“What is MPF?”

The Mandatory Provident Fund Schemes (abbreviated as MPF), is a retirement protection plan in Hong Kong. The Legislative Council of Hong Kong passed the “Mandatory Provident Fund Schemes Ordinance” on July 27, 1995, and officially implemented it on December 1, 2000. Except for a few exempt individuals, the scheme requires employees and self-employed persons aged 18 to 65 in Hong Kong to participate, with both employers and employees contributing to establish the fund. Generally, employees can only withdraw contributions when they reach 65 years old or provide special reasons.

What is a Mandatory Provident Fund Intermediary?

Mandatory Provident Fund Intermediaries (abbreviated as MPF Intermediaries), refers to professionals engaged in MPF business in Hong Kong. They are mainly responsible for assisting employers and employees in choosing, transferring, and claiming MPF schemes, providing professional advice to clients, and ensuring that clients comply with relevant regulations.

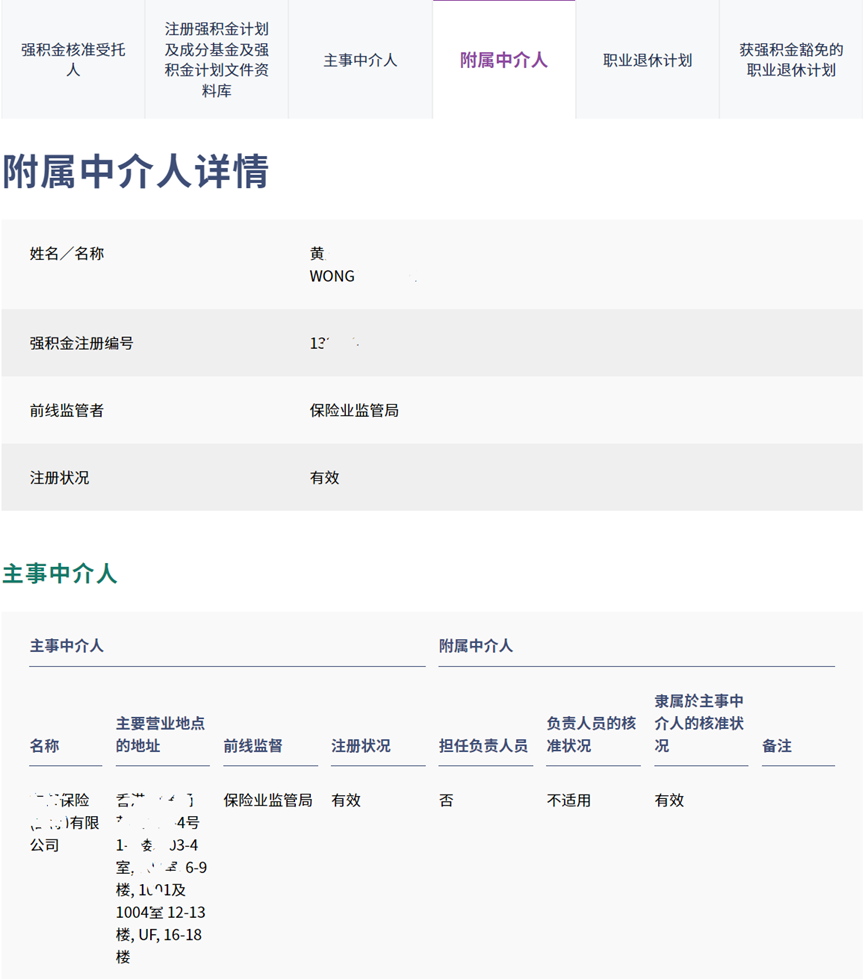

In Hong Kong, anyone must first register with the Mandatory Provident Fund Schemes Authority (MPFA, abbreviated as MPFA) to become an MPF intermediary before they can engage in MPF sales and promotional activities. MPF intermediaries are divided into two categories: principal intermediaries and subsidiary intermediaries. Principal intermediaries usually refer to companies or banks, while the individual MPF salespersons we usually understand are representatives of the principal intermediaries and belong to subsidiary intermediaries (hereinafter referred to as MPF Intermediaries (Subsidiary)). The registration information of MPF intermediaries can be confirmed in the public register of the MPFA.

Who can become a Mandatory Provident Fund (MPF) intermediary?

The Mandatory Provident Fund Schemes Authority (MPFA) is authorized to register the following individuals as MPF intermediaries if they meet relevant regulations, to approve them as principal intermediaries for regulated activities:

- Individual persons who are licensed by the Securities and Futures Commission to conduct Type 1 regulated activity (dealing in securities) or Type 4 regulated activity (advising on securities) under the Securities and Futures Ordinance, or both;

- Individual persons who are registered by the Monetary Authority to conduct Type 1 regulated activity (dealing in securities) or Type 4 regulated activity (advising on securities) under the Banking Ordinance, or both;

- Licensed individual long term business insurance agents, insurance broker companies or representatives under the Insurance Ordinance authorized by the Insurance Authority.

How to become an MPF intermediary?

According to the “MPF Intermediary Registration Handbook,” to register as an MPF intermediary (subsidiary), applicants:

1.Must be regulated by the industry and have a good reputation, i.e., not have their industry qualifications or MPF intermediary registration revoked/suspended for disciplinary reasons within a year preceding the application date;

2.Must not have lost the qualification to register with the MPFA;

3.Must belong to a principal intermediary;

4.Must take and pass the MPFA’s qualifying examination.

When is it necessary to take the MPF Intermediary Qualifying Examination?

Individuals applying to become MPF intermediaries must pass the MPF Intermediary Qualifying Examination to meet registration requirements. The specific situations are as follows:

- New applicants must take and pass the examination within a year before registering as an MPF intermediary.

- If applicants who have passed the exam have not registered as MPF intermediaries within three years preceding the application date, they must retake and pass the exam to re-register.

- If MPF intermediaries have their registration revoked due to non-completion of continuous training, they must retake and pass the exam to re-register.

Where can you take the MPF Intermediary Qualifying Examination?

The “Mandatory Provident Fund Schemes Examination” offered by the Peak of the Vocational Training Council (VTC) and the “MPF Intermediary Examination” offered by the Hong Kong Securities and Investment Institute (HKSI) are both qualifying examinations designated by the MPFA. Those who pass the exam will be recognized as meeting the examination requirements for MPF intermediaries.

The scope of both examinations includes the following contents:

Regulatory framework;

Key features of the MPF system;

Functions of the MPF trustee;

MPF schemes and investments;

Transitional arrangements between occupational retirement schemes and the MPF system; and

Regulation of MPF intermediaries.

The “Mandatory Provident Fund Schemes Examination” by the Peak of the Vocational Training Council (VTC) includes a written test and a computer test, while the “MPF Intermediary Examination” by the Hong Kong Securities and Investment Institute (HKSI) only provides a written test.

Exam format: Multiple-choice questions

Question language: Bilingual in Chinese and English

Number of questions: 80 questions

Exam duration: 2 hours

Exam fee: Computer-based test $370; Written test $305

Exam results: “Pass” or “Fail”.

The passing score is 70%, and candidates must answer correctly 56 questions to pass the examination.

The exam result notification does not show specific scores and will not disclose the questions and their correct answers.

The registration link for the “Mandatory Provident Fund Schemes Examination” by the Peak of the Vocational Training Council (VTC) is as follows:

The registration link for the “MPF Intermediary Examination” by the Hong Kong Securities and Investment Institute (HKSI) is as follows:

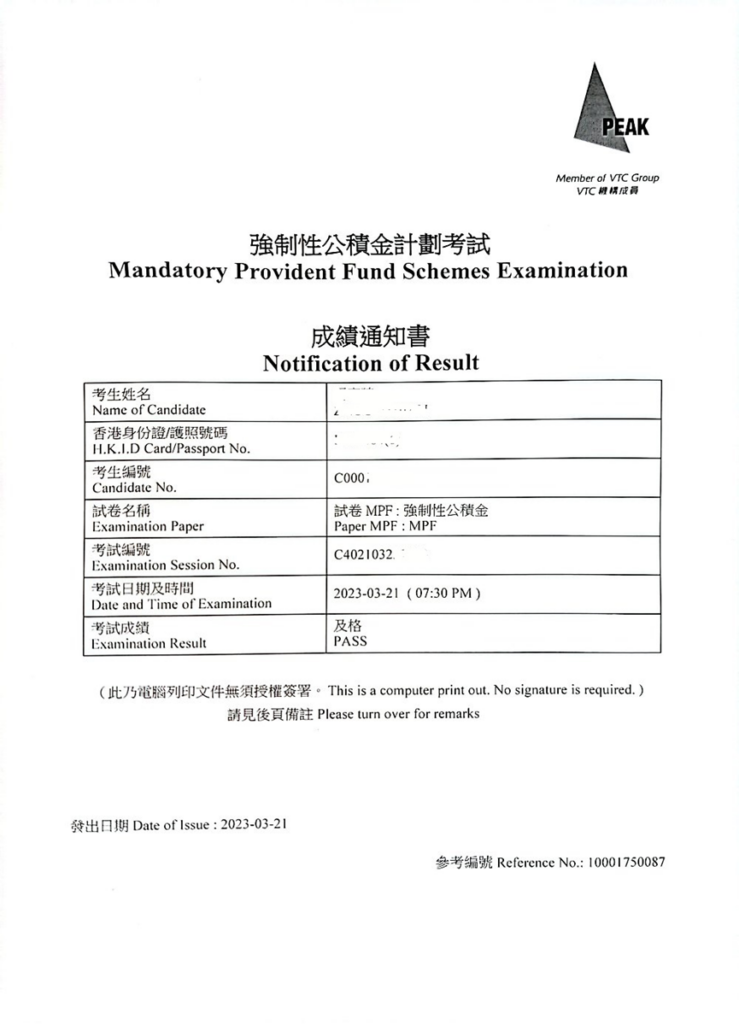

How to get the result notification?

For candidates taking the “Mandatory Provident Fund Schemes Examination” at the Peak of the Vocational Training Council (VTC) Examination Centre:

Written test results:

Can be viewed, downloaded, and printed from the “Exam Results Inquiry” system on the examination center’s webpage, starting from the fifth complete working day after the exam.

Computer test results:

They will be displayed on the computer screen immediately after the exam. The exam results displayed on the screen are for reference only and are subject to the results printed on the result notification. Candidates can download and print the result notification from the “Exam Results Inquiry” system on the examination center’s webpage, starting one hour after the designated end time of the exam.

The examination center does not provide printed copies of the result notification. Exam results and result notifications will be stored in the “Exam Results Inquiry” system for three months (counting from the exam date).

Candidates who have taken the “MPF Intermediary Examination” written test at the Hong Kong Securities and Investment Institute can check their exam results on the HKSI e-service website about seven working days after the exam. The exam result notification will be retained for 1 year for candidates to download and print.

Where to find study materials for the MPF Intermediary Qualification Examination?

1.Official Study Manual

The Mandatory Provident Fund Schemes Authority (MPFA) has compiled the “Mandatory Provident Fund Schemes/MPF Intermediaries Examination Study Manual” to assist candidates in preparing for the examination, which can be downloaded for free from the MPFA website.

Link to free download of the MPFA “Mandatory Provident Fund Schemes/MPF Intermediaries Examination Study Manual”: https://www.mpfa.org.hk/-/media/files/supervision/mpf-intermediaries/registration-requirements/study_notes_9th_chi_v3.pdf

2.Free Tutorial Videos

Bilibili: https://www.bilibili.com/video/BV18t411e7Ff/?vd_source=d4cdb4b41821c08c5020dac2c8422d92

YouTube:

3.Free Practice Questions

It should be noted that the study manual for the MPF Intermediaries Examination is 196 pages long and the scope of the examination is quite broad. Our short-term memory may not be reliable, and rote memorization may make it difficult to remember so many unprocessed concepts. There’s a good chance that by the time you’ve finished the entire book, you’ve already forgotten most of the first half. Moreover, the questions drawn for each exam are not exactly the same, and there’s a great deal of luck involved.

Therefore, when preparing for the IIQE examination, you should ensure that you have a thorough understanding of the exam outline and requirements, formulate a suitable study plan, and actively participate in mock exams to improve your examination skills.

Hence, our recommended study method is:

Read a chapter of the study manual/free tutorial video first.

Complete a chapter’s worth of practice questions.

Reinforce your understanding and memory of the knowledge by repeating this process.

Finally, we wish you success in your exam!

How can we help?

2CExam provides HKSI LE, IIQE, EAQE and SQE related exam preparation materials. We sell mock question banks for HKSI LE Papers 1, 2, 3, 5, 6, 7, 8, 9, 12 in Chinese and English; and bibles for HKSI LE Papers 1, 2, 6, 7, 8 in Chinese. We also offer 1 on 1 tutorial services. Besides, we have also made free tutorial videos for HKSI LE Papers 1, 2, 6, 7, 8, 12 and posted on public channels such as Youtube/ Bilibili/ Tencent/ Iqiyi. 2CExam has been an exam training expert for years. Should you need any help please visit www.2cexam.com or contact us through:

Phone +852 2110 9644 Email: [email protected] Wechat: hk2cexam WhatsApp: +852 9347 2064

Please support us by leaving comments and likes if you think this article helps you!

You can scan or click on the QR codes to visit our social media.

Latest Article

Categories

過往文章

Contact US

-

Phone:

+852 2110 9644

-

Email:

-

WhatsApp

+852 9347 2064

-

WeChat

hk2cexam

Interesting Articles

What is an IIQE license?

How to register for the exam? How to prepare? Isn’t the IIQE test score a license?! Obtaining a passing score in the IIQE (Insurance Intermediaries Qualifying Examination) held by the Institute of Professional Education and Knowledge (VTC PEAK) is one of the requirements for applying for an insurance practitioner license. Since PEAK is a statutory…

What is the HKSI license?

How to register for the exam? How to prepare? What?! The HKSI exam result is not a license? HKSI, Hong Kong Securities and Investment Institute’s designated LE’s (Licensing Examination, Qualifying Examination) passing result is one of the competency requirements for applying for a license to become a representative and/or responsible officer. However, HKSI is a…

What exactly is a Hong Kong securities license?

Is it an HKSI license or an SFC license or an HKMA license? What is the 178 license? We often hear people mention the 178 license, what does that mean exactly? In fact “178 license” is a common misnomer. 178 does not refer to a license, but a combination of exam papers that need to…

Insurance Intermediary Qualification Examination (IIQE) Exemptions

Type A & B of exempted applicants According to Insurance Authority’s Insurance Intermediaries Quality Assurance Scheme (IIQAS), There are 5 types (A, B, C, D, E) of individuals who could be exempted from the IIQE requirement. Type A individuals could be exempted from IIQE Paper 1 (Principles and Practice of Insurance), IIQE Paper 2 (General…

What Is the Difference Between SFC License And HKMA License?

Which license should a bank employee apply for? Will it be supervised by the SFC or HKMA? What is a SFC license? The full name of SFC is the Securities and Futures Commission, and it is the statutory regulator of the securities industry in Hong Kong. The Securities and Futures Commission was established in accordance…

What is the validity period of the HKSI LE Hong Kong Securities Examination results?

If you ever asked the questions above, then this article is specially written for you! In order to better comprehend the specification of HKSI’s licensing details, we must first clarify the relationship between the various institutions. HKSI is the abbreviation for Hong Kong Securities and Investment Institute. If you ever considered obtaining license(s) for securities-related…

HKSI LE Exemption

Let’s talk about Exemptions: Hong Kong Securities and Investment Institute (HKSI) Licensing Examination Paper 7,8,9,11,12 – Common Misunderstandings we all have when it comes to comprehending the Hong Kong Securities and Investment Institute’s (HKSI) exemption methods and requirements. Able to Have Exemptions from HKSI Examination Papers 7 to 12 By fulfilling any of the following…

What is the validity period of the EAQE/SQE exam?

As a city with a dense population, Hong Kong’s property prices continue to be extremely lucrative. With each buying and selling transaction involves several million, being a real estate agent is a way for many people to make a fortune. Imagine how selling only one deal monthly can already enable you to have a comfortable…

What is the validity period of IIQE test results?

“If you have money, buy insurance, if you don’t have money, you can sell insurance.” I wonder if you have heard of this saying. Many people rely on insurance to support themselves and their families. Before entering the industry to sell insurance, you need to take at least 2 Insurance Intermediaries Qualifying Examination (IIQE) exam…

- « Previous

- 1

- …

- 11

- 12

- 13