Insurance Authority has taken over the supervision of the insurance industry for more than two years. The IIQE Paper 1 (Insurance Intermediary Qualification Examination) finally put the new regulatory structure in the study manual, and the new study manual can be…

5 Reasons You Should Not Study Only the IIQE note

Students who are taking the IIQE or took it before would know that the study note is a several-hundred pages exam coverage full of long paragraphs. Not to mention the length of the texts, the expression of ideas requires the readers a lot of concentration to understand. Thus, some candidates think only studying the mock…

Can’t Earn a Lot with Low Educational Background? 3 Major Industries You Can Make a Fortune in

In today’s society, because of education inflation, having only a college degree may not help you get a job with a high salary. While there are many people who don’t actually have a particular career path inclination, as long as the salary is good enough, people choose that path. In fact, there are three major…

10 Tips for Preparing the HKSI LE Securities Exam

Many people think that the coverage of the HKSI LE securities exam is broad, and we are here to help you. The following are 10 small tips to improve the efficiency of revision and enhance the understanding of concepts! Improve Studying Efficiency Question Answering Skills How can we help? 2CExam provides HKSI LE, IIQE, EAQE…

How to change the game by passing the IIQE exam even with a low educational background?

You do not need a strong educational background to be successful in the insurance industry Always feel that your salary is low, and you cannot be promoted due to a low educational background? Do you want to have higher achievements and a faster and more professional career path? In fact, education is not the main…

9 Easy Secrets for Preparing the HKSI LE Licensing Examination

Before taking the HKSI LE securities exam, students need to do some preparations: 1. Registration Students need to register for the exam on HKSI’s website first. 2. Download the study manual Students can download it for free after registration. 3. Search 2CExam’s free video courses Our senior tutors has navigated the…

5 Reasons You Should Not Study Only the HKSI LE manual

Students who are taking the HKSI LE or took it before would know that the study manual is a several-hundred pages exam coverage full of long paragraphs. Not to mention the length of the texts, the expression of ideas requires the readers a lot of concentration to understand. Thus, some candidates think only studying…

5 Key Points Mainlander Candidate Must Know When Partaking in the HKSI LE Exam

What is the HKSI LE exam? The full name of the exam is called the Licensing Examination, or LE for short. The organizer of the exam is not the Securities and Futures Commission (SFC), but a non-government organization named Hong Kong Securities and Investment Institute, or HKSI for short. Generally speaking, this exam is…

Why do people still buy materials from 2CExam while PEAK provides free study notes?

In addition to organizing IIQE exams, VTC PEAK Academy will also provide students who take the IIQE exam with the exam coverage called the Study Note. It depicts what is covered in the exam with hundreds of pages and full of paragraphs. It is lengthy and contains a lot of datas and examples that…