What is an HKSI certificate?

What is the use of an HKSI exam transcript? What is an HKSI certificate? Do I need an HKSI exam transcript or an HKSI certificate when applying for SFC registration?

To work in the securities industry in Hong Kong, passing the Hong Kong Securities and Futures Commission (SFC) Licensing Exam LE is required. The organization that conducts this exam is the Hong Kong Securities and Investment Institute (HKSI).

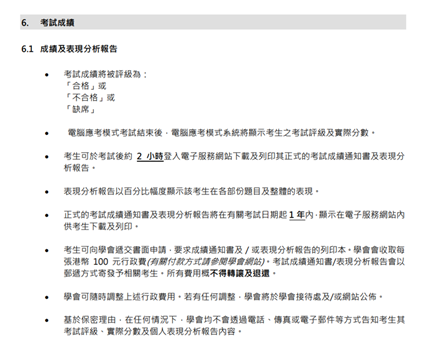

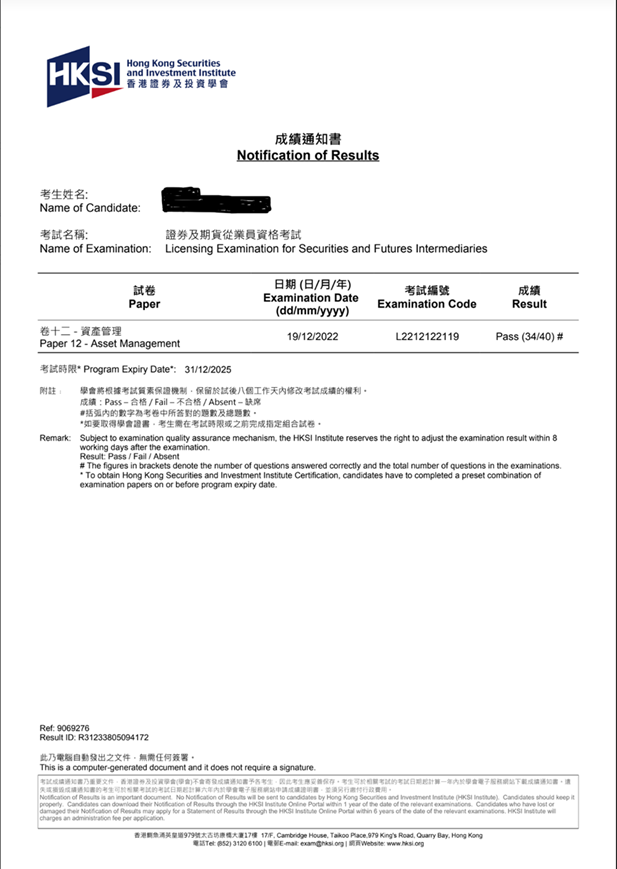

Candidates who take the HKSI LE exam will receive an HKSI LE exam transcript and performance analysis report after the exam.

The exam transcript records the candidate's name, exam name, exam date, and score. The performance analysis report shows the candidate's performance in each section and overall in percentage terms.

Candidates who take the computer-based exam can usually log in to the HKSI electronic service website and download and print the official exam transcript and performance analysis report about 2 hours after the exam.

What is the use of an HKSI LE exam transcript?

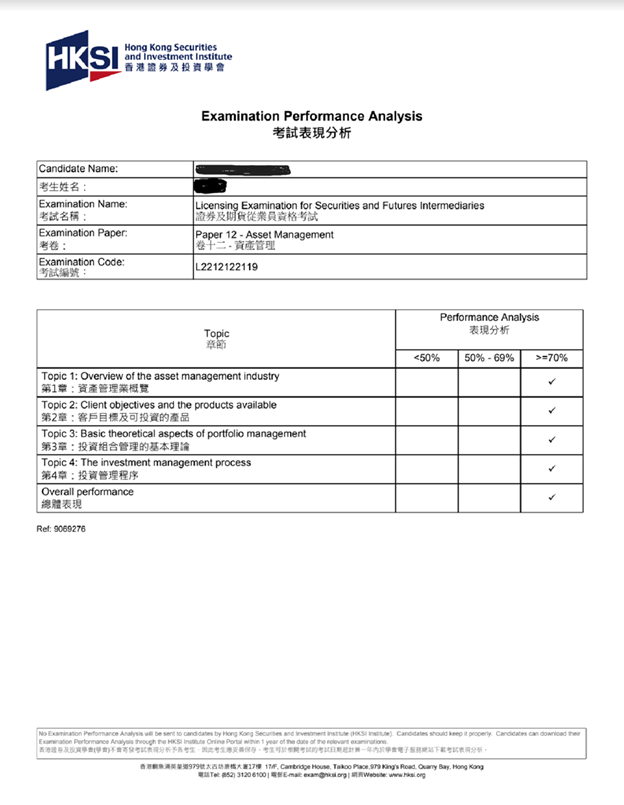

The SFC's "Competence Guidelines" state that "individuals should have acquired industry recognized qualifications and passed local regulatory framework examinations within three years prior to the submission of the application."

If someone wants to apply for an SFC license, they need to complete the relevant HKSI LE exams within three years prior to the application. This means that the validity period for HKSI exam scores is three years. If an exam paper combination is required, all exam papers must have been taken within three years prior to applying for the license.

If an individual already holds an SFC-regulated activity license and needs to apply for another category of regulated activity license, are their previous exam scores still valid?

The answer is yes. According to the SFC's "Competence Guidelines," "if an individual has acted as a responsible officer or a licensed representative in relation to any local regulatory framework examination-related regulated activity at any time in the last three years, the SFC may recognize relevant local regulatory framework examination(s) passed by the individual within three years."

For example, if student A passed exam papers 1, 7, and 8 three years ago and obtained an SFC license for regulated activity Type 1 - securities trading in the past three years, then if A applies to add regulated activity Type 2 - futures contract trading, they do not need to retake exam papers 1 and 7, but only need to take exam paper 9.

If A did not obtain an SFC license in the past three years, and applies for regulated activity Type 2 - futures contract trading, then they need to take exam papers 1, 7, and 9.

How does the SFC determine whether the license applicant has passed the exam and whether the exam scores are still valid?

The answer is the HKSI LE exam transcript. The exam information on the HKSI LE exam transcript is a valid proof of whether the candidate passed the exam and whether the exam scores are still valid within the three-year period. Therefore, when submitting an application for an SFC license, the applicant needs to submit the HKSI LE exam transcript along with the application materials.

Do you know that HKSI also issues qualification certificates in addition to exam transcripts?

The HKSI Institute issues two types of qualification certificates

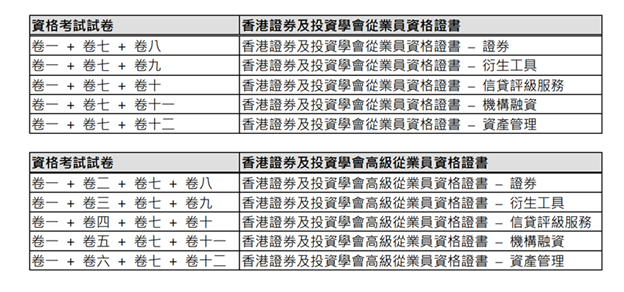

1.The HKSI Institute Licensing Examination Certificate

2.The HKSI Institute Advanced Certification

For example, passing exam papers 1, 7, and 8 of the HKSI LE can lead to obtaining the HKSI Institute Licensing Examination Certificate for securities.

Passing exam papers 1, 6, 7, and 12 of the HKSI LE can lead to obtaining the HKSI Institute Advanced Certification in Asset Management.

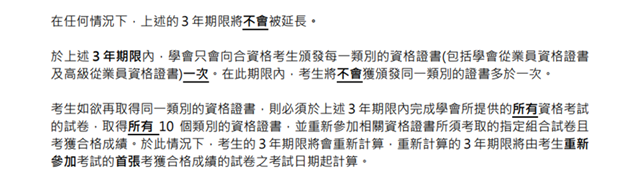

HKSI requires all candidates who participate in its qualification exams to pass a designated combination of exam papers within three years to obtain the HKSI Institute's qualification certificate. The three-year period is counted from the exam date of the candidate's first passed exam paper.

Please note that the above three-year period will not be extended under any circumstances.

Candidates who meet the above requirements can download the corresponding certificate from the HKSI website about 8 working days after passing the designated combination of exams.

Is there any connection between HKSI qualification certificates and SFC licenses?

No, there is no connection between HKSI qualification certificates and SFC licenses.

What are the uses of HKSI qualification certificates?

HKSI qualification certificates can be used for various purposes. For example, the "Insurance Intermediaries Quality Assurance Scheme" states that individuals who hold the HKSI Institute Licensing Examination Certificate or the HKSI Institute Advanced Certification are exempted from taking the Investment-linked Long Term Insurance (IIQE Paper 5) exam.

In addition, HKSI qualification certificates can also serve as professional credentials to enhance one's resume or CV.

How can we help?

2CExam provides HKSI LE, IIQE, EAQE and SQE related exam preparation materials. We sell mock question banks for HKSI LE Papers 1, 2, 3, 5, 6, 7, 8, 9, 12 in Chinese and English; and bibles for HKSI LE Papers 1, 2, 6, 7, 8 in Chinese. We also offer 1 on 1 tutorial services. Besides, we have also made free tutorial videos for HKSI LE Papers 1, 2, 6, 7, 8, 12 and posted on public channels such as Youtube/ Bilibili/ Tencent/ Iqiyi. 2CExam has been an exam training expert for years. Should you need any help please visit www.2cexam.com or contact us through:

Phone +852 2110 9644 Email: [email protected] Wechat: hk2cexam WhatsApp: +852 9347 2064

Please support us by leaving comments and likes if you think this article helps you!

You can scan or click on the QR codes to visit our social media.

Latest Article

Categories

過往文章

Contact US

-

Phone:

+852 2110 9644

-

Email:

-

WhatsApp

+852 9347 2064

-

WeChat

hk2cexam

Interesting Articles

Is the HKSI paper-based exam or the computer-based exam easier? Which is better to partake in?

Many people are curious about the differences between the HKSI LE’s computer-based exam and the paper-based exam. As per the two exams’ content, they are pretty much identical. The two exams use the same Study Guide, the exam questions are drawn in the same question bank. Some people say that they have taken…

What are the differences between a computer-based and paper-based exam for the Estate Agents / Salespersons Qualifying Examinations?

There are differences between the computer-based exam and the paper-based exam? Some people say that the computer-based exam / paper-based exam will be easier? Many people are curious about the differences between the EAQE/SQE’s computer- based exam and the paper- based exam. As per the two exams’ content, they are pretty much…

What is the difference between the computer-based exam and the paper-based exam of the Insurance Intermediaries Qualifying Examination

Many people are curious about the difference between the IIQE’s computer-based exam and the paper-based exam. First of all, IIQE does not hold many paper-based examinations. In many cases, it will only hold paper-based examinations for Paper 1. If you have special needs, such as not being proficient with computers, or having a vision…

What are the differences between the computer-based exam and the paper-based exam of the Licensing Examination for Securities and Futures Intermediaries (LE)?

There are differences between the computer-based exam and the paper-based exam? Some people say that the computer-based exam / paper-based exam will be easier? Many people are curious about the differences between the HKSI LE’s computer-based exam and the paper-based exam. First of all, HKSI does not hold many paper-based examinations. In many…

Which Licensing Examination for Securities and Futures Intermediaries exam paper should I partake in?

If you want to work in the front line of the securities industry, you have a good chance of needing to take The Licensing Examination for Securities and Futures Intermediaries. As for what test papers you need to take, first of all, you need to know that the number of the exam paper has…

If I have an overseas professional qualification, can I obtain a SFC securities license simply by recognising my prior qualification

Some students have worked in the securities finance industry outside of Hong Kong, and now they also need to obtain a securities business license in Hong Kong. Can work experience in the securities industry abroad help you waive the exam and allows a candidate to directly apply for the securities license from the Securities…

In order to obtain exemption from the HKSI LE exam or SFC’s academic requirement, how is relevant industry experience considered?

After reading the “Competency Guidelines” issued by the Securities Regulatory Commission, some students may have a big question mark on “Relevant Industry Experience”, “have X years of experience in the past X years”, and then ask us what kind of experience are counted as industry experience so they can be exempted from the Licensing Examination…

Which insurance intermediary qualifying examination paper should I take?

If you want to work in the front line of the insurance industry, you have a good chance of needing to take the Insurance Intermediaries Qualifying Examination (IIQE). As for what exam papers you need to take, first you can check whether you meet certain conditions to be exempted from specific exam paper combinations…

The difference between IA Responsible Officer(RO) and technical representative (TR)

Regulatory Organisation Before explaining the difference between Responsible Officer and Technical Representative, you must first know that there is only one regulatory agency that regulates companies engaging in insurance business: the Insurance Authority (IA). All the powers concerning licensing matters, supervision tasks, sanctions and investigations of intermediaries of insurance intermediaries, insurance companies and insurance…

The differences between a SFC Responsible Officer (RO), HKMA Executive Officer (EO) and a Sale Representative (Rep)

The different regulatory agencies Before explaining the differences between a responsible officer (RO), HKMA’s executive officer (EO) and sales representative (Rep), you must first know that there are two regulatory agencies that regulates companies that are engaging in securities business: the Securities and Futures Commission (SFC) and Hong Kong Monetary Authority (HKMA).The regulatory…