Hong Kong Insurance Intermediary License Application Guide

According to the Insurance Ordinance (Chapter 41), one of the main functions of the Insurance Authority (IA) is to regulate and supervise the insurance industry by governing the conduct of insurance intermediaries through a licensing system.

Therefore, individuals who want to enter the insurance industry need to apply for a license from the IA after passing the insurance intermediary examination. Since the IA does not conduct examinations itself, aspiring Hong Kong insurance intermediaries need to take the entrance examination at the PEAK Continuing Education Center of the Vocational Training Council (VTC) in Hong Kong. VTC PEAK is only responsible for administering the examination and does not handle licensing matters.

How to apply for an IA Hong Kong insurance license?

To work in the Hong Kong insurance industry, one must hold a license. So, how can one apply for a Hong Kong insurance license?

The IA’s requirements for individual license applications are as follows:

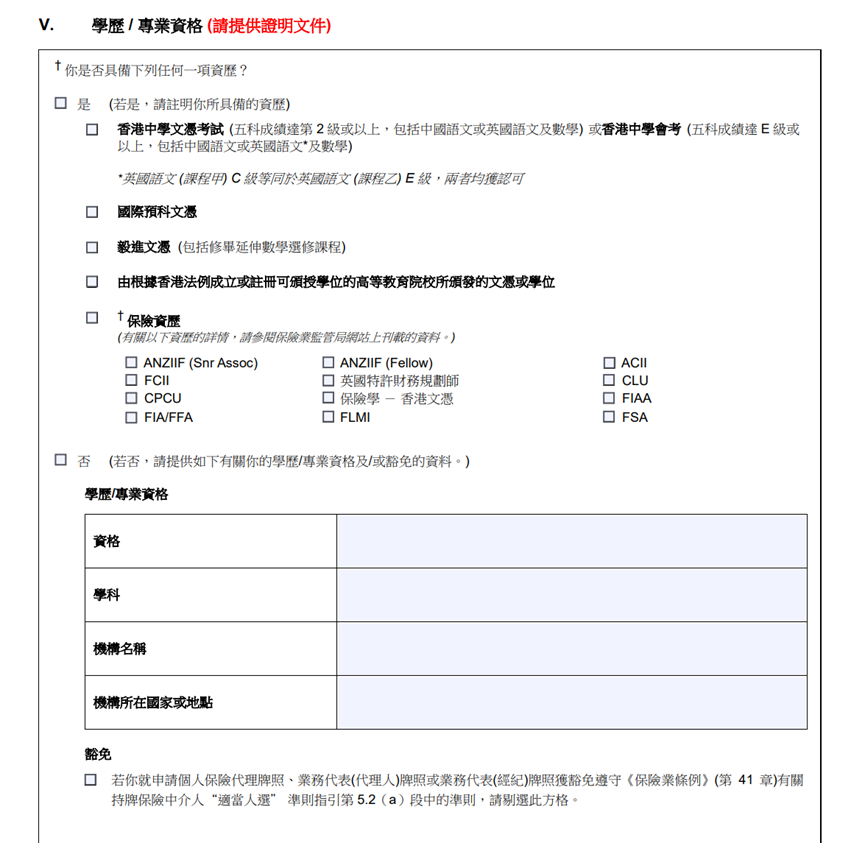

1.Meet the educational requirements stipulated in the “Guidelines on the ‘Fit and Proper’ Criteria for Licensed Insurance Intermediaries under the Insurance Ordinance (Chapter 41)”, such as at least graduating from Form 5, achieving a pass in 5 subjects in the Hong Kong Certificate of Education Examination (HKCEE) or Diploma Examination (HKDSE), with 2 of the subjects including Chinese, Mathematics or English, Mathematics, etc.

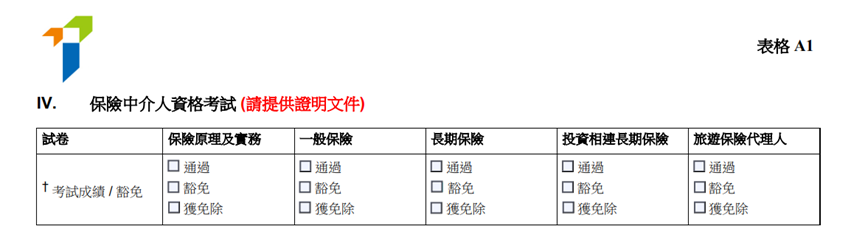

2.Meet the requirements for the insurance intermediary qualification examination, unless exempted;

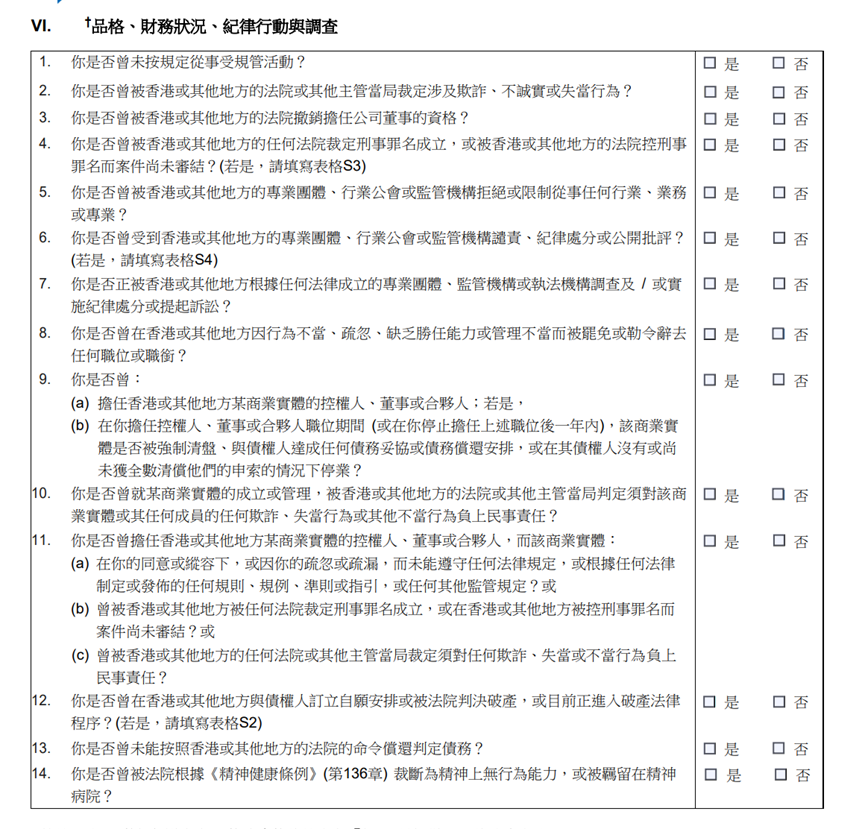

3.Have a credible reputation and financial status.

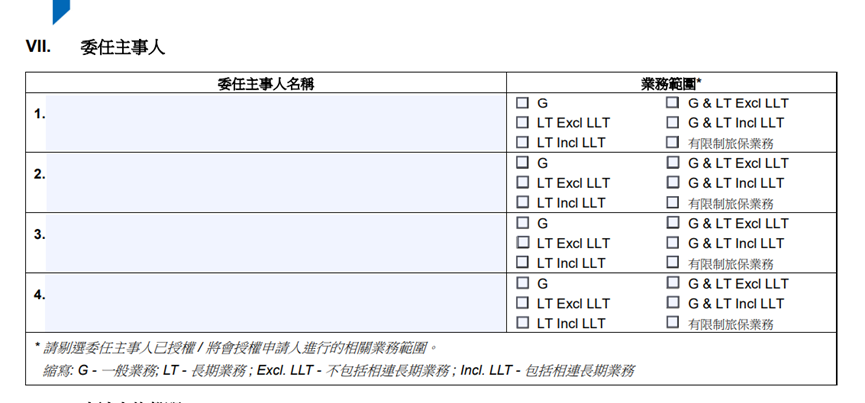

Generally, most license applicants can meet the educational and credit requirements, and only need to pass the insurance intermediary qualification examination administered by the Vocational Training Council. After passing the examination, the license applicant also needs to find an insurance company or insurance brokerage to act as their appointing principal, which is also known as “listing.”

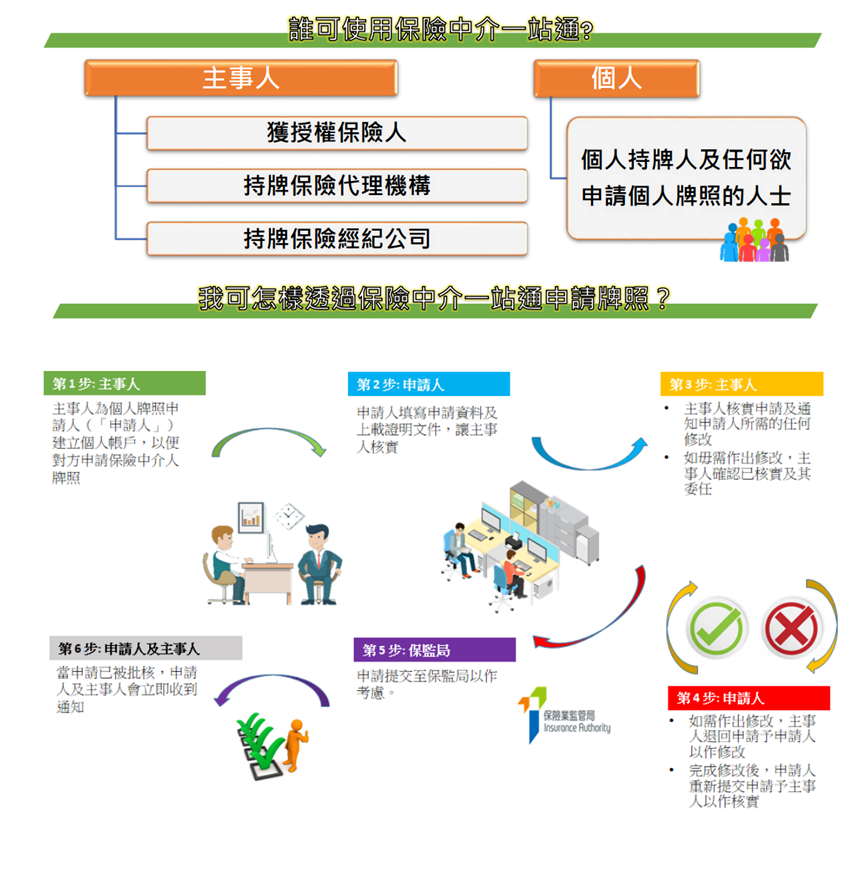

Once everything is ready, you can start preparing to apply for a license from the IA. The application process involves submitting the “Insurance Intermediary Form” in writing by the company or submitting the license application electronically to the IA through the online platform “Insurance Intermediary One-Stop Service” (currently only applicable to individual license applications).

Is the insurance license issued for a limited period? When do I need to retake the insurance intermediary qualification examination?

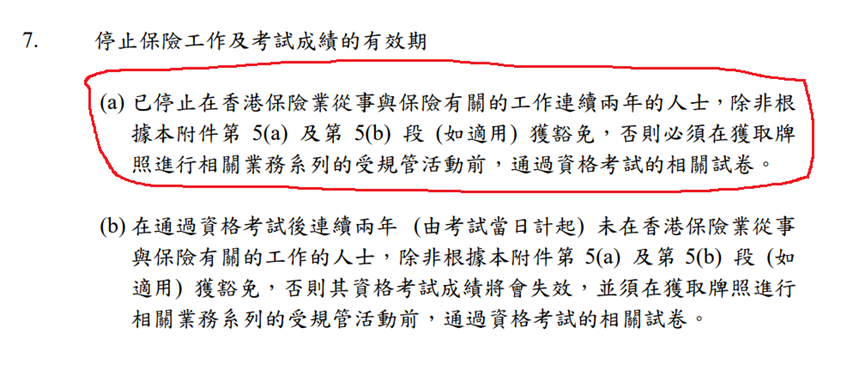

Once you pass the insurance intermediary qualification examination and successfully obtain a license, the license will remain valid as long as you do not leave the insurance company or brokerage that applied for the license on your behalf and meet the renewal requirements. You do not need to retake the Insurance Intermediary IIQE examination you have already passed.

However, if you leave your affiliated insurance company or brokerage and do not find another insurance company or brokerage to list you within two years after leaving, you will need to retake the relevant insurance intermediary examination.

Is there a fee for applying for a license?

As the Hong Kong Insurance Authority took over the supervision of the insurance industry on September 23, 2019, the license application fees have been waived for the first five years (from September 23, 2019, to September 22, 2024) under the new insurance intermediary regulatory regime. The license fees for the subsequent period have not been announced yet.

How can we help?

2CExam provides HKSI LE, IIQE, EAQE and SQE related exam preparation materials. We sell mock question banks for HKSI LE Papers 1, 2, 3, 5, 6, 7, 8, 9, 12 in Chinese and English; and bibles for HKSI LE Papers 1, 2, 6, 7, 8 in Chinese. We also offer 1 on 1 tutorial services. Besides, we have also made free tutorial videos for HKSI LE Papers 1, 2, 6, 7, 8, 12 and posted on public channels such as Youtube/ Bilibili/ Tencent/ Iqiyi. 2CExam has been an exam training expert for years. Should you need any help please visit www.2cexam.com or contact us through:

Phone +852 2110 9644 Email: [email protected] Wechat: hk2cexam WhatsApp: +852 9347 2064

Please support us by leaving comments and likes if you think this article helps you!

You can scan or click on the QR codes to visit our social media.

Latest Article

Categories

過往文章

Contact US

-

Phone:

+852 2110 9644

-

Email:

-

WhatsApp

+852 9347 2064

-

WeChat

hk2cexam

Interesting Articles

How to check the results of HKSI Paper?

How to check the results of HKSI LE Paper? How to check the results of HKSI LE paper? There are two situations for this. The first one is that if you take the exam in Hong Kong, most of them are computer-based exams, and you will know your results immediately after you finish the exam.…

What exam should I take if I want to be a sponsor?

In Hong Kong, unless an individual or company is exempted, If they wish to conduct the ten “regulated activities” defined by the Securities and Futures Ordinance, they need to apply for a license/registration with the Securities and Futures Commission. Type 1: Dealing in securities Type 2: Dealing in future contracts Type 3: Leveraged…

What exam should I take if I want to help customers buy and sell futures and options?

In Hong Kong, unless an individual or company is exempted, if they wish to conduct the ten “regulated activities” defined by the Securities and Futures Ordinance, they need to apply for a license/registration with the Securities and Futures Commission. Type 1 Dealing in securities Type 2 Dealing in futures contracts Type 3 Leveraged foreign…

What exam should I take if I want to help clients buy and sell Hong Kong stocks, US stocks, and bonds?

In Hong Kong, unless an individual or company is exempted, if they wish to conduct ten “regulated activities” defined by the Securities and Futures Ordinance, they need to apply for a license/registration with the SFC. Type 1 Dealing in securities Type 2 Dealing in futures contracts Type 3 Leveraged foreign exchange trading Type…

What exam should I take if I want to sell group insurance, accident insurance and disability insurance with death compensation?

Are group insurance, accident insurance and disability insurance with death compensation general insurance policies or long-term policies? In fact, there is no absolute answer, because an insurance policy with both accident/disability compensation and life insurance components can be general policies or long-term policies, depending on the plan. As in death compensation accident insurance: It…

What exam should I take if I want to sell life insurance, savings life insurance, annuities, and critical illness insurance?

Life insurance, endowment insurance, annuities, and critical illness insurance are all insurances that are particularly related to human life. Life insurance and endowment life insurance are types of insurance that pay consolation money to the beneficiary after the death of the insured. Annuities are closely related to the life of the insured. Basically for…

What exam should I take if I want to sell accident insurance, domestic helper insurance, and medical insurance?

Accident insurance, domestic helper insurance, and medical insurance are all medical-related insurances that are purchased in order to avoid burdening huge (medical) expenses. According to Hong Kong’s “Insurance Ordinance”, general business protection covers 17 categories, including accidents, sickness, and general legal liability. Therefore, if you want to sell accident insurance, domestic helper insurance, and medical…

What exam should I take if I want to sell engineering insurance and liability insurance?

Engineering insurance and liability insurance are insurances designed to avoid huge financial burdens caused by huge losses. Part of the engineering insurance will protect the legal liabilities of causing the third party to be injured or have property losses; while the liability insurance is to compensate for the liabilities derived from causing injuries or losses…

What exam should I take if I want to sell car insurance, water damage insurance, home insurance, property insurance, and marine cargo insurance?

Car insurance, water damage insurance, home insurance, property insurance, and marine cargo insurance are all property insurances that are purchased to cover losses caused by accidents. According to Hong Kong’s “Insurance Ordinance”, general business insurance covers 17 major categories, including land vehicles, ships, fires and natural forces, damage to property, etc. Therefore, if you want…

What is the Use for IIQE Certificates?

Is there any difference between notification of results and a certificate? Do I need to submit both at the same time when I apply for a license? The IIQE notification of results and certificate are two different kinds of proof. The Vocational Training Council (VTC) Institute of Professional Education and Knowledge (PEAK) is responsible…