What is an insurance broker in Hong Kong?

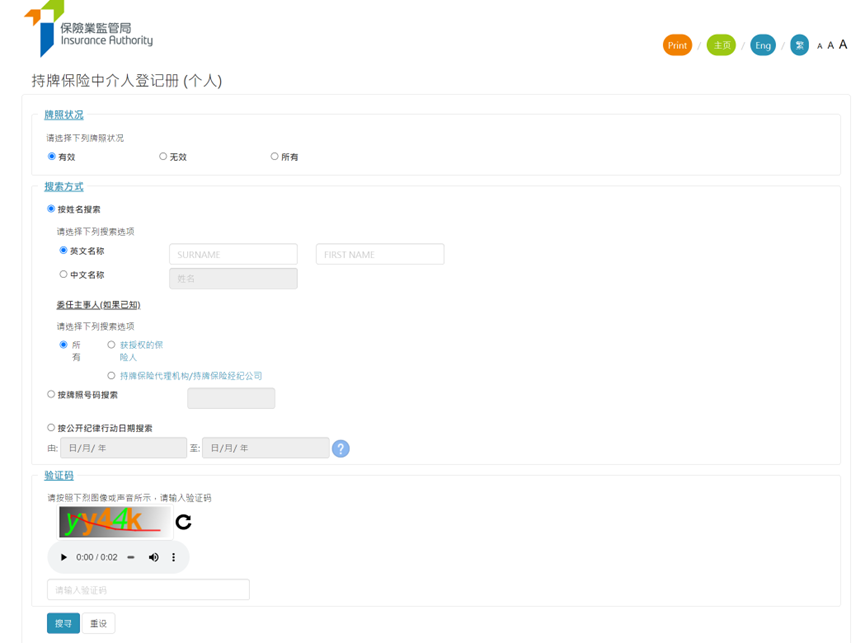

In Hong Kong, the business of promoting, advising on, and servicing insurance products is regulated by the Insurance Authority of Hong Kong.

“According to Section 64G of the Insurance Ordinance, no person may carry on a regulated activity or hold himself out as carrying on a regulated activity in the course of his business or employment or for reward unless the person is a licensed insurance intermediary or a person exempt under the Insurance Ordinance. Any person who contravenes Section 64G of the Insurance Ordinance commits an offense.” Therefore, anyone in Hong Kong must obtain a license from the Insurance Authority of Hong Kong to become a licensed insurance intermediary in order to engage in insurance sales and promotion activities.

Licensed insurance intermediaries in Hong Kong refer to professionals who are engaged in the promotion, advising, and servicing of insurance products. Their main responsibilities include understanding customer needs, promoting insurance products, providing after-sales service, and coordinating communication with insurance companies.

Individual licensed insurance intermediaries are divided into three categories: licensed individual insurance agents, licensed business representatives (agents), and licensed business representatives (brokers). The information of licensed insurance intermediaries can be found in the “Register of Licensed Insurance Intermediaries” of the Insurance Authority.

How to become a licensed insurance intermediary in Hong Kong?

The Insurance Authority stipulates that, regardless of whether they are licensed individual insurance agents, licensed business representatives (agents), or licensed business representatives (brokers), applicants must:

Meet the educational requirements stipulated in the “Guidelines on the ‘Fit and Proper’ Criteria for Licensed Insurance Intermediaries under the Insurance Ordinance (Cap. 41)” (Guideline 23);

Unless exempted, meet the requirements of the Insurance Intermediary Qualifying Examination;

Have credible reputation and financial status.

Therefore, if you want to enter the insurance industry in Hong Kong, you must pass the Insurance Intermediary Qualifying Examination and apply for the corresponding license from the Hong Kong Insurance Authority within the valid period of the exam results. Only then can you officially carry out insurance business as a licensed insurance intermediary.

What is the Insurance Intermediary Qualifying Examination in Hong Kong?

The Insurance Intermediaries Qualifying Examination (IIQE) is an examination stipulated by the Insurance Authority of Hong Kong, the regulatory authority of the Hong Kong insurance industry. It aims to ensure that insurance intermediaries have the necessary professional knowledge and skills, thereby protecting consumer interests and maintaining the stability and fairness of the insurance market.

Passing the IIQE is a necessary condition for insurance intermediaries in Hong Kong to obtain a license, and it is one of the entry thresholds for the Hong Kong insurance industry.

What is the minimum educational requirement to apply to become a licensed insurance intermediary?

According to the Insurance Ordinance, a licensed insurance intermediary must be a “fit and proper” person. According to the “Guidelines on the ‘Fit and Proper’ Criteria for Licensed Insurance Intermediaries under the Insurance Ordinance (Cap. 41)” (“Guideline 23”), applicants for individual licensed insurance intermediaries (i.e., licensed individual insurance agents, licensed business representatives (agents), or licensed business representatives (brokers)) must obtain one of the following educational or professional qualifications:

1.Hong Kong Diploma of Secondary Education (HKDSE) or Hong Kong Certificate of Education Examination (HKCEE) – passing in five subjects including Chinese Language/English Language and Mathematics.

2.International Baccalaureate Diploma.

3.Yi Jin Diploma – applicants should complete the Extended Mathematics elective.

4.For Mainland China’s college entrance examination, the score should be at or above the “second-line” in the relevant province/city; or the scores for Chinese/English and Mathematics should reach 50% or above; and the total score of the college entrance examination should reach 50% or above; and the official certification of the college entrance examination results should be obtained from the “XueXin Net”.

The Insurance Intermediaries Qualifying Examination consists of five papers: Principles and Practice of Insurance (Paper I, IIQE Paper 1), General Insurance (Paper II, IIQE Paper 2), Long Term Insurance (Paper III, IIQE Paper 3), Investment-Linked Long Term Insurance (Paper V, IIQE Paper 5), and Travel Insurance Agents Examination (Paper VI, IIQE Paper 6).

Unless exempted, those who intend to engage in:

- General insurance brokerage business must pass the Principles and Practice of Insurance Examination (Paper I, IIQE Paper 1) and General Insurance Examination (Paper II, IIQE Paper 2).

- Long-term insurance (excluding linked long-term insurance) brokerage business must pass the Principles and Practice of Insurance Examination (Paper I, IIQE Paper 1) and Long Term Insurance Examination (Paper III, IIQE Paper 3).

- Long-term insurance (including linked long-term insurance) brokerage business must pass the Principles and Practice of Insurance Examination (Paper I, IIQE Paper 1), Long Term Insurance Examination (Paper III, IIQE Paper 3), and Investment-Linked Long Term Insurance Examination (Paper V, IIQE Paper 5).

- Composite insurance (excluding linked long-term insurance) brokerage business must pass the Principles and Practice of Insurance Examination (Paper I, IIQE Paper 1), General Insurance Examination (Paper II, IIQE Paper 2), and Long Term Insurance Examination (Paper III, IIQE Paper 3).

- Composite insurance (including linked long-term insurance) brokerage business must pass the Principles and Practice of Insurance Examination (Paper I, IIQE Paper 1), General Insurance Examination (Paper II, IIQE Paper 2), Long Term Insurance Examination (Paper III, IIQE Paper 3), and Investment-Linked Long Term Insurance Examination (Paper V, IIQE Paper 5).

- Travel insurance agent business must pass the Travel Insurance Agents Examination (Paper VI, IIQE Paper 6).

| Exam PaperBusiness category | I | II | III | V | VI |

| General Insurance | ✓ | ✓ | |||

| Long Term Insurance (excluding linked) | ✓ | ✓ | |||

| Long Term Insurance (including linked) | ✓ | ✓ | ✓ | ||

| Composite Insurance (excluding linked) | ✓ | ✓ | ✓ | ||

| Composite Insurance (including linked) | ✓ | ✓ | ✓ | ✓ | |

| Travel Insurance Agent | ✓ |

Where can you take the Insurance Intermediaries Qualifying Examination Paper I “Principles and Practice of Insurance”?

The Insurance Intermediaries Qualifying Examination (IIQE) Paper 1 in Hong Kong is administered by the Vocational Training Council’s Professional Examination and Assessment Centre (PEAK). The examination is available in written, computer-based, and remote formats.

Exam type: Multiple Choice Questions

Language of the test: Bilingual, in English and Chinese

Number of questions: 75

Duration of the exam: 2 hours

Exam fee: $250 for the computer-based exam; $185 for the written exam; $850 for the remote exam.

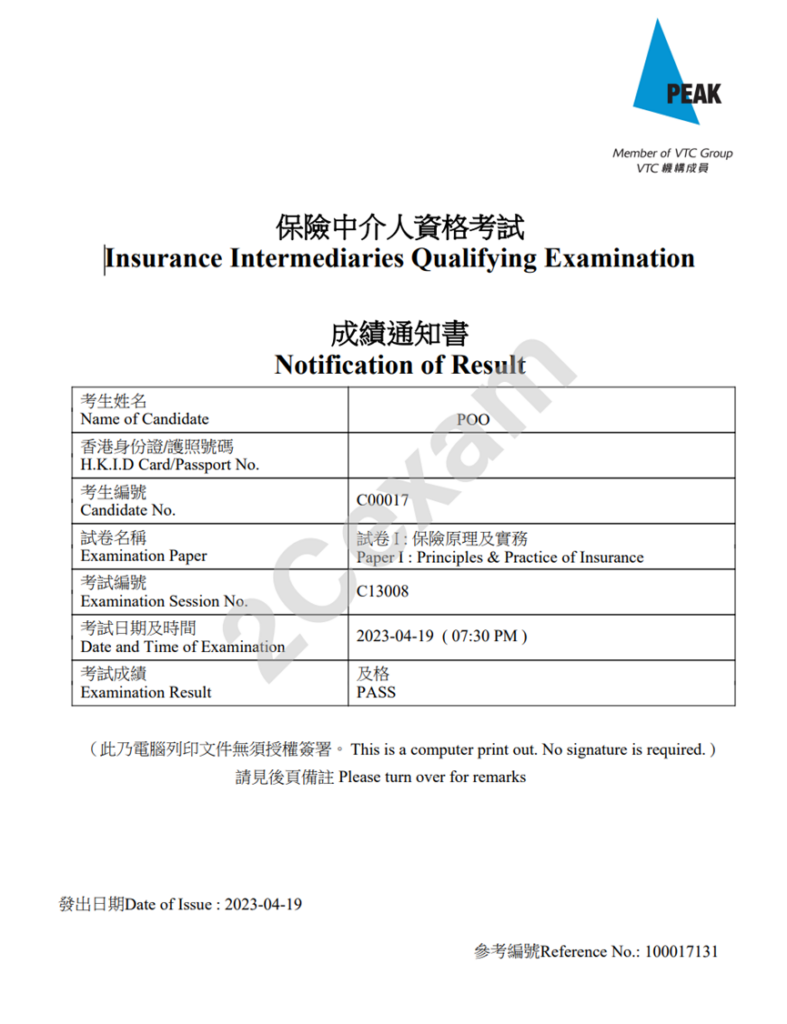

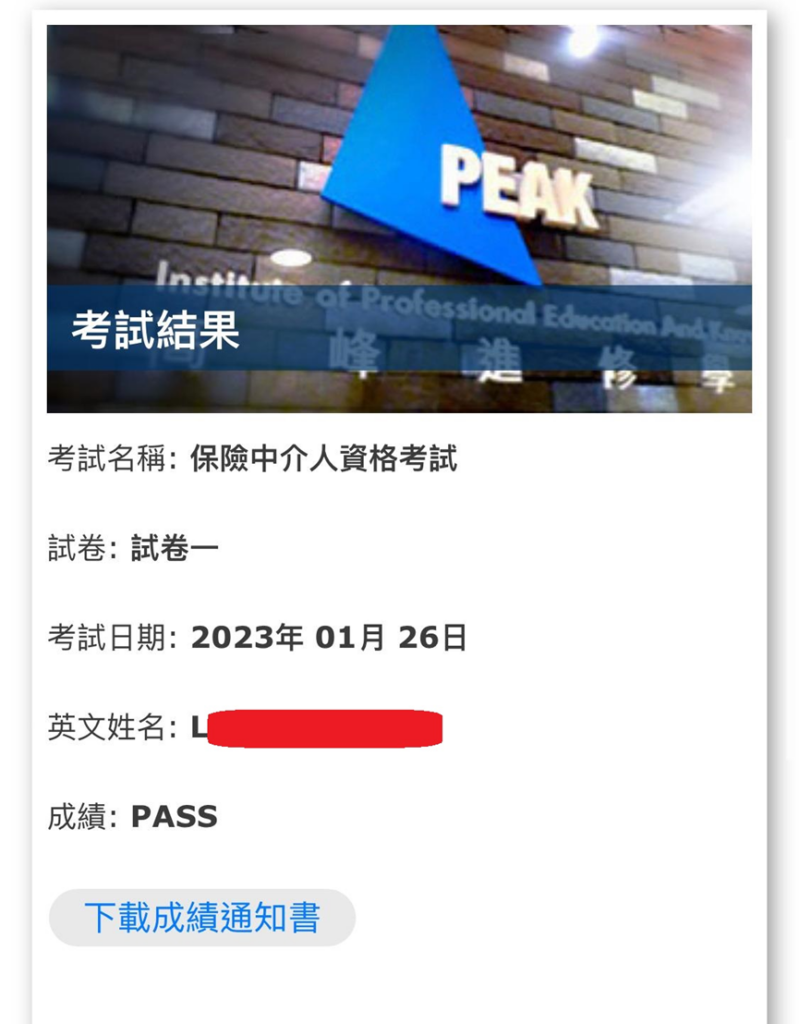

Exam results: “Pass” or “Fail”

The pass mark is 70%. Candidates must answer 53 questions correctly to pass the exam.

The examination results notice will not show the specific scores, nor will it disclose the questions and their correct answers.

The syllabus for the Insurance Intermediaries Qualifying Examination Paper I “Principles and Practice of Insurance” in Hong Kong is as follows:

| Chapter | Weight |

| Chapter 1 – Risk and Insurance | 12% |

| Chapter 2 – Legal Principles | 16% |

| Chapter 3 – Principles of Insurance | 30% |

| Chapter 4 – Main Functions of Insurance Companies | 9% |

| Chapter 5 – Structure of the Hong Kong Insurance Industry | 5% |

| Chapter 6 – Regulatory Framework of the Insurance Industry | 21% |

| Chapter 7 – Professional Ethics and Other Relevant Issues | 7% |

| Total | 100% |

The registration link for the “Principles and Practice of Insurance” examination held by the PEAK of VTC Vocational Training Council is as follows: https://www.peak.edu.hk/exam/econline/zh/

Please note that students who pass the remote examination need to, within 18 months from the date of the examination:

1.Complete the specific training course for the relevant qualification examination paper operated by the Vocational Training Council (some Continuing Professional Training hours can be obtained after completing the course); or

2.Participate in the relevant paper of the original qualification examination and obtain a passing score.

Otherwise, the license will expire at the end of the 18-month period.

How to get the notice of results?

For candidates who participate in the “Principles and Practice of Insurance” in the PEAK Examination Center of the Vocational Training Council,

1.Written exam

The results of the written examination can be viewed, downloaded, and printed in the “Check Examination Results” system on the website of the examination center from the fifth full working day after the examination.

2.Computer examination

The results of the computer examination will be displayed on the computer screen immediately after the examination.

Candidates can download and print the notice of results in the “Check Examination Results” system on the website of the examination center one hour after the designated end time of the examination.

3.Remote examination

The results of the remote examination will be displayed on the computer screen of the examination device immediately after the examination.

Candidates can view, download, and print the notice of results in the “Check Examination Results” system on the website of the examination center from the third full working day after the examination.

Please note that the examination center does not provide a printed copy of the notice of results. The examination results and the notice of results will only be stored in the “Check Examination Results” system for three months (calculated from the examination date).

Where to find free study materials for Insurance Intermediaries Qualifying Examination Paper I “Principles and Practice of Insurance”?

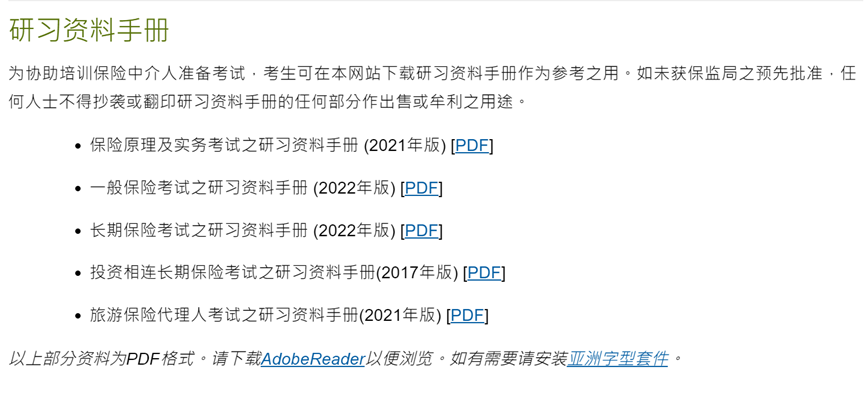

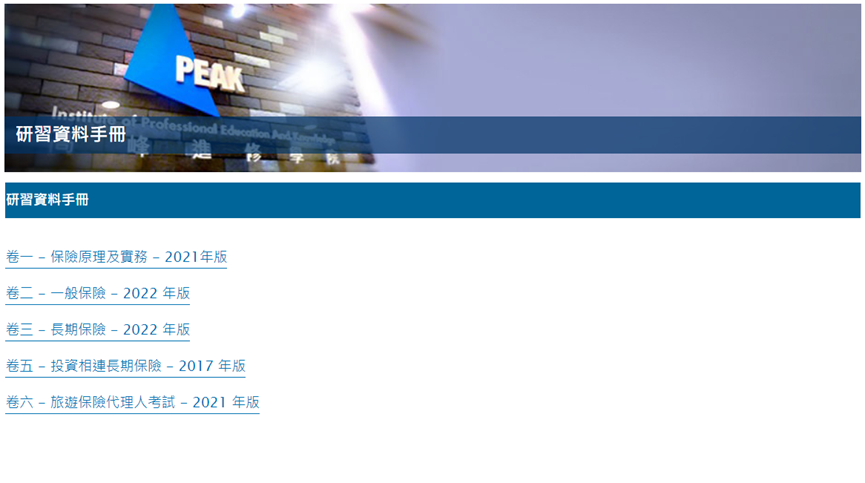

Official study guide

The Insurance Authority has compiled a “Study Guide for the Principles and Practice of Insurance Examination” to assist candidates in preparing for the examination. It can be downloaded for free on the Insurance Authority and PEAK’s websites.

Insurance Authority free download link:

PEAK free download link:

2.Free instructional videos

B station: https://www.bilibili.com/video/BV18t411e7gi/?vd_source=d4cdb4b41821c08c5020dac2c8422d92

YouTube: https://www.youtube.com/playlist?list=PLilKLKW6-ssgwIUeOjeCYOISXctmuOo5M

3.Free practice questions

It should be noted that since the study guide of “Study Guide for the Principles and Practice of Insurance Examination” is a total of 212 pages, the knowledge points covered by the examination are wide, and short-term memory may be relatively unreliable. It may be difficult to memorize so many concepts that have not been understood, because there is a good chance that after reading the whole book, you have already forgotten most of the first half.

And, the questions drawn in each examination are not the same, there is a big luck component.

Therefore, when preparing for the IIQE examination, you should ensure that you fully understand the examination syllabus and requirements, formulate an appropriate study plan, and actively participate in mock exams to improve your test-taking ability.

Therefore, our suggested review method is:

1.Read a chapter of the study guide/free tutorial videos first.

2.Complete the practice of a chapter of mock questions.

This will reinforce your understanding and memory of the material.

Lastly, good luck with your exam!

How can we help?

2CExam provides HKSI LE, IIQE, EAQE and SQE related exam preparation materials. We sell mock question banks for HKSI LE Papers 1, 2, 3, 5, 6, 7, 8, 9, 12 in Chinese and English; and bibles for HKSI LE Papers 1, 2, 6, 7, 8 in Chinese. We also offer 1 on 1 tutorial services. Besides, we have also made free tutorial videos for HKSI LE Papers 1, 2, 6, 7, 8, 12 and posted on public channels such as Youtube/ Bilibili/ Tencent/ Iqiyi. 2CExam has been an exam training expert for years. Should you need any help please visit www.2cexam.com or contact us through:

Phone +852 2110 9644 Email: [email protected] Wechat: hk2cexam WhatsApp: +852 9347 2064

Please support us by leaving comments and likes if you think this article helps you!

You can scan or click on the QR codes to visit our social media.

Latest Article

Categories

過往文章

Contact US

-

Phone:

+852 2110 9644

-

Email:

-

WhatsApp

+852 9347 2064

-

WeChat

hk2cexam

Interesting Articles

If the IIQE insurance exam has more than one exam paper, which exam paper should I partake in first? How should I prioritise and organise my exam schedule?

Many students who are new to the insurance industry would ask us: “ Which paper should I take first when the Insurance Intermediaries Qualifying Examination (IIQE) has that many papers? “ Which exam paper should I take first? The Insurance Authority (AI) has no requirement for the order of passing the exam in all…

If I need to take more than one paper for the HKSI LE exam, which paper should I partake in first? In what order should I take them?

Many students who did not have a business background would ask us: “ Which paper should I take first when The Hong Kong Licensing Examination for Securities and Futures Intermediaries (HKSI LE) has that many papers? “ Which exam paper should I take first? The SFC has no requirement for the order…

What is the difference between an insurance company and an insurance brokerage company

Isn’t every company that sells insurance policies called an insurance company? Insurance companies refer to companies that will launch their own new products (insurance plans). These companies usually have a larger scale. They will arrange everything from product development, front-line sales, underwriting, claims, complaints, and actuarial calculations. To ensure compliance with the requirements…

Who cannot register or take the EAQE/SQE Real Estate Qualifying Examination?

Is there a threshold for the real estate examination? There are no thresholds when it comes to partaking in the real estate exam; your nationality, age, education, work experience, and professional qualifications do not matter when it comes to applying for the real estate exam. As long as one can afford the exam fee,…

Are there free courses for EAQE/SQE real estate exams? Can I take classes online or remotely?

Where can I find real estate courses? Estate Agent Course 2021 Centaline Training Institute: http://www.cti-edu.com/icms/template.aspx?series=16 Midland: http://www.midlandu.com.hk/chi/campus/ Rose Garden: http://www.rosegarden-consultants.com/index.html?gclid=Cj0KCQjwvYSEBhDjARIsAJMn0lhII0WauuWfhByB0WIQKOYKdEiRlMB76v36PQtXefflav1cII3lVtoaAimmEALw_wcB HKCTSVT:https://hkctsvt.edu.hk/tc/programmes/real-estate-agency/ft-programme-erb-placement-tied-courses-ct210ds City University, School of Continuing and Professional Education (Scope): https://www.scope.edu/Home/Programmes/DiplomaCertificateandShortCourse/ERB%E4%BA%BA%E6%89%8D%E7%99%BC%E5%B1%95%E8%A8%88%E5%8A%83%E8%AA%B2%E7%A8%8B/%E5%9C%B0%E7%94%A2%E4%BB%A3%E7%90%86%E6%84%9B%E5%A2%9E%E5%80%BC.aspx 2CEXAM free Youtube course (Material Provided in Contonese Only) Estate Agent Qualifying Examination (EAQE) Course Explanation [Not Past Paper,…

Where can I get the free EAQE/SQE real estate practice exam questions?

Where can I find a book/study manual/review manual for the real estate licensing exam? Mock exam questions you can use official reference questions https://www.eaa.org.hk/Portals/0/Sections/Exam/2015/Sample%20Question/Sample%20Questions_E.pdf 2. 2CEXAM mock exam questions With regard to EAQE Estate Agents Qualifying Examination. Only Chinese version is available For Chinese version Printed Version, please visit our website:…

What is the difference between EAQE and SQE exam?

What is the functional difference between the EAQE and SQE exam? EAQE has broader functions than SQE. Basically, the EAQE exam is omnipotent. If you want to become an estate agent, you must take the EAQE, which is also known as the Estate Agent Qualifying Exam. EAQE results can also be used to…

Is the real estate examination not held by the Estate Agent Authority ? 5 tips for entering the industry

Real estate examinations are held by PEAK The EAQE and SQE exams are held by the Vocational Training Council’s (VTC) PEAK. VTC PEAK is a statutory organization that provides professional education and training in Hong Kong. It is also an accredited organization that conducts EAQE and SQE examinations.Students who wish to apply for…

Can I work as a real estate agent/salesperson if I fail the HKCEE?

To become a real estate agent/salesperson, you need to meet a number of conditions including minimum academic requirements in order to successfully apply for a license. Can I work as a real estate agent/salesperson if I fail the HKCEE? The website of the Estate Agents Authority contains a page of guidelines on the minimum…

Can I work as a real estate agent/salesperson if I have not studied at university?

To become an estate agent/salesperson, you need to meet a number of conditions to successfully apply for a license. One of the most concerned conditions is the academic requirements. Qualification requirements for applying for a license In fact, the requirements for becoming a real estate agent or salesperson are not very high, and…