What is a Hong Kong Insurance Intermediary?

In Hong Kong, the business of selling, advising, and servicing insurance products is regulated by the Insurance Authority (IA).

According to section 64G of the Insurance Ordinance, no person may carry on a regulated activity in the course of his business or employment, or hold himself out as carrying on a regulated activity, for remuneration, unless the person is a licensed insurance intermediary or an exempt person under the Insurance Ordinance. Any person who contravenes section 64G of the Insurance Ordinance commits an offence.“

Therefore, in Hong Kong, anyone must obtain a license from the IA to become a licensed insurance intermediary in order to engage in insurance sales and promotion activities.

A Licensed Insurance Intermediary refers to professionals in Hong Kong who are engaged in selling, advising, and servicing insurance products. Their main duties include understanding customer needs, selling insurance products, providing after-sales services, and coordinating with insurance companies.

Individual licensed insurance intermediaries are divided into three categories: Licensed Individual Insurance Agents, Licensed Business Representatives (Agents), and Licensed Business Representatives (Brokers).

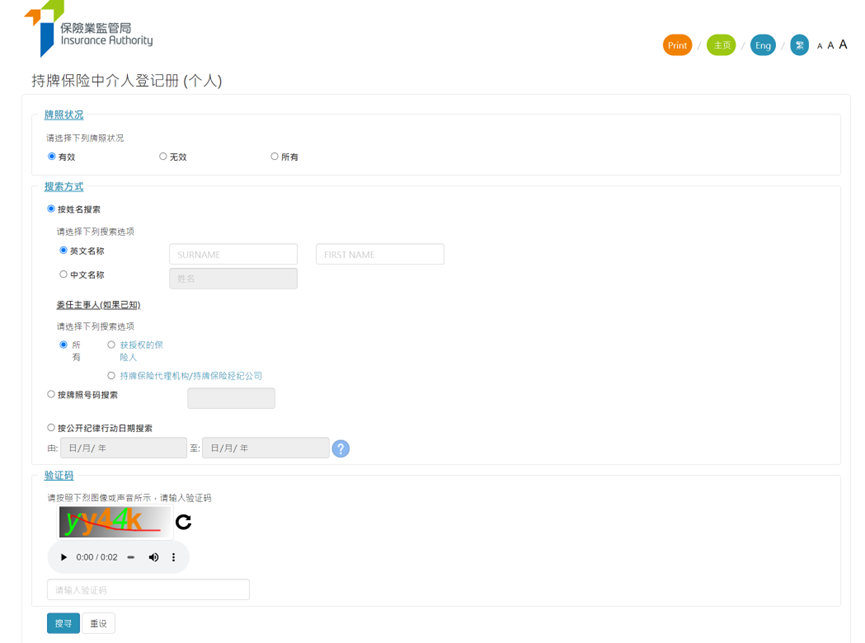

The information of licensed insurance intermediaries can be checked in the Register of Licensed Insurance Intermediaries of the IA.

How to become a Licensed Insurance Intermediary in Hong Kong?

The IA stipulates that whether it is a Licensed Individual Insurance Agent, Licensed Business Representative (Agent), or Licensed Business Representative (Broker), the applicant must:

- Meet the educational requirements specified in the Guidelines on the “Fit and Proper” Criteria for Licensed Insurance Intermediaries under the Insurance Ordinance (Cap. 41) (Guideline 23);

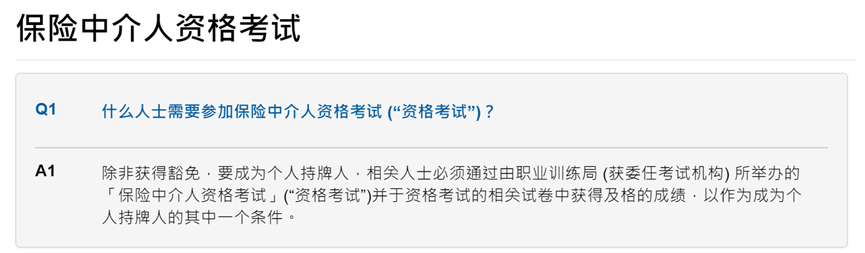

- Unless exempted, meet the requirements of the insurance intermediary qualification examination;

- Have a creditable reputation and financial status.

Therefore, if you want to enter the Hong Kong insurance industry, you must pass the insurance intermediary qualification examination and apply for a corresponding license from the IA within the validity period of the score to become a licensed insurance intermediary before you can officially start insurance business.

What is the Hong Kong Insurance Intermediary Qualification Examination?

The Insurance Intermediaries Qualifying Examination (IIQE), is a test stipulated by the Insurance Authority of Hong Kong to ensure that insurance intermediaries have the necessary professional knowledge and abilities, thereby protecting consumers’ interests and maintaining the stability and fairness of the insurance market.

Passing the IIQE is a necessary condition for Hong Kong insurance intermediaries to obtain a license, and it is also one of the thresholds for entering the Hong Kong insurance industry.

What is the minimum educational requirement to apply to become a licensed insurance intermediary?

According to the Insurance Ordinance, a licensed insurance intermediary must be a fit and proper person.

According to the Guidelines on the “Fit and Proper” Criteria for Licensed Insurance Intermediaries under the Insurance Ordinance (Cap. 41) (“Guideline 23”), an applicant for an individual licensed insurance intermediary (i.e., a licensed individual insurance agent, a licensed business representative (agent), or a licensed business representative (broker)) must have one of the following educational or professional qualifications:

- Hong Kong Diploma of Secondary Education (“DSE”) or Hong Kong Certificate of Education Examination (“HKCEE”) – Passes in five subjects, including Chinese Language / English Language and Mathematics;

- International Baccalaureate;

- Yi Jin Diploma – Applicants should take Extended Mathematics as an elective;

- For Mainland China’s Gaokao, the score in the relevant province / city must be at or above the “Second Class Line”; or the scores in Chinese / English and Mathematics must be 50% or above; and the total score in Gaokao must be 50% or above; and an official certification of the Gaokao score must be obtained from the “XueXin Network”.

How many papers are there in the Hong Kong Insurance Intermediary Qualification Examination?

The Insurance Intermediaries Qualifying Examination consists of five papers:

• Principles and Practice of Insurance Paper (Paper I, IIQE Paper 1)

• General Insurance Paper (Paper II, IIQE Paper 2)

• Long Term (Life) Insurance Paper (Paper III, IIQE Paper 3)

• Investment-linked Long Term (Life) Insurance Paper (Paper V, IIQE Paper 5)

• Travel Insurance Agents Examination Paper (Paper VI, IIQE Paper 6)

Unless exempted, those intending to engage in:

- General insurance intermediary business must pass the Principles and Practice of Insurance Examination (Paper I, IIQE Paper 1) and the General Insurance Examination (Paper II, IIQE Paper 2).

- Long-term insurance (excluding linked long-term insurance) intermediary business must pass the Principles and Practice of Insurance Examination (Paper I, IIQE Paper 1) and the Long Term (Life) Insurance Examination (Paper III, IIQE Paper 3).

- Long-term insurance (including linked long-term insurance) intermediary business must pass the Principles and Practice of Insurance Examination (Paper I, IIQE Paper 1), the Long Term (Life) Insurance Examination (Paper III, IIQE Paper 3), and the Investment-linked Long Term (Life) Insurance Examination (Paper V, IIQE Paper 5).

- Composite insurance (excluding linked long-term insurance) intermediary business must pass the Principles and Practice of Insurance Examination (Paper I, IIQE Paper 1), the General Insurance Examination (Paper II, IIQE Paper 2), and the Long Term (Life) Insurance Examination (Paper III, IIQE Paper 3).

- Composite insurance (including linked long-term insurance) intermediary business must pass the Principles and Practice of Insurance Examination (Paper I, IIQE Paper 1), the General Insurance Examination (Paper II, IIQE Paper 2), the Long Term (Life) Insurance Examination (Paper III, IIQE Paper 3), and the Investment-linked Long Term (Life) Insurance Examination (Paper V, IIQE Paper 5).

- Travel insurance agency business must pass the Travel Insurance Agents Examination (Paper VI, IIQE Paper 6).

| Exam PaperBusiness category | I | II | III | V | VI |

| General Insurance | ✓ | ✓ | |||

| Long Term Insurance (excluding linked) | ✓ | ✓ | |||

| Long Term Insurance (including linked) | ✓ | ✓ | ✓ | ||

| Composite Insurance (excluding linked) | ✓ | ✓ | ✓ | ||

| Composite Insurance (including linked) | ✓ | ✓ | ✓ | ✓ | |

| Travel Insurance Agent | ✓ |

Where can I take the exam for Qualification Examination for Insurance Intermediaries – Paper V: Investment-Linked Long Term Insurance?

The Insurance Intermediaries Qualifying Examination IIQE Paper 5, “Investment-linked Long Term Insurance”, is administered by the Professional Education and Knowledge (PEAK) division of the Vocational Training Council (VTC) in Hong Kong. The exam can be taken as a written test, computer test, or a remote examination.

Exam format: Multiple-choice questions

Language: Bilingual (Chinese and English)

Number of questions: 80 questions

Duration: 2 hours

Fee: Computer Test $250; Written Test $185; Remote Examination $850

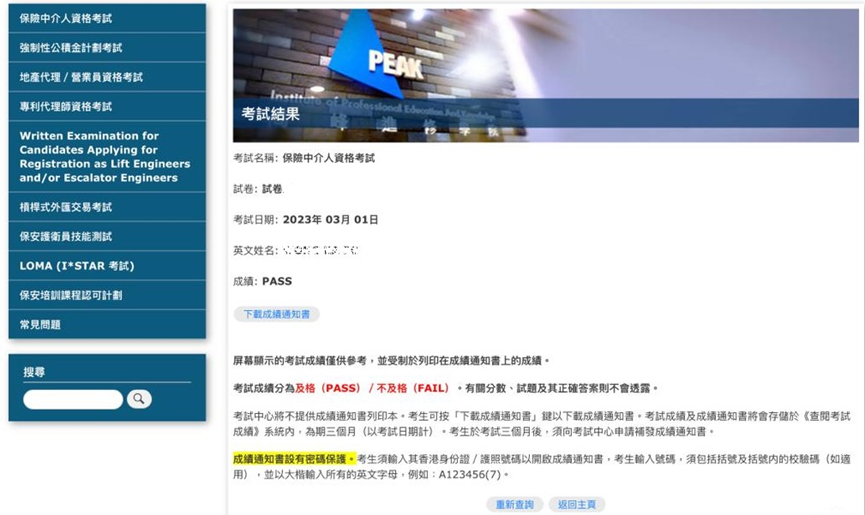

Exam Result: “Pass” or “Fail”

The passing score is 70%, and candidates must answer 56 questions correctly to achieve a passing grade. The result notification will not show the specific score, nor will it publish the questions and their correct answers.

The examination syllabus for the Insurance Intermediaries Qualifying Examination IIQE Paper 5 “Investment-linked Long Term Insurance” in Hong Kong is as follows:

| Chapter & Title | Weightage |

| Chapter 1 Introduction to Investment-linked Long Term Policies | 2.5% |

| Chapter 2 Investments | 20% |

| Chapter 3 Investment Assets | 35% |

| Chapter 4 Investment-linked Long Term Policies | 32.5% |

| Chapter 5 Regulatory Framework in Hong Kong | 10% |

| Total | 100% |

The registration link for the “Investment-linked Long Term Insurance” exam organized by the PEAK of VTC, the Vocational Training Council, is as follows: https://www.peak.edu.hk/exam/econline/zh/

Please note that candidates who pass the remote examination will need to within 18 months from the date of the exam:

1. Complete the special training course for the relevant qualifying examination paper operated by the Vocational Training Council (part of the continuing professional training hours can be obtained after the completion of the course); or

2.Take the relevant paper of the original qualifying exam and pass it.

Otherwise, the license will expire at the end of the 18-month period.

How to get the score notice?

For candidates taking the “Investment-linked Long Term Insurance” exam at the PEAK Exam Center of the Vocational Training Council:

1.For candidates taking the “Investment-linked Long Term Insurance” exam at the PEAK Exam Center of the Vocational Training Council:

2.Computer Exam

The computer exam results will be displayed on the computer screen immediately after the exam.

Candidates can download and print the score notice from the “Check Exam Results” system on the exam center webpage one hour after the specified end time of the exam.

3.Remote Exam

The remote exam results will be displayed on the computer screen of the exam device immediately after the exam.

Candidates can view, download, and print the score notice from the “Check Exam Results” system on the exam center webpage starting from the third complete working day after the exam.

Please note that the exam center does not provide printed copies of the score notice. The exam results and score notices will only be stored in the “Check Exam Results” system for a period of three months (calculated from the date of the exam).

Where to find free study materials for the Insurance Intermediaries Qualifying Examination Paper V “Investment-linked Long Term Insurance”?

1.Official Study Manual

The IA has prepared the “Investment-linked Long Term Insurance Exam Study Manual” to assist candidates in their exam preparation. Candidates can download it for free from the IA and PEAK websites.

IA free download link:

PEAK free download link:

2.Free teaching videos on Youtube

3.Free exercises

It’s worth noting that the “Investment-linked Long Term Insurance Exam Study Manual” has a total of 339 pages and covers a broad range of topics. Short-term memory can be relatively unreliable, and it can be challenging to remember so many concepts that have not been understood through rote memorization. There’s a good chance that by the time you finish the whole book, you would have forgotten most of what was in the first half.

Also, the questions that are selected for each exam may not be the same, and there can be a significant element of luck.

Therefore, when preparing for the IIQE exam, you should make sure you fully understand the syllabus and requirements, formulate an appropriate study plan, and actively participate in mock exams to improve your test-taking abilities.

Therefore, our suggested revision method is:

1.First read a chapter of the study manual/free instructional video

2.Complete the practice exercises for a chapter of the mock test.

This is to reinforce the understanding and memorization of knowledge repeatedly.

Lastly, good luck with your exam! We hope you pass with flying colors!

How can we help?

2CExam provides HKSI LE, IIQE, EAQE and SQE related exam preparation materials. We sell mock question banks for HKSI LE Papers 1, 2, 3, 5, 6, 7, 8, 9, 12 in Chinese and English; and bibles for HKSI LE Papers 1, 2, 6, 7, 8 in Chinese. We also offer 1 on 1 tutorial services. Besides, we have also made free tutorial videos for HKSI LE Papers 1, 2, 6, 7, 8, 12 and posted on public channels such as Youtube/ Bilibili/ Tencent/ Iqiyi. 2CExam has been an exam training expert for years. Should you need any help please visit www.2cexam.com or contact us through:

Phone +852 2110 9644 Email: [email protected] Wechat: hk2cexam WhatsApp: +852 9347 2064

Please support us by leaving comments and likes if you think this article helps you!

You can scan or click on the QR codes to visit our social media.

Latest Article

Categories

過往文章

Contact US

-

Phone:

+852 2110 9644

-

Email:

-

WhatsApp

+852 9347 2064

-

WeChat

hk2cexam

Interesting Articles

What is an IIQE license?

How to register for the exam? How to prepare? Isn’t the IIQE test score a license?! Obtaining a passing score in the IIQE (Insurance Intermediaries Qualifying Examination) held by the Institute of Professional Education and Knowledge (VTC PEAK) is one of the requirements for applying for an insurance practitioner license. Since PEAK is a statutory…

What is the HKSI license?

How to register for the exam? How to prepare? What?! The HKSI exam result is not a license? HKSI, Hong Kong Securities and Investment Institute’s designated LE’s (Licensing Examination, Qualifying Examination) passing result is one of the competency requirements for applying for a license to become a representative and/or responsible officer. However, HKSI is a…

What exactly is a Hong Kong securities license?

Is it an HKSI license or an SFC license or an HKMA license? What is the 178 license? We often hear people mention the 178 license, what does that mean exactly? In fact “178 license” is a common misnomer. 178 does not refer to a license, but a combination of exam papers that need to…

Insurance Intermediary Qualification Examination (IIQE) Exemptions

Type A & B of exempted applicants According to Insurance Authority’s Insurance Intermediaries Quality Assurance Scheme (IIQAS), There are 5 types (A, B, C, D, E) of individuals who could be exempted from the IIQE requirement. Type A individuals could be exempted from IIQE Paper 1 (Principles and Practice of Insurance), IIQE Paper 2 (General…

What Is the Difference Between SFC License And HKMA License?

Which license should a bank employee apply for? Will it be supervised by the SFC or HKMA? What is a SFC license? The full name of SFC is the Securities and Futures Commission, and it is the statutory regulator of the securities industry in Hong Kong. The Securities and Futures Commission was established in accordance…

What is the validity period of the HKSI LE Hong Kong Securities Examination results?

If you ever asked the questions above, then this article is specially written for you! In order to better comprehend the specification of HKSI’s licensing details, we must first clarify the relationship between the various institutions. HKSI is the abbreviation for Hong Kong Securities and Investment Institute. If you ever considered obtaining license(s) for securities-related…

HKSI LE Exemption

Let’s talk about Exemptions: Hong Kong Securities and Investment Institute (HKSI) Licensing Examination Paper 7,8,9,11,12 – Common Misunderstandings we all have when it comes to comprehending the Hong Kong Securities and Investment Institute’s (HKSI) exemption methods and requirements. Able to Have Exemptions from HKSI Examination Papers 7 to 12 By fulfilling any of the following…

What is the validity period of the EAQE/SQE exam?

As a city with a dense population, Hong Kong’s property prices continue to be extremely lucrative. With each buying and selling transaction involves several million, being a real estate agent is a way for many people to make a fortune. Imagine how selling only one deal monthly can already enable you to have a comfortable…

What is the validity period of IIQE test results?

“If you have money, buy insurance, if you don’t have money, you can sell insurance.” I wonder if you have heard of this saying. Many people rely on insurance to support themselves and their families. Before entering the industry to sell insurance, you need to take at least 2 Insurance Intermediaries Qualifying Examination (IIQE) exam…

- « Previous

- 1

- …

- 11

- 12

- 13