When purchasing insurance in Hong Kong, there are generally two types of insurance salespeople that you may encounter: insurance agents and insurance brokers.

What are the differences in their roles or responsibilities? Do they need to register with recognized organizations before working? And what are their professional qualifications?

This article will answer these questions one by one.

In Hong Kong, both companies and individuals must hold an insurance license to conduct insurance business.

Licensed insurance intermediaries in Hong Kong are divided into licensed insurance agents and licensed insurance brokers.

1.Licensed Insurance Agents

Licensed insurance agents include licensed individual insurance agents, licensed insurance agency and licensed responsible officers (agents).

Licensed individual insurance agents and licensed insurance agencies are authorized agents appointed by authorized insurers (i.e. insurance companies), with the insurance companies being their principals. They promote, offer advice, and make arrangements for policies provided by the appointed insurance companies.

Licensed responsible officers (agents) are agents appointed by licensed insurance agencies (i.e. licensed insurance agencies are their principals). They promote, offer advice, and make arrangements for policies provided by the appointed insurers of licensed insurance agencies.

In addition, insurance agents are divided into independent agents and employed agents according to the contract signed with insurance companies.

Employed agents have an employment relationship with a single insurance company and may receive a base salary, as well as commissions and bonuses.

Independent agents do not have an employment relationship with the insurance company they represent. They are appointed to sell insurance products and provide after-sales service by the insurance company and earn commissions from each policy arranged.

Independent licensed individual insurance agents cannot represent more than four insurance companies at the same time, with a maximum of two being life insurance companies.

Both independent and employed agents can represent insurance companies, explain the application process to customers, prepare and submit relevant insurance documents, manage policies, and assist policyholders in making claims.

The commission of insurance agents is calculated as a percentage of the premium, with the amount usually decreasing as the policy term gets longer. For example, for a 10-year policy, the agent may receive a commission of about 25% to 40% of the premium in the first year, which will decrease to about 7% to 5% in the second year, and will be 0% in the fifth or sixth year.

2.Insurance Brokers

Licensed insurance brokers include licensed insurance brokerage firms and licensed business representatives (brokers).

Licensed insurance brokerage firms provide advice on policies to clients and act as their agents in handling policy-related matters, including the purchase, negotiation, and arrangement of policies with insurance companies. They can collaborate with multiple insurance companies simultaneously, acting as a liaison between the policyholder and the insurance company, and recommend and sell insurance products based on the policyholder’s needs.

Licensed business representatives (brokers) are appointed representatives of licensed insurance brokerage firms (i.e., representing licensed insurance brokerage firms). In this capacity, they provide advice on policies to clients and represent the licensed insurance brokerage firm that appointed them in handling policy-related matters on behalf of their clients.

In common parlance, an insurance broker usually refers to a licensed business representative of a licensed insurance brokerage firm, also known as a broker.

The income of insurance brokers in Hong Kong typically comes from commissions paid by insurance companies, not clients. Insurance brokerage firms usually receive a one-time commission from insurance companies after the policy takes effect. For example, signing a new 10-year policy might yield a commission of about 40%-70% of the premium. If the policyholder cancels or reduces coverage within a specified period, the insurance company may also claw back the commission.

In summary, in everyday life, the three main types of licensed insurance intermediaries that we interact with are: licensed individual insurance agents appointed by insurance companies, licensed business representatives (agents) appointed by licensed insurance agency firms, and licensed business representatives (brokers) appointed by licensed insurance brokerage firms.

The primary responsibilities of both licensed insurance agents and licensed insurance brokers are to assist policyholders in understanding, learning about, and buying and selling insurance products.

Among them, licensed insurance brokers represent policyholders, while licensed insurance agents represent insurance companies; licensed insurance brokers can sell products from different insurance companies; licensed insurance agents can only sell products provided by insurance companies; licensed insurance brokers provide fewer after-sales services for insurance companies; licensed insurance agents can usually provide after-sales services directly.

Insurance brokers have an advantage in product diversity, enabling policyholders to access more market information. In contrast, insurance agents represent one or several insurance companies, and they may have a deeper understanding of the company’s insurance products. They may also be more direct and efficient when handling policy or claims-related matters. Both rely on their professionalism and experience to judge and select suitable insurance products for their clients.

Both insurance brokers and insurance agents rely on commissions as their primary source of income.

Finally, it should be noted that individuals or companies cannot act as both insurance agents and insurance brokers simultaneously.

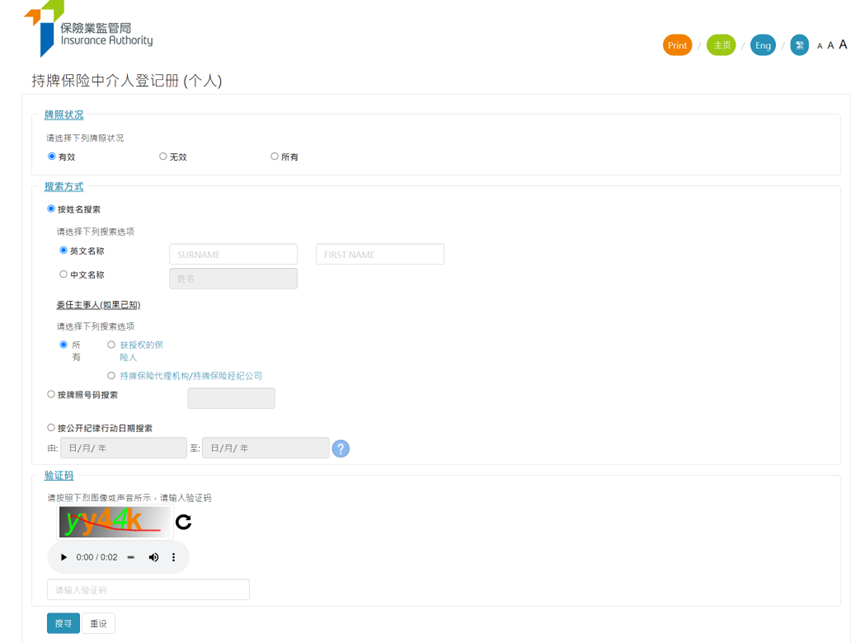

You can verify their identities in the Licensed Insurance Intermediaries Register (Individual).

How can we help?

2CExam provides HKSI LE, IIQE, EAQE and SQE related exam preparation materials. We sell mock question banks for HKSI LE Papers 1, 2, 3, 5, 6, 7, 8, 9, 12 in Chinese and English; and bibles for HKSI LE Papers 1, 2, 6, 7, 8 in Chinese. We also offer 1 on 1 tutorial services. Besides, we have also made free tutorial videos for HKSI LE Papers 1, 2, 6, 7, 8, 12 and posted on public channels such as Youtube/ Bilibili/ Tencent/ Iqiyi. 2CExam has been an exam training expert for years. Should you need any help please visit www.2cexam.com or contact us through:

Phone +852 2110 9644 Email: [email protected] Wechat: hk2cexam WhatsApp: +852 9347 2064

Please support us by leaving comments and likes if you think this article helps you!

You can scan or click on the QR codes to visit our social media.

Latest Article

Categories

過往文章

Contact US

-

Phone:

+852 2110 9644

-

Email:

-

WhatsApp

+852 9347 2064

-

WeChat

hk2cexam

Interesting Articles

What is an IIQE license?

How to register for the exam? How to prepare? Isn’t the IIQE test score a license?! Obtaining a passing score in the IIQE (Insurance Intermediaries Qualifying Examination) held by the Institute of Professional Education and Knowledge (VTC PEAK) is one of the requirements for applying for an insurance practitioner license. Since PEAK is a statutory…

What is the HKSI license?

How to register for the exam? How to prepare? What?! The HKSI exam result is not a license? HKSI, Hong Kong Securities and Investment Institute’s designated LE’s (Licensing Examination, Qualifying Examination) passing result is one of the competency requirements for applying for a license to become a representative and/or responsible officer. However, HKSI is a…

What exactly is a Hong Kong securities license?

Is it an HKSI license or an SFC license or an HKMA license? What is the 178 license? We often hear people mention the 178 license, what does that mean exactly? In fact “178 license” is a common misnomer. 178 does not refer to a license, but a combination of exam papers that need to…

Insurance Intermediary Qualification Examination (IIQE) Exemptions

Type A & B of exempted applicants According to Insurance Authority’s Insurance Intermediaries Quality Assurance Scheme (IIQAS), There are 5 types (A, B, C, D, E) of individuals who could be exempted from the IIQE requirement. Type A individuals could be exempted from IIQE Paper 1 (Principles and Practice of Insurance), IIQE Paper 2 (General…

What Is the Difference Between SFC License And HKMA License?

Which license should a bank employee apply for? Will it be supervised by the SFC or HKMA? What is a SFC license? The full name of SFC is the Securities and Futures Commission, and it is the statutory regulator of the securities industry in Hong Kong. The Securities and Futures Commission was established in accordance…

What is the validity period of the HKSI LE Hong Kong Securities Examination results?

If you ever asked the questions above, then this article is specially written for you! In order to better comprehend the specification of HKSI’s licensing details, we must first clarify the relationship between the various institutions. HKSI is the abbreviation for Hong Kong Securities and Investment Institute. If you ever considered obtaining license(s) for securities-related…

HKSI LE Exemption

Let’s talk about Exemptions: Hong Kong Securities and Investment Institute (HKSI) Licensing Examination Paper 7,8,9,11,12 – Common Misunderstandings we all have when it comes to comprehending the Hong Kong Securities and Investment Institute’s (HKSI) exemption methods and requirements. Able to Have Exemptions from HKSI Examination Papers 7 to 12 By fulfilling any of the following…

What is the validity period of the EAQE/SQE exam?

As a city with a dense population, Hong Kong’s property prices continue to be extremely lucrative. With each buying and selling transaction involves several million, being a real estate agent is a way for many people to make a fortune. Imagine how selling only one deal monthly can already enable you to have a comfortable…

What is the validity period of IIQE test results?

“If you have money, buy insurance, if you don’t have money, you can sell insurance.” I wonder if you have heard of this saying. Many people rely on insurance to support themselves and their families. Before entering the industry to sell insurance, you need to take at least 2 Insurance Intermediaries Qualifying Examination (IIQE) exam…

- « Previous

- 1

- …

- 11

- 12

- 13