The Hong Kong Securities and Investment (HKSI) Licensing Examination (LE) is one of the most popular exams in the Hong Kong financial market. It primarily tests an individual’s professional knowledge and abilities in securities and investments in order to obtain a license to practice in the securities and investment industry.

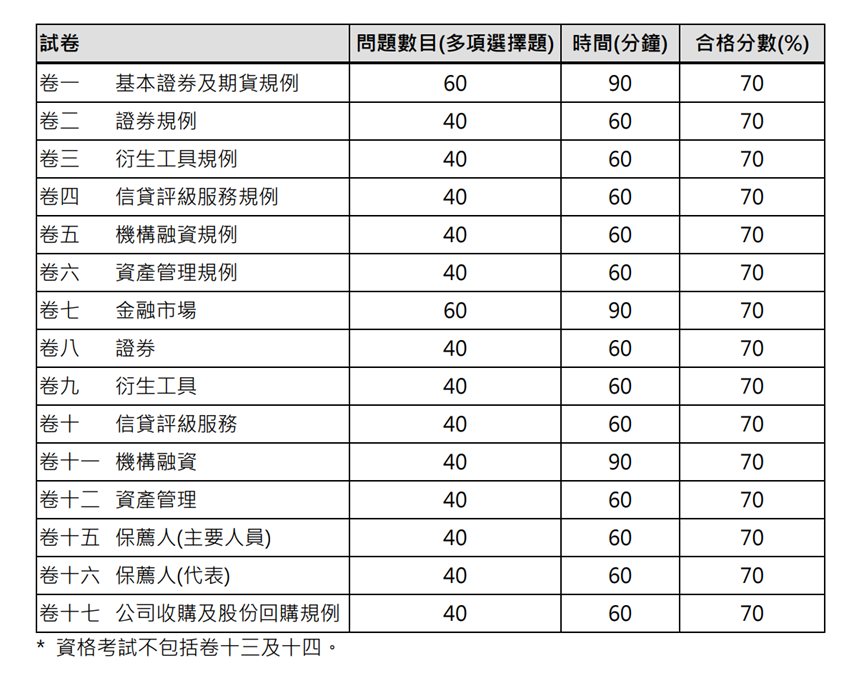

There are currently 15 different papers for the HKSI LE exam, which are divided into regulatory papers, application papers, and sponsor papers, among others. Candidates typically need to pass the regulatory papers and either the application or sponsor papers in order to participate in SFC regulatory activities.

Is it necessary to take every paper in the exam?

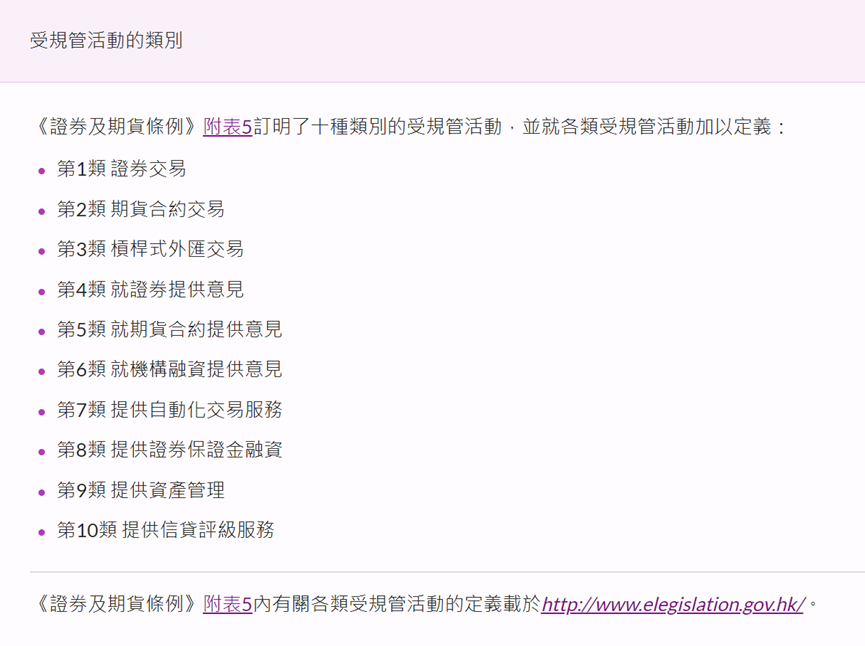

The answer is NO! According to Schedule 5 of the Securities and Futures Ordinance, there are 10 different regulated activities, and different combinations of papers are required for participating in each activity.

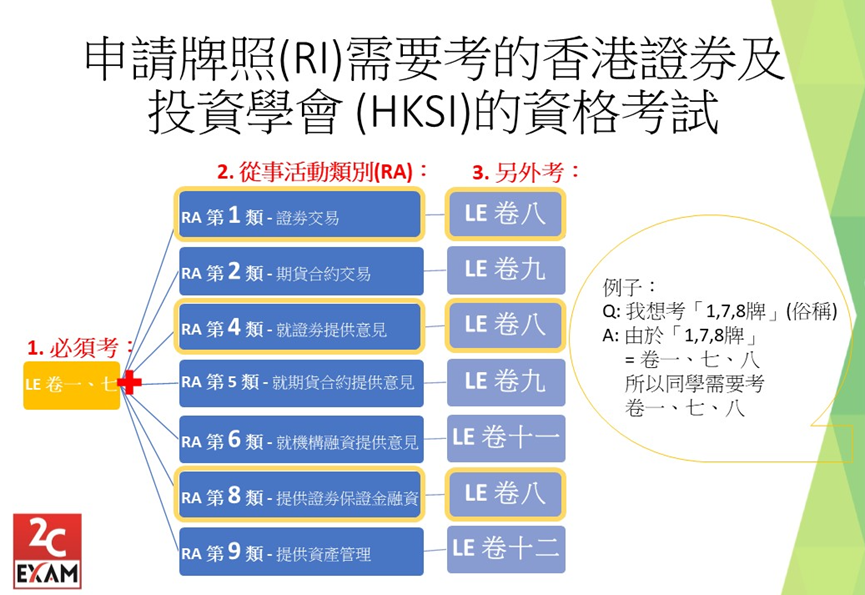

Please note that the regulated activity categories do not correspond directly to the HKSI exam paper numbers. This means that wanting to engage in regulated activities in Category 2 does not necessarily require taking HKSI Paper 2.Apart from Paper 1, the HKSI Securities and Investment (S&I) Licensing Examination has two categories of papers in Paper 2 to Paper 6 for responsible officers (RO) or executive officers (EO), and Paper 7 to Paper 12 for licensed representatives (LR) or relevant individuals (ReI).If you do not have any experience in the securities industry, you should start by becoming a licensed representative/ relevant individual.

The following is the exam combination for applying to be a licensed representative:

For example, if you want to become a licensed representative (LR) of a licensed corporation and participate in securities trading, buying and selling securities products such as Hong Kong stocks, US stocks, bonds, etc. on behalf of clients, you may need to pass Papers 1, 7, and 8 of the HKSI exam.

To participate in futures contract trading, the required papers would be Papers 1, 7, and 9.

If you wish to work for an asset management company and handle products related to funds or discretionary accounts, you may need to take Papers 1, 7, and 12.

Paper 1 covers the “Basic Securities and Futures Regulations”, Paper 7 covers “Financial Markets”, Paper 8 covers “Securities”, Paper 9 covers “Derivatives”, and Paper 12 covers “Asset Management”.

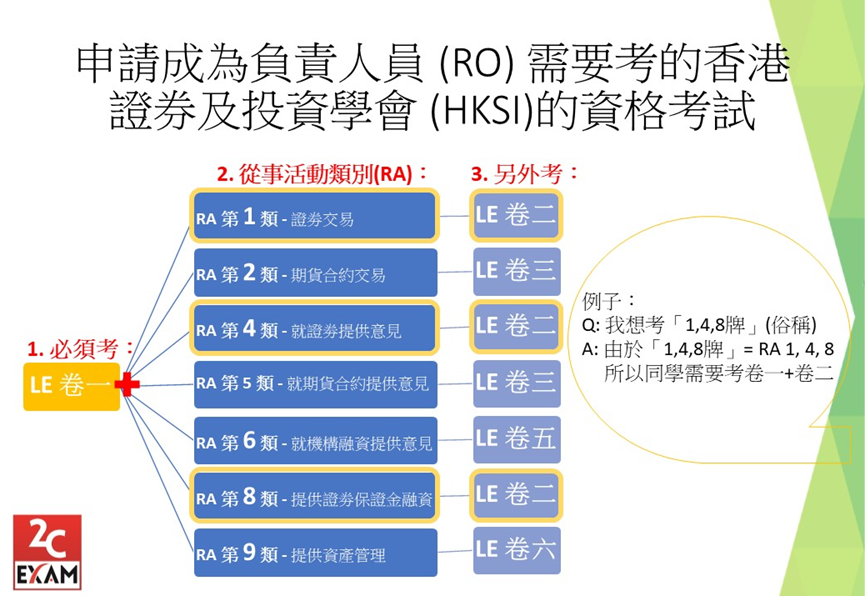

Responsible officers are senior management personnel of licensed corporations (LC), while executive officers are senior management personnel of registered institutions (RI).

Responsible officers/executive officers are responsible for supervising the regulated activities of the company to ensure compliance with SFC regulations and requirements.

To become a responsible officer/executive officer, at least 3 years of securities industry experience is required, including at least 2 years of experience in managing subordinates.

If you want to become a responsible officer (RO) or executive officer (EO) of a licensed corporation, you need to pass the following exams:

For example, if a responsible officer needs to supervise the securities trading operations of a company to ensure compliance with SFC regulations and requirements, they need to pass Papers 1 and 2, with Paper 2 covering the “Securities Regulations”.Unless exempted, responsible officers typically need to take more regulatory papers than licensed representatives.

If you already hold an SFC license for a regulated activity and apply for a license for another regulated activity, are your previous exam results still valid?

The answer is yes.

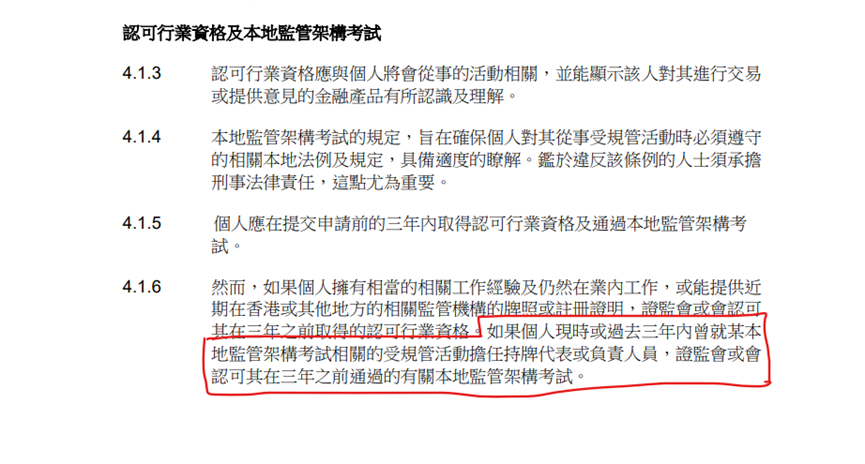

According to the SFC’s “Competency Guidelines”, “If an individual has been licensed as a licensed representative or responsible officer for a relevant regulated activity by a local regulatory regime and has passed the relevant local regulatory regime examinations within the preceding three years, the SFC will recognize the relevant local regulatory regime examinations passed by the individual within three years.”

For example, if student A passed Papers 1, 7, and 8 three years ago and obtained an SFC license for regulated activity Type 1 – Securities Trading within the past three years, they do not need to retake Papers 1 and 7 when applying for an SFC license for regulated activity Type 2 – Futures Contract Trading. Instead, they only need to take Paper 9.

Are there any exemptions for the HKSI exam?

Yes. If you have relevant academic qualifications, professional certifications, or industry experience, you may be exempted from taking Papers 7 to 12 of the HKSI exam. For details, please refer to “How to Apply for Exemption from HKSI LE?”

How can we help?

2CExam provides HKSI LE, IIQE, EAQE and SQE related exam preparation materials. We sell mock question banks for HKSI LE Papers 1, 2, 3, 5, 6, 7, 8, 9, 12 in Chinese and English; and bibles for HKSI LE Papers 1, 2, 6, 7, 8 in Chinese. We also offer 1 on 1 tutorial services. Besides, we have also made free tutorial videos for HKSI LE Papers 1, 2, 6, 7, 8, 12 and posted on public channels such as Youtube/ Bilibili/ Tencent/ Iqiyi. 2CExam has been an exam training expert for years. Should you need any help please visit www.2cexam.com or contact us through:

Phone +852 2110 9644 Email: [email protected] Wechat: hk2cexam WhatsApp: +852 9347 2064

Please support us by leaving comments and likes if you think this article helps you!

You can scan or click on the QR codes to visit our social media.

Latest Article

Categories

過往文章

Contact US

-

Phone:

+852 2110 9644

-

Email:

-

WhatsApp

+852 9347 2064

-

WeChat

hk2cexam

Interesting Articles

What is an IIQE license?

How to register for the exam? How to prepare? Isn’t the IIQE test score a license?! Obtaining a passing score in the IIQE (Insurance Intermediaries Qualifying Examination) held by the Institute of Professional Education and Knowledge (VTC PEAK) is one of the requirements for applying for an insurance practitioner license. Since PEAK is a statutory…

What is the HKSI license?

How to register for the exam? How to prepare? What?! The HKSI exam result is not a license? HKSI, Hong Kong Securities and Investment Institute’s designated LE’s (Licensing Examination, Qualifying Examination) passing result is one of the competency requirements for applying for a license to become a representative and/or responsible officer. However, HKSI is a…

What exactly is a Hong Kong securities license?

Is it an HKSI license or an SFC license or an HKMA license? What is the 178 license? We often hear people mention the 178 license, what does that mean exactly? In fact “178 license” is a common misnomer. 178 does not refer to a license, but a combination of exam papers that need to…

Insurance Intermediary Qualification Examination (IIQE) Exemptions

Type A & B of exempted applicants According to Insurance Authority’s Insurance Intermediaries Quality Assurance Scheme (IIQAS), There are 5 types (A, B, C, D, E) of individuals who could be exempted from the IIQE requirement. Type A individuals could be exempted from IIQE Paper 1 (Principles and Practice of Insurance), IIQE Paper 2 (General…

What Is the Difference Between SFC License And HKMA License?

Which license should a bank employee apply for? Will it be supervised by the SFC or HKMA? What is a SFC license? The full name of SFC is the Securities and Futures Commission, and it is the statutory regulator of the securities industry in Hong Kong. The Securities and Futures Commission was established in accordance…

What is the validity period of the HKSI LE Hong Kong Securities Examination results?

If you ever asked the questions above, then this article is specially written for you! In order to better comprehend the specification of HKSI’s licensing details, we must first clarify the relationship between the various institutions. HKSI is the abbreviation for Hong Kong Securities and Investment Institute. If you ever considered obtaining license(s) for securities-related…

HKSI LE Exemption

Let’s talk about Exemptions: Hong Kong Securities and Investment Institute (HKSI) Licensing Examination Paper 7,8,9,11,12 – Common Misunderstandings we all have when it comes to comprehending the Hong Kong Securities and Investment Institute’s (HKSI) exemption methods and requirements. Able to Have Exemptions from HKSI Examination Papers 7 to 12 By fulfilling any of the following…

What is the validity period of the EAQE/SQE exam?

As a city with a dense population, Hong Kong’s property prices continue to be extremely lucrative. With each buying and selling transaction involves several million, being a real estate agent is a way for many people to make a fortune. Imagine how selling only one deal monthly can already enable you to have a comfortable…

What is the validity period of IIQE test results?

“If you have money, buy insurance, if you don’t have money, you can sell insurance.” I wonder if you have heard of this saying. Many people rely on insurance to support themselves and their families. Before entering the industry to sell insurance, you need to take at least 2 Insurance Intermediaries Qualifying Examination (IIQE) exam…

- « Previous

- 1

- …

- 11

- 12

- 13