If you want to work in the front line of the insurance industry, you have a good chance of needing to take the Insurance Intermediaries Qualifying Examination (IIQE). As for what exam papers you need to take, first you can check whether you meet certain conditions to be exempted from specific exam paper combinations of IIQE. For IIQE exemption, please refer to Exemption from Insurance Intermediary Qualification Examination (IIQE)

Will the exam papers for insurance agents and insurance brokers be different?

If you want to know the difference between the two, please refer to What is the difference between an insurance agent and an insurance broker?

The combination of exam papers for insurance agents and insurance brokers are the same. In other words, if you want to change from an insurance agent to a broker, as long as the license has not expired, you do not need to retake any exams, and vice versa.

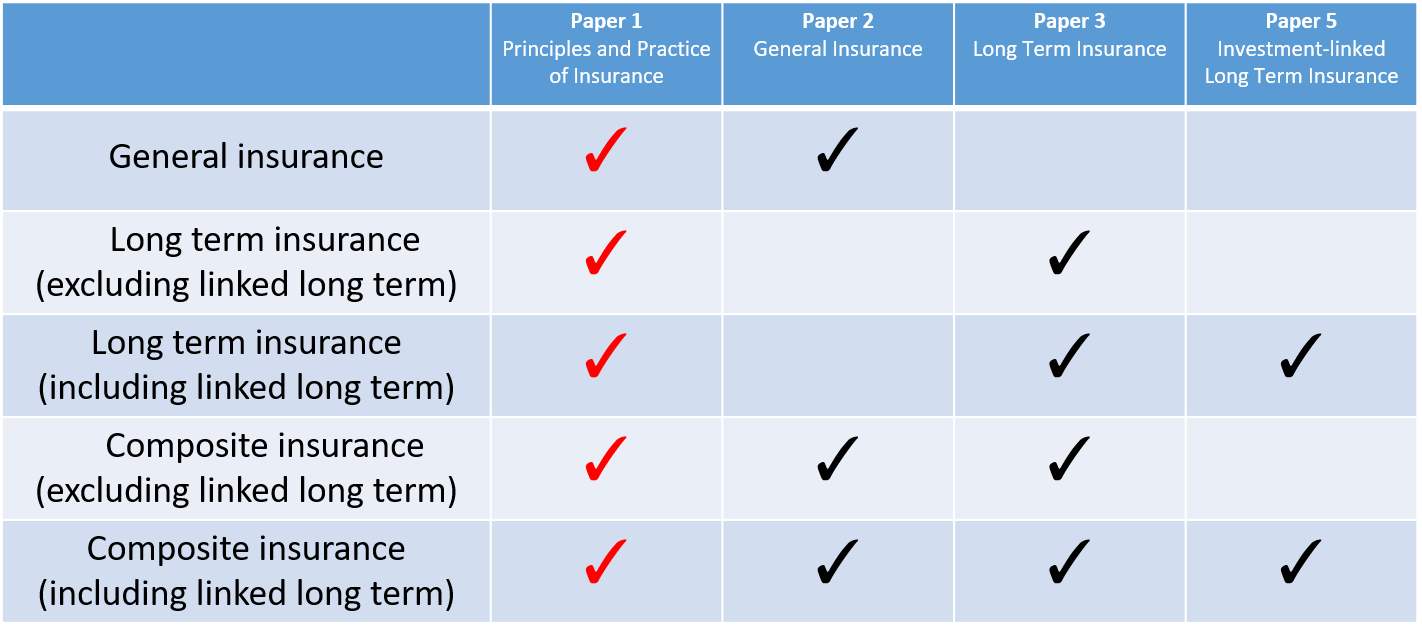

What exam papers do I need to take if I want to sell general insurance?

If you want to sell some general business insurance policies, such as car insurance, personal accident and sickness insurance, fire insurance, money insurance, director and senior officer liability insurance, product liability insurance, public liability insurance, marine insurance, etc., you need to take the IIQE paper 1 Principles and Practices of Insurance and paper 2 General Insurance.

A container ship arriving in port on a very calm day.

What exam papers do I need to take if I want to sell long-term insurance?

If you want to sell long-term business insurance policies, such as savings life insurance, term life insurance, universal life insurance, whole life insurance, annuities and other life-related policies, you need to take the IIQE paper 1 Insurance – Principles and Practices and Paper 3- Long Term Insurance.

What exam paper do I need to take if I want to sell investment-linked long-term insurance?

To sell long-term insurance policies that are directly related to investment products, not only do you need to partake in paper 1 and paper 3 exams, but you also need to partake in IIQE paper 5-investment-linked long-term insurance exam. If one did not partake in paper 5 exam, but only partake in paper 1 and 3 exams, one cannot sell investment-linked insurance policies.

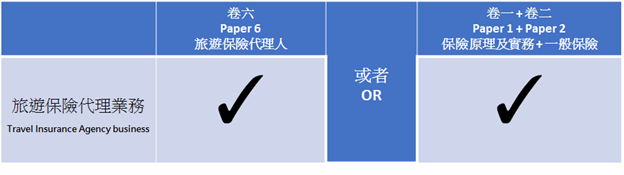

What exam paper do I need to take if I want to sell travel insurance?

If you work in a travel agency and only need to sell travel insurance without considering selling other types of insurance, you can choose to take the IIQE Paper 6 – Travel Insurance Agent exam. However if you also want to consider the practicality of the exam, you can also take IIQE Paper 1 and Paper 2 instead to learn about other general insurance knowledge.

What exam paper should I take if I want to sell MPF?

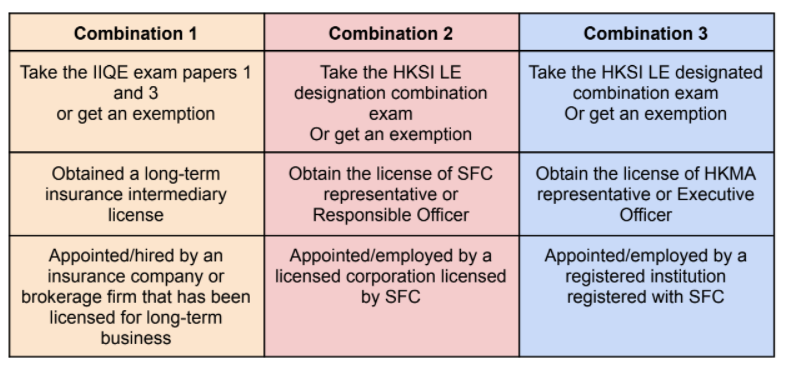

The MPF examination paper was formerly called IIQE Paper 4, but it has now been separated from the Insurance Intermediary Qualifying Examination and has been renamed the Mandatory Provident Fund Schemes Examination (MPFE). However, if you want to obtain a license to become an MPF intermediary, you must first meet any of the following combination conditions that is indicated vertically in the table below.

Therefore, it is necessary to partake in more than one exam if you wish to sell MPF.

All in all, if you want to become an insurance intermediary and you do not have any professional qualifications or industry experience, you generally need to take more than one exam paper.

How can we help?

2CExam provides HKSI LE, IIQE, EAQE and SQE related exam preparation materials. We sell mock question banks for IIQE Papers 1, 2, 3, 5 and MPFE in Chinese and English; and bibles for IIQE Papers 1, 2, 3, MPFE in Chinese. We also offer 1 on 1 tutorial services. Besides, we have also made free tutorial videos for IIQE Papers 1, 2, 3 and MPFE and posted on public channels such as Youtube/ Bilibili/ Tencent/ Iqiyi. 2CExam has been an exam training expert for years. Should you need any help please visit www.2cexam.com or contact us through:

Phone +852 2110 9644 Email: [email protected] Wechat: hk2cexam WhatsApp: +852 9347 2064

Please support us by leaving comments and likes if you think this article helps you!

You can scan or click on the QR codes to visit our social media.

Latest Article

Categories

過往文章

Contact US

-

Phone:

+852 2110 9644

-

Email:

-

WhatsApp

+852 9347 2064

-

WeChat

hk2cexam

Interesting Articles

What exam should I take if I want to be a sponsor?

In Hong Kong, unless an individual or company is exempted, If they wish to conduct the ten “regulated activities” defined by the Securities and Futures Ordinance, they need to apply for a license/registration with the Securities and Futures Commission. Type 1: Dealing in securities Type 2: Dealing in future contracts Type 3: Leveraged…

What exam should I take if I want to help customers buy and sell futures and options?

In Hong Kong, unless an individual or company is exempted, if they wish to conduct the ten “regulated activities” defined by the Securities and Futures Ordinance, they need to apply for a license/registration with the Securities and Futures Commission. Type 1 Dealing in securities Type 2 Dealing in futures contracts Type 3 Leveraged foreign…

What exam should I take if I want to help clients buy and sell Hong Kong stocks, US stocks, and bonds?

In Hong Kong, unless an individual or company is exempted, if they wish to conduct ten “regulated activities” defined by the Securities and Futures Ordinance, they need to apply for a license/registration with the SFC. Type 1 Dealing in securities Type 2 Dealing in futures contracts Type 3 Leveraged foreign exchange trading Type…

What exam should I take if I want to sell group insurance, accident insurance and disability insurance with death compensation?

Are group insurance, accident insurance and disability insurance with death compensation general insurance policies or long-term policies? In fact, there is no absolute answer, because an insurance policy with both accident/disability compensation and life insurance components can be general policies or long-term policies, depending on the plan. As in death compensation accident insurance: It…

What exam should I take if I want to sell life insurance, savings life insurance, annuities, and critical illness insurance?

Life insurance, endowment insurance, annuities, and critical illness insurance are all insurances that are particularly related to human life. Life insurance and endowment life insurance are types of insurance that pay consolation money to the beneficiary after the death of the insured. Annuities are closely related to the life of the insured. Basically for…

What exam should I take if I want to sell accident insurance, domestic helper insurance, and medical insurance?

Accident insurance, domestic helper insurance, and medical insurance are all medical-related insurances that are purchased in order to avoid burdening huge (medical) expenses. According to Hong Kong’s “Insurance Ordinance”, general business protection covers 17 categories, including accidents, sickness, and general legal liability. Therefore, if you want to sell accident insurance, domestic helper insurance, and medical…

What exam should I take if I want to sell engineering insurance and liability insurance?

Engineering insurance and liability insurance are insurances designed to avoid huge financial burdens caused by huge losses. Part of the engineering insurance will protect the legal liabilities of causing the third party to be injured or have property losses; while the liability insurance is to compensate for the liabilities derived from causing injuries or losses…

What exam should I take if I want to sell car insurance, water damage insurance, home insurance, property insurance, and marine cargo insurance?

Car insurance, water damage insurance, home insurance, property insurance, and marine cargo insurance are all property insurances that are purchased to cover losses caused by accidents. According to Hong Kong’s “Insurance Ordinance”, general business insurance covers 17 major categories, including land vehicles, ships, fires and natural forces, damage to property, etc. Therefore, if you want…

What is the Use for IIQE Certificates?

Is there any difference between notification of results and a certificate? Do I need to submit both at the same time when I apply for a license? The IIQE notification of results and certificate are two different kinds of proof. The Vocational Training Council (VTC) Institute of Professional Education and Knowledge (PEAK) is responsible…

What is the Use of an HKSI Notification of Result and Certificate? Do I Need to Submit Both for SFC/HKMA License Application?

HKSI’s notification of results and HKSI certificate are two different kinds of proof. The Hong Kong Securities and Investment Institute is responsible for organizing examinations and issuing certificates. Therefore, the notification of results and certificates are issued by HKSI. However, passing the HKSI LE exam and being issued a certificate is not necessarily related. Anyone…