Contrary to the common belief that “anyone with a smooth tongue can sell insurance” and “the threshold for the insurance industry is low, anyone can do it well,” insurance sales is not as simple as it seems.

In 2015, Google attempted to enter the online insurance sales market. At that time, Google launched a service called “Google Compare,” which allowed consumers to compare and purchase financial products such as car insurance, credit cards, and loans. However, in 2017, two years later, Google announced the closure of the service.

According to reports, Google Compare encountered some challenges in the market, including difficulties in negotiating with insurance companies, regulatory issues, and lower consumer acceptance of online insurance purchasing, especially the latter.

The core of insurance is risk assessment and management. Online sales may not be able to provide this kind of service. For example, online sales cannot provide face-to-face communication with customers, and it is difficult to provide personalized risk assessments and customized insurance products. In addition, online sales may also have security and privacy issues, which cannot provide customers with sufficient protection and a sense of trust.

So, what services can professional insurance practitioners offer?

1.Risk Assessment

Professional insurance practitioners need to comprehensively analyze factors such as customer needs, risk tolerance, financial status, family and health conditions, etc., and conduct detailed assessments of various risks to develop targeted solutions. Those who are not sufficiently trained may not be able to grasp customer needs and tolerance, leading to the purchase of inappropriate insurance products, which not only wastes resources but also increases risk, causing concern instead.

2.Insurance Product Knowledge

There is a wide variety of insurance products, each with its unique features and limitations. Insurance contracts often use professional jargon and complex language, making them difficult for ordinary people to understand. If insurance practitioners cannot clearly explain the details of the product terms, customers may misunderstand and purchase products that do not meet their needs.

3.Specialized Customer Service

Purchasing insurance is not a regular consumer product, but a long-term investment decision that may involve changes in health, finances, and family, requiring adjustments to the policy. In case of accidents or losses, customers need to apply for claims from the insurance company, which involves a complicated process requiring numerous documents and proofs. High-quality customer service is needed at this time. Professional insurance practitioners should pay attention to customer needs and demands, providing quick and accurate responses.

In Hong Kong, insurance brokers and insurance agents are two important roles for these professional insurance practitioners, both of which are insurance intermediaries.

In the past, there was no unified regulatory authority to oversee the entire insurance industry in Hong Kong. Insurance brokers and insurance agents were regulated by different organizations: insurance brokers were supervised by professional associations such as the Professional Insurance Brokers Association (PIBA) and the Hong Kong Confederation of Insurance Brokers (HKCIB), while insurance agents were regulated by the Hong Kong Federation of Insurers (HKFI). These organizations were responsible for registering and managing insurance brokers and agents and handling complaints related to them.

The Hong Kong Insurance Authority (IA) was established on December 7, 2015, with the enactment of the Insurance Companies (Amendment) Ordinance 2015. On June 26, 2017, it took over from the former government department, the Office of the Commissioner of Insurance, to regulate insurance companies. On September 23, 2019, it replaced PIBA, HKCIB, and HKFI to regulate insurance intermediaries.

The IA is independent of the government, aiming to comply with international standards, oversee the development of the insurance industry, and provide better protection for policyholders.

With the establishment of the Insurance Authority, the regulatory work of the insurance industry has become more stringent.

Now, the registration and management of insurance brokers and insurance agents are both handled by the Insurance Authority.

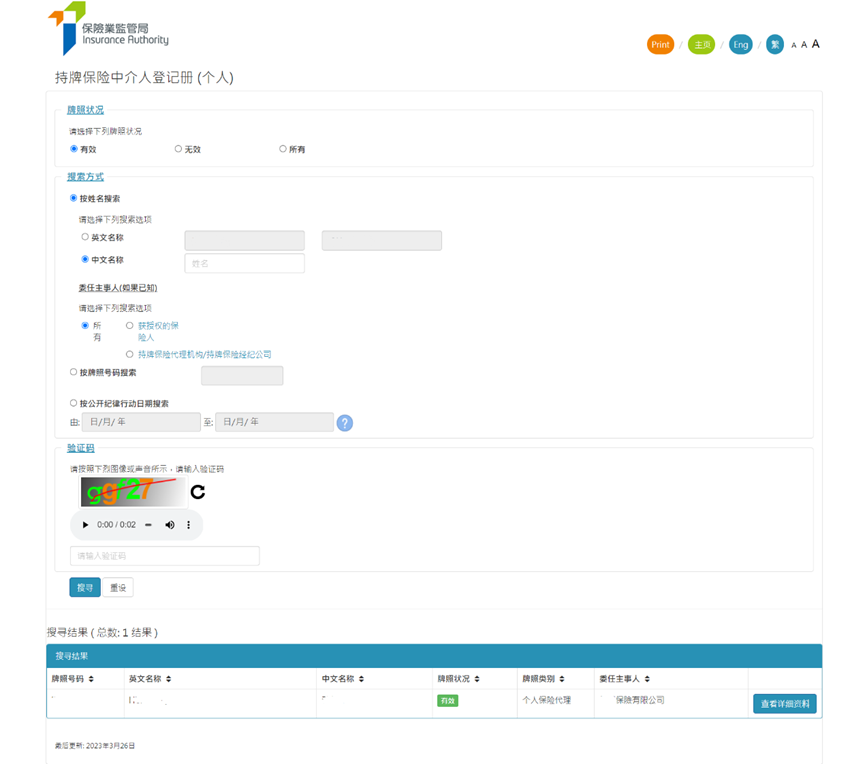

To search for insurance intermediaries who are still registered and valid since September 23, 2019, or who have been registered in the past, you can directly check and verify the “Licensed Insurance Intermediaries (Individual)” Register on the Insurance Authority website: https://iir.ia.org.hk/#/search/individual

If you want to inquire about the insurance intermediary license records that have expired before September 23, 2019, you can try the following two methods:

Method 1: Oral confirmation

Phone: 38999983

Please call the Insurance Authority during office hours (Monday to Friday, 8:45 am to 12:45 pm, and 1:45 pm to 6:00 pm) and provide the license number or ID number of the intermediary you want to inquire about from HKFI/PIBA/CIB.

Method 2: Written confirmation

Email: [email protected]

Provide the license number or ID number of the intermediary you want to inquire about from HKFI/PIBA/CIB in the email and ask the Insurance Authority about the relevant license records.

If you can’t find any information using the methods above, you may have encountered a scammer. In that case, there’s no need to say anything else – run!

How can we help?

2CExam provides HKSI LE, IIQE, EAQE and SQE related exam preparation materials. We sell mock question banks for HKSI LE Papers 1, 2, 3, 5, 6, 7, 8, 9, 12 in Chinese and English; and bibles for HKSI LE Papers 1, 2, 6, 7, 8 in Chinese. We also offer 1 on 1 tutorial services. Besides, we have also made free tutorial videos for HKSI LE Papers 1, 2, 6, 7, 8, 12 and posted on public channels such as Youtube/ Bilibili/ Tencent/ Iqiyi. 2CExam has been an exam training expert for years. Should you need any help please visit www.2cexam.com or contact us through:

Phone +852 2110 9644 Email: [email protected] Wechat: hk2cexam WhatsApp: +852 9347 2064

Please support us by leaving comments and likes if you think this article helps you!

You can scan or click on the QR codes to visit our social media.

Latest Article

Categories

過往文章

Contact US

-

Phone:

+852 2110 9644

-

Email:

-

WhatsApp

+852 9347 2064

-

WeChat

hk2cexam

Interesting Articles

Why would it be a disadvantage for foreigners to take the IIQE exam?

Some students who have taken the exams several times may pay attention to both the Chinese and English questions simultaneously, they will find that the content of the questions in Chinese or English exam is actually the same. Sometimes the topics are more difficult to understand in Chinese, and some topics are more difficult…

Why is it a disadvantage for foreigners to take the HKSI LE securities exam?

The HKSI LE exam provides two languages, Chinese and English, and both are provided during the exam. Some students who have taken the exams several times may pay attention to both the Chinese and English questions simultaneously, they will find that the content of the questions in Chinese or English exams is actually…

Which IIQE exam is easier? The English version or the Chinese version?

From time to time, students who purchase mock questions will ask us whether it is better to take the IIQE exam in Chinese or English? Some students who have taken the exams several times may pay attention to both the Chinese and English questions simultaneously. They will find that the content of the…

Is the HKSI LE exam easier to take in English? Or in Chinese?

From time to time, students who purchase mock questions will ask us whether it is better to take the HKSI LE exam in Chinese or English? If you have taken the exams several times and have paid attention to both the Chinese and English questions, you will find that the content of the…

Can I obtain an insurance license from the Insurance Authority (IA) without taking any examination if I have a foreign professional qualification?

Does the IA recognize insurance-related work experience gained outside of Hong Kong? Some students will ask us what kind of work experience is considered as insurance related industry experience, because their academic qualifications do not meet the requirements. Some people might have the misconception, thinking that without a license, how can one have industry…

Can I apply for a real estate license from the EAA Estate Agent Authority if I have a criminal record?

To apply for a real estate business license, you need to meet the “fit and proper” guidelines issued by the Estate Agent Authority (EAA). Estate Agent Authority will explore your past criminal records including but not limited to rigging, fraud or other dishonest acts, such as theft, handling stolen goods, using false documents, leaving…

Can I apply for an insurance license from the Insurance Authority if I have criminal records?

To apply for an insurance license, you need to meet the “Fit and Proper” Guidelines issued by the Insurance Authority (IA). The IA will look into your past criminal records, the Monetary Authority / Securities and Futures Commission / MPFA / other relevant agencies’ sanction records, as well as whether there are any places…

If I have a criminal record, can I still apply for the SFC’s securities license?

To apply for a securities license, you need to meet the Guidelines on Competence issued by the Securities and Futures Commission. Among them, the SFC will explore your past criminal records, whether you have ever had disciplinary actions, known frauds, misrepresentations, etc. in other licensed corporations in the past. In other words, past…

What is counted as relevant industry experience under the IA license transition arrangements?

One of the most repercussive reforms after the Insurance Authority took over the supervision of the insurance industry is the change of the minimum academic qualification requirement from Secondary school form 5 level to passing 5 subjects in the Hong Kong Certificate of Education Examination (HKCEE) / Hong Kong Diploma of Secondary Education (HKDSE),…

Minimum academic requirements for applying for an EAA license

Is there a minimum education requirement for the real estate industry? The conditions for the licensing of the real estate industry are included in the “Fit and proper person to hold a licence” guidelines issued by the Estate Agent Authority (EAA). All real estate agents and salespersons who wish to be licensed must…