“What is MPF?”

The Mandatory Provident Fund Schemes (abbreviated as MPF), is a retirement protection plan in Hong Kong. The Legislative Council of Hong Kong passed the “Mandatory Provident Fund Schemes Ordinance” on July 27, 1995, and officially implemented it on December 1, 2000. Except for a few exempt individuals, the scheme requires employees and self-employed persons aged 18 to 65 in Hong Kong to participate, with both employers and employees contributing to establish the fund. Generally, employees can only withdraw contributions when they reach 65 years old or provide special reasons.

What is a Mandatory Provident Fund Intermediary?

Mandatory Provident Fund Intermediaries (abbreviated as MPF Intermediaries), refers to professionals engaged in MPF business in Hong Kong. They are mainly responsible for assisting employers and employees in choosing, transferring, and claiming MPF schemes, providing professional advice to clients, and ensuring that clients comply with relevant regulations.

In Hong Kong, anyone must first register with the Mandatory Provident Fund Schemes Authority (MPFA, abbreviated as MPFA) to become an MPF intermediary before they can engage in MPF sales and promotional activities. MPF intermediaries are divided into two categories: principal intermediaries and subsidiary intermediaries. Principal intermediaries usually refer to companies or banks, while the individual MPF salespersons we usually understand are representatives of the principal intermediaries and belong to subsidiary intermediaries (hereinafter referred to as MPF Intermediaries (Subsidiary)). The registration information of MPF intermediaries can be confirmed in the public register of the MPFA.

Who can become a Mandatory Provident Fund (MPF) intermediary?

The Mandatory Provident Fund Schemes Authority (MPFA) is authorized to register the following individuals as MPF intermediaries if they meet relevant regulations, to approve them as principal intermediaries for regulated activities:

- Individual persons who are licensed by the Securities and Futures Commission to conduct Type 1 regulated activity (dealing in securities) or Type 4 regulated activity (advising on securities) under the Securities and Futures Ordinance, or both;

- Individual persons who are registered by the Monetary Authority to conduct Type 1 regulated activity (dealing in securities) or Type 4 regulated activity (advising on securities) under the Banking Ordinance, or both;

- Licensed individual long term business insurance agents, insurance broker companies or representatives under the Insurance Ordinance authorized by the Insurance Authority.

How to become an MPF intermediary?

According to the “MPF Intermediary Registration Handbook,” to register as an MPF intermediary (subsidiary), applicants:

1.Must be regulated by the industry and have a good reputation, i.e., not have their industry qualifications or MPF intermediary registration revoked/suspended for disciplinary reasons within a year preceding the application date;

2.Must not have lost the qualification to register with the MPFA;

3.Must belong to a principal intermediary;

4.Must take and pass the MPFA’s qualifying examination.

When is it necessary to take the MPF Intermediary Qualifying Examination?

Individuals applying to become MPF intermediaries must pass the MPF Intermediary Qualifying Examination to meet registration requirements. The specific situations are as follows:

- New applicants must take and pass the examination within a year before registering as an MPF intermediary.

- If applicants who have passed the exam have not registered as MPF intermediaries within three years preceding the application date, they must retake and pass the exam to re-register.

- If MPF intermediaries have their registration revoked due to non-completion of continuous training, they must retake and pass the exam to re-register.

Where can you take the MPF Intermediary Qualifying Examination?

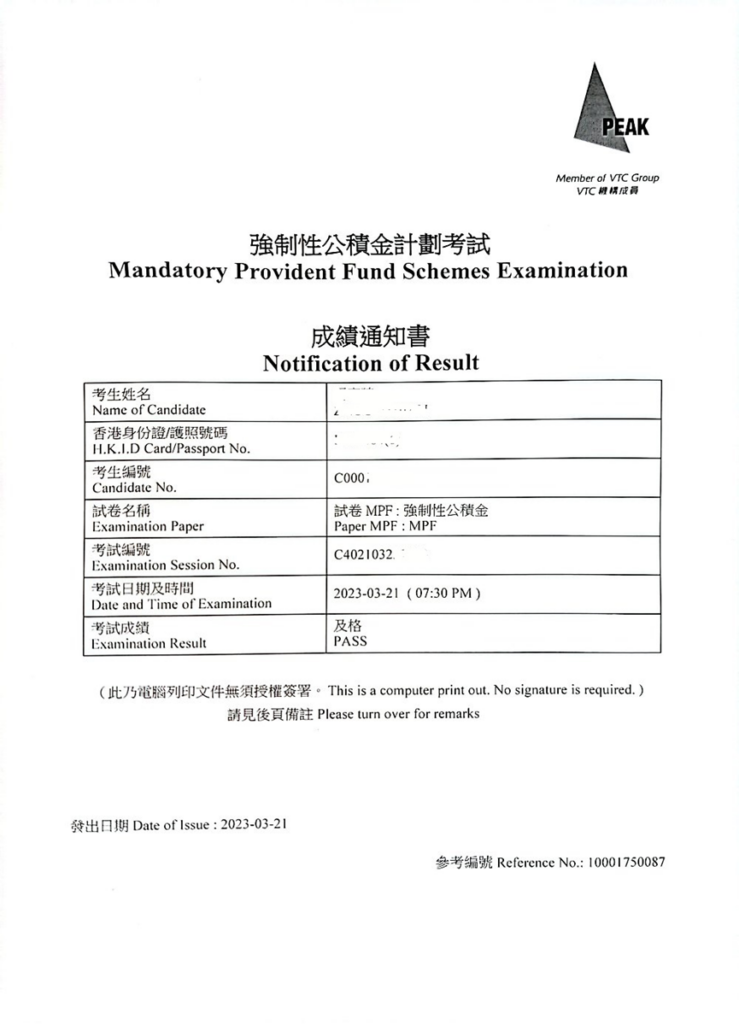

The “Mandatory Provident Fund Schemes Examination” offered by the Peak of the Vocational Training Council (VTC) and the “MPF Intermediary Examination” offered by the Hong Kong Securities and Investment Institute (HKSI) are both qualifying examinations designated by the MPFA. Those who pass the exam will be recognized as meeting the examination requirements for MPF intermediaries.

The scope of both examinations includes the following contents:

Regulatory framework;

Key features of the MPF system;

Functions of the MPF trustee;

MPF schemes and investments;

Transitional arrangements between occupational retirement schemes and the MPF system; and

Regulation of MPF intermediaries.

The “Mandatory Provident Fund Schemes Examination” by the Peak of the Vocational Training Council (VTC) includes a written test and a computer test, while the “MPF Intermediary Examination” by the Hong Kong Securities and Investment Institute (HKSI) only provides a written test.

Exam format: Multiple-choice questions

Question language: Bilingual in Chinese and English

Number of questions: 80 questions

Exam duration: 2 hours

Exam fee: Computer-based test $370; Written test $305

Exam results: “Pass” or “Fail”.

The passing score is 70%, and candidates must answer correctly 56 questions to pass the examination.

The exam result notification does not show specific scores and will not disclose the questions and their correct answers.

The registration link for the “Mandatory Provident Fund Schemes Examination” by the Peak of the Vocational Training Council (VTC) is as follows:

The registration link for the “MPF Intermediary Examination” by the Hong Kong Securities and Investment Institute (HKSI) is as follows:

How to get the result notification?

For candidates taking the “Mandatory Provident Fund Schemes Examination” at the Peak of the Vocational Training Council (VTC) Examination Centre:

Written test results:

Can be viewed, downloaded, and printed from the “Exam Results Inquiry” system on the examination center’s webpage, starting from the fifth complete working day after the exam.

Computer test results:

They will be displayed on the computer screen immediately after the exam. The exam results displayed on the screen are for reference only and are subject to the results printed on the result notification. Candidates can download and print the result notification from the “Exam Results Inquiry” system on the examination center’s webpage, starting one hour after the designated end time of the exam.

The examination center does not provide printed copies of the result notification. Exam results and result notifications will be stored in the “Exam Results Inquiry” system for three months (counting from the exam date).

Candidates who have taken the “MPF Intermediary Examination” written test at the Hong Kong Securities and Investment Institute can check their exam results on the HKSI e-service website about seven working days after the exam. The exam result notification will be retained for 1 year for candidates to download and print.

Where to find study materials for the MPF Intermediary Qualification Examination?

1.Official Study Manual

The Mandatory Provident Fund Schemes Authority (MPFA) has compiled the “Mandatory Provident Fund Schemes/MPF Intermediaries Examination Study Manual” to assist candidates in preparing for the examination, which can be downloaded for free from the MPFA website.

Link to free download of the MPFA “Mandatory Provident Fund Schemes/MPF Intermediaries Examination Study Manual”: https://www.mpfa.org.hk/-/media/files/supervision/mpf-intermediaries/registration-requirements/study_notes_9th_chi_v3.pdf

2.Free Tutorial Videos

Bilibili: https://www.bilibili.com/video/BV18t411e7Ff/?vd_source=d4cdb4b41821c08c5020dac2c8422d92

YouTube:

3.Free Practice Questions

It should be noted that the study manual for the MPF Intermediaries Examination is 196 pages long and the scope of the examination is quite broad. Our short-term memory may not be reliable, and rote memorization may make it difficult to remember so many unprocessed concepts. There’s a good chance that by the time you’ve finished the entire book, you’ve already forgotten most of the first half. Moreover, the questions drawn for each exam are not exactly the same, and there’s a great deal of luck involved.

Therefore, when preparing for the IIQE examination, you should ensure that you have a thorough understanding of the exam outline and requirements, formulate a suitable study plan, and actively participate in mock exams to improve your examination skills.

Hence, our recommended study method is:

Read a chapter of the study manual/free tutorial video first.

Complete a chapter’s worth of practice questions.

Reinforce your understanding and memory of the knowledge by repeating this process.

Finally, we wish you success in your exam!

How can we help?

2CExam provides HKSI LE, IIQE, EAQE and SQE related exam preparation materials. We sell mock question banks for HKSI LE Papers 1, 2, 3, 5, 6, 7, 8, 9, 12 in Chinese and English; and bibles for HKSI LE Papers 1, 2, 6, 7, 8 in Chinese. We also offer 1 on 1 tutorial services. Besides, we have also made free tutorial videos for HKSI LE Papers 1, 2, 6, 7, 8, 12 and posted on public channels such as Youtube/ Bilibili/ Tencent/ Iqiyi. 2CExam has been an exam training expert for years. Should you need any help please visit www.2cexam.com or contact us through:

Phone +852 2110 9644 Email: [email protected] Wechat: hk2cexam WhatsApp: +852 9347 2064

Please support us by leaving comments and likes if you think this article helps you!

You can scan or click on the QR codes to visit our social media.

Latest Article

Categories

過往文章

Contact US

-

Phone:

+852 2110 9644

-

Email:

-

WhatsApp

+852 9347 2064

-

WeChat

hk2cexam

Interesting Articles

Why would it be a disadvantage for foreigners to take the IIQE exam?

Some students who have taken the exams several times may pay attention to both the Chinese and English questions simultaneously, they will find that the content of the questions in Chinese or English exam is actually the same. Sometimes the topics are more difficult to understand in Chinese, and some topics are more difficult…

Why is it a disadvantage for foreigners to take the HKSI LE securities exam?

The HKSI LE exam provides two languages, Chinese and English, and both are provided during the exam. Some students who have taken the exams several times may pay attention to both the Chinese and English questions simultaneously, they will find that the content of the questions in Chinese or English exams is actually…

Which IIQE exam is easier? The English version or the Chinese version?

From time to time, students who purchase mock questions will ask us whether it is better to take the IIQE exam in Chinese or English? Some students who have taken the exams several times may pay attention to both the Chinese and English questions simultaneously. They will find that the content of the…

Is the HKSI LE exam easier to take in English? Or in Chinese?

From time to time, students who purchase mock questions will ask us whether it is better to take the HKSI LE exam in Chinese or English? If you have taken the exams several times and have paid attention to both the Chinese and English questions, you will find that the content of the…

Can I obtain an insurance license from the Insurance Authority (IA) without taking any examination if I have a foreign professional qualification?

Does the IA recognize insurance-related work experience gained outside of Hong Kong? Some students will ask us what kind of work experience is considered as insurance related industry experience, because their academic qualifications do not meet the requirements. Some people might have the misconception, thinking that without a license, how can one have industry…

Can I apply for a real estate license from the EAA Estate Agent Authority if I have a criminal record?

To apply for a real estate business license, you need to meet the “fit and proper” guidelines issued by the Estate Agent Authority (EAA). Estate Agent Authority will explore your past criminal records including but not limited to rigging, fraud or other dishonest acts, such as theft, handling stolen goods, using false documents, leaving…

Can I apply for an insurance license from the Insurance Authority if I have criminal records?

To apply for an insurance license, you need to meet the “Fit and Proper” Guidelines issued by the Insurance Authority (IA). The IA will look into your past criminal records, the Monetary Authority / Securities and Futures Commission / MPFA / other relevant agencies’ sanction records, as well as whether there are any places…

If I have a criminal record, can I still apply for the SFC’s securities license?

To apply for a securities license, you need to meet the Guidelines on Competence issued by the Securities and Futures Commission. Among them, the SFC will explore your past criminal records, whether you have ever had disciplinary actions, known frauds, misrepresentations, etc. in other licensed corporations in the past. In other words, past…

What is counted as relevant industry experience under the IA license transition arrangements?

One of the most repercussive reforms after the Insurance Authority took over the supervision of the insurance industry is the change of the minimum academic qualification requirement from Secondary school form 5 level to passing 5 subjects in the Hong Kong Certificate of Education Examination (HKCEE) / Hong Kong Diploma of Secondary Education (HKDSE),…

Minimum academic requirements for applying for an EAA license

Is there a minimum education requirement for the real estate industry? The conditions for the licensing of the real estate industry are included in the “Fit and proper person to hold a licence” guidelines issued by the Estate Agent Authority (EAA). All real estate agents and salespersons who wish to be licensed must…