What is the difference between an SFC license and HKMA registration in Hong Kong?

In Hong Kong, the statutory organization responsible for regulating the securities and futures markets is the Securities and Futures Commission (SFC).

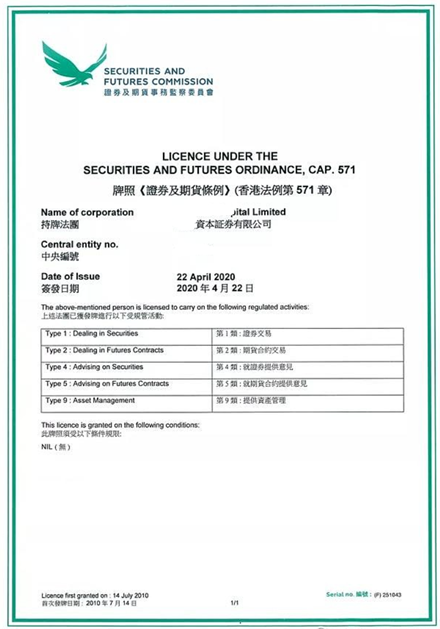

The Securities and Futures Ordinance, which came into effect on April 1, 2003, grants the SFC regulatory authority over the securities and futures markets in Hong Kong, including the important function of "licensing and regulating intermediaries engaged in regulated activities". According to the Securities and Futures Ordinance, unless exempted, anyone who carries on a regulated activity in the securities and futures markets or in the non-bank retail leveraged foreign exchange market in Hong Kong, or who holds themselves out as carrying on such activities, must obtain a license or registration from the SFC in accordance with the relevant provisions of the Securities and Futures Ordinance, or they will be committing a serious offense.

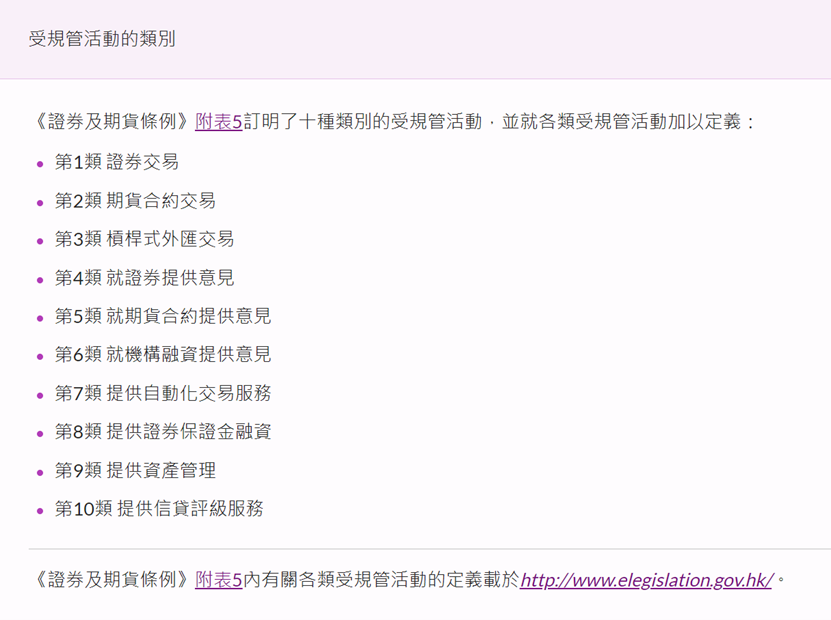

Schedule 5 of the Securities and Futures Ordinance specifies ten categories of regulated activities.

In brief, if a company or individual wants to engage in regulated activities such as securities trading, futures contracts trading, or asset management, they must obtain the qualifications from the SFC to conduct such regulated activities.

This qualification is divided into two types:

Obtaining an SFC license to become a licensed corporation or licensed person;

Registering to become a registered institution or registered person, that is, obtaining the so-called HKMA license in the industry.

So how do you determine which type of license to apply for?

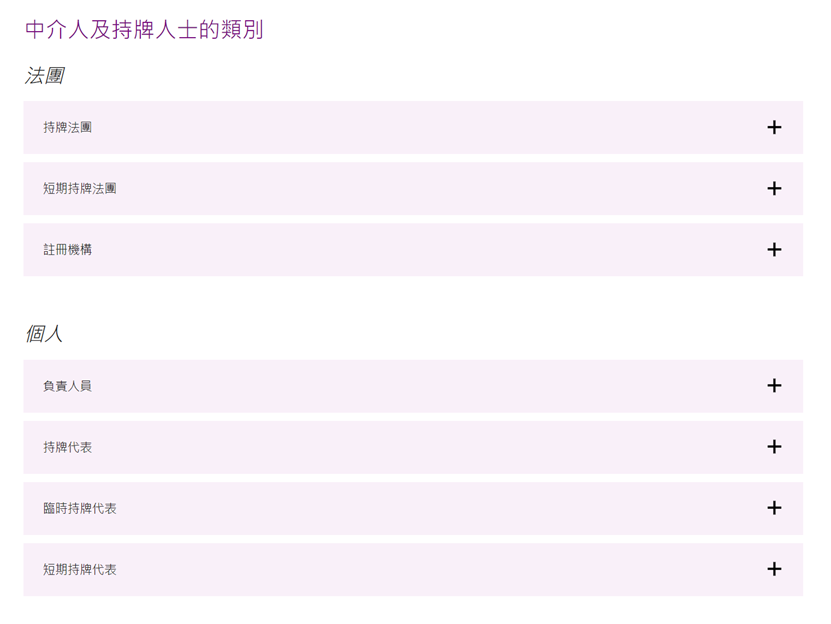

According to sections 116 and 117 of the Securities and Futures Ordinance, non-licensed financial institutions become licensed corporations (LCs) once they apply for and obtain a license from the SFC.

Individuals who are engaged in regulated activities under a licensed corporation are known as licensed representatives (LRs) after obtaining a license issued by the Securities and Futures Commission (SFC).

After being approved by the SFC, the licensed representative becomes a responsible officer (RO) responsible for supervising regulated activities.

According to section 119 of the Securities and Futures Ordinance, a recognized financial institution that has been registered with the SFC is referred to as a registered institution (RI).

Employees of registered institutions who engage in regulated activities and whose names are entered in the Securities Industry Record of the Hong Kong Monetary Authority (HKMA) are referred to as relevant individuals (ReI).

A licensed representative or relevant person affiliated with a registered institution, who has applied to and received approval from the Monetary Authority to serve as the executive officer (EO) of the registered institution.

The main difference between SFC and HKMA licenses is whether the corporation or affiliated corporation is a recognized financial institution.

So, what is a recognized institution?

A recognized institution refers to licensed banks, restricted-license banks, and deposit-taking companies.

In simple terms, it refers to banks. Companies registered in Hong Kong or overseas companies registered with the Hong Kong Companies Registry are considered non-recognized institutions.

Why are recognized institutions registered with the SFC instead of applying for a license?

According to the Banking Ordinance, the Hong Kong Monetary Authority (HKMA), also known as the Monetary Authority, is responsible for granting, suspending, and revoking the recognition status of recognized institutions. It has general discretionary powers to decide whether to approve or reject applications for recognition to conduct banking or deposit-taking business in Hong Kong.

The HKMA is the statutory regulatory body for the banking industry in Hong Kong, while the Securities and Futures Commission (SFC) is the primary regulatory body for the securities industry in Hong Kong. Therefore, if a bank wishes to engage in securities business regulated by the SFC, it needs to register with the SFC. The registration process involves the bank submitting application materials to the HKMA, which then reviews and forwards them to the SFC for registration. Banks engaged in securities business regulated by the SFC are jointly supervised by the HKMA and the SFC, with the HKMA remaining the frontline regulatory body.

Therefore, banks conducting securities business register with the SFC as registered institutions, rather than being directly regulated and licensed by the SFC as licensed corporations.

The differences between the two can be summarized in the table below:

| Corporate Category | SFC Qualification Category | Employee License Category | Regulatory Authority |

| Non-Recognized Institution | Licensed Corporation | Licensed Individual | SFC |

| Recognized Institution | Registered Institution | Relevant Individual | HKMA and SFC |

Lastly, complaints against a licensed corporation or licensed individual are handled by the SFC. Complaints against registered institutions or relevant individuals are the responsibility of the HKMA.

How can we help?

2CExam provides HKSI LE, IIQE, EAQE and SQE related exam preparation materials. We sell mock question banks for HKSI LE Papers 1, 2, 3, 5, 6, 7, 8, 9, 12 in Chinese and English; and bibles for HKSI LE Papers 1, 2, 6, 7, 8 in Chinese. We also offer 1 on 1 tutorial services. Besides, we have also made free tutorial videos for HKSI LE Papers 1, 2, 6, 7, 8, 12 and posted on public channels such as Youtube/ Bilibili/ Tencent/ Iqiyi. 2CExam has been an exam training expert for years. Should you need any help please visit www.2cexam.com or contact us through:Phone +852 2110 9644 Email: [email protected] Wechat: hk2cexam WhatsApp: +852 9347 2064

Please support us by leaving comments and likes if you think this article helps you!

You can scan or click on the QR codes to visit our social media.

Latest Article

Categories

過往文章

Contact US

-

Phone:

+852 2110 9644

-

Email:

-

WhatsApp

+852 9347 2064

-

WeChat

hk2cexam

Interesting Articles

Real estate exam registration strategy: how difficult is it to apply for the real estate exam? Here are 5 registration tips!

In addition to seats in prestigious schools and university admission quotas, Hong Kong also has another “competitive” phenomenon -acquiring a spot for real estate examinations. Generally, you can sign up at 9 o’clock in the morning on the day of registration, but the slots are normally full within a few minutes. The real estate…

It is often said that knowing people is better than having good literacy skills. How to know more financial professionals within the industry? What are the benefits of getting to know more professionals within the financial industry?

In the financial industry, what are the benefits of knowing more industry professionals? When working in the same industry, do we need to act like we are each other’s opponent country? Does working in the same industry mean that we are in a competitive relationship? In fact, it is not only the financial industry, but…

Questions regarding applying a for license after passing the HKSI LE exam

Questions regarding applying for a license after passing the HKSI exam Students often inquire about licensing issues after passing the HKSI LE examination. Many people ask what other factors will affect the licensing besides the examination results ? In fact, there are several conditions that need to be met: The first one is…

Should I take the HKSI Hong Kong Securities and Futures Exam in Hong Kong or the Mainland?

Should I take the HKSI Hong Kong Securities and Futures Exam in Hong Kong or the Mainland? For mainland candidates, this article will be very useful. First of all, the exam can be taken in Mainland China, but there are many restrictions. In this article, I will analyze the advantages of taking the exam…

How to obtain HKSI Hong Kong Securities and Futures Examination study materials?

How to obtain HKSI Hong Kong Securities and Futures Examination study materials? Many students asked why there is so little information relating to The Licensing Examination for Securities and Futures Intermediaries. Whether you use Google or Baidu to search for information you will find that this examination is actually taken every day, but there…

Do I have to buy a designated calculator to take the HKSI LE securities exam? Can I use my HKCEE/DSE calculator?

Within the HKSI LE exam, certain parts of the exam allow you to use your HKCEE/DSE calculator; whereas in some circumstances, bringing a calculator is mandatory. Some students may ask, whether an HKEAA Approved calculator be used in the HKSI LE exam? The answer is yes, but it will be somehow inconvenient. Some people…

What exam should I take if I want to work at a fund house?

In Hong Kong, unless an individual or company is designated for exemption, if they wish to conduct the following ten types of “regulated activities” defined by the Securities and Futures Ordinance, they need to apply for a license/registration with the Securities and Futures Commission. Type 1: dealing in securities Type 2: dealing in…

Real estate examination timetable and registration method for the second half calendar year of 2021

Where to register? If you want to register for the real EAQE or SQE exam, students need to go to the VTC PEAK website to view the details. Below we will explain how you can register for the exam. The registration website is: https://www.peak.edu.hk/exam/en/page.php?id=575661 Below is the announcement, when you enter the VTC PEAK registration…

HKSI Hong Kong Securities and Futures Examination Difficulty and Passing Rate

HKSI Hong Kong Securities and Futures Examination Difficulty and Passing Rate Hello everyone, let’s talk about the difficulty level of the Hong Kong Securities and Futures Examination today. Many students are asking about the difficulty level of the exam itself. The answer varies and depends on many factors. Some people say that the…

How to check the results of HKSI Paper?

How to check the results of HKSI LE Paper? How to check the results of HKSI LE paper? There are two situations for this. The first one is that if you take the exam in Hong Kong, most of them are computer-based exams, and you will know your results immediately after you finish the exam.…