The Hong Kong Securities and Investment (HKSI) Licensing Examination (LE) is one of the most popular exams in the Hong Kong financial market. It primarily tests an individual’s professional knowledge and abilities in securities and investments in order to obtain a license to practice in the securities and investment industry.

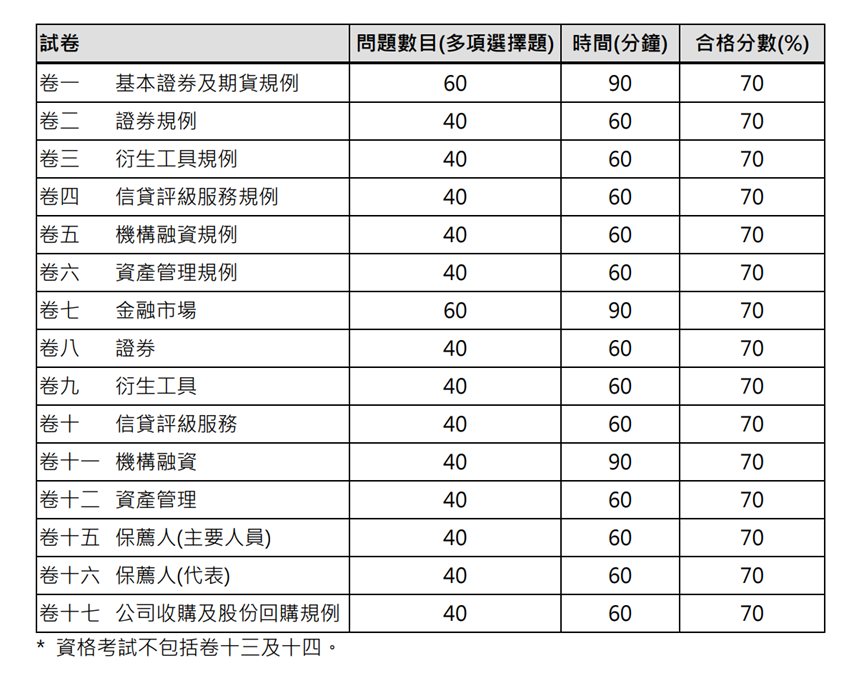

There are currently 15 different papers for the HKSI LE exam, which are divided into regulatory papers, application papers, and sponsor papers, among others. Candidates typically need to pass the regulatory papers and either the application or sponsor papers in order to participate in SFC regulatory activities.

Is it necessary to take every paper in the exam?

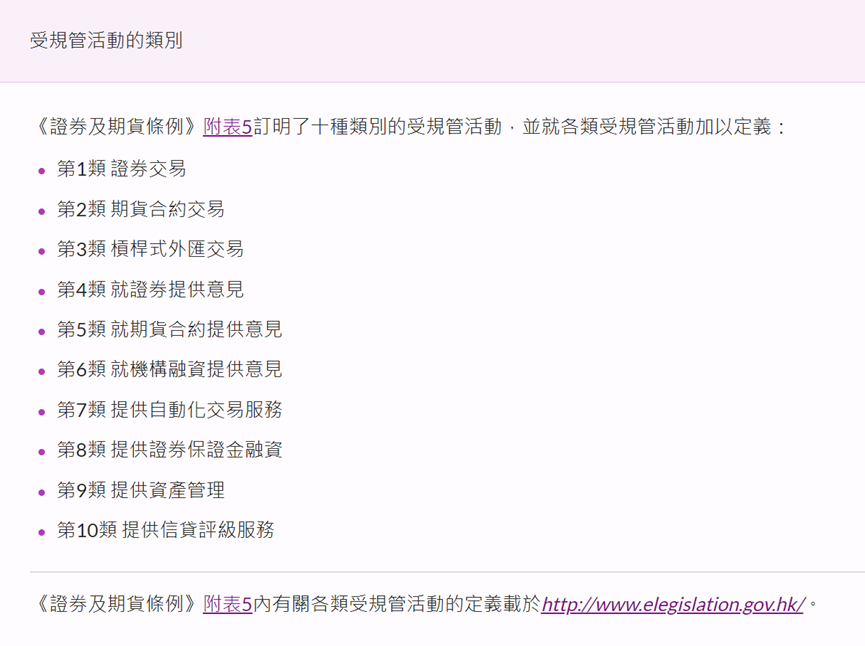

The answer is NO! According to Schedule 5 of the Securities and Futures Ordinance, there are 10 different regulated activities, and different combinations of papers are required for participating in each activity.

Please note that the regulated activity categories do not correspond directly to the HKSI exam paper numbers. This means that wanting to engage in regulated activities in Category 2 does not necessarily require taking HKSI Paper 2.Apart from Paper 1, the HKSI Securities and Investment (S&I) Licensing Examination has two categories of papers in Paper 2 to Paper 6 for responsible officers (RO) or executive officers (EO), and Paper 7 to Paper 12 for licensed representatives (LR) or relevant individuals (ReI).If you do not have any experience in the securities industry, you should start by becoming a licensed representative/ relevant individual.

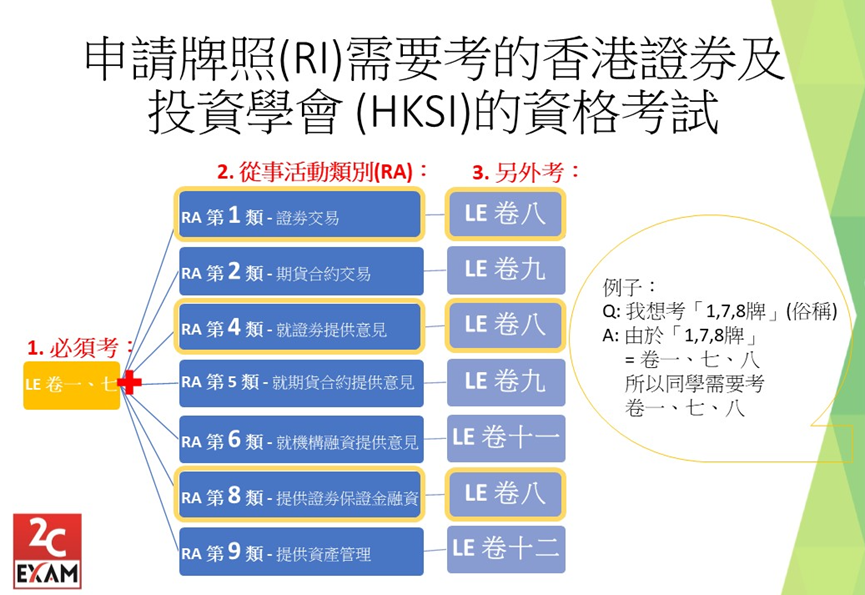

The following is the exam combination for applying to be a licensed representative:

For example, if you want to become a licensed representative (LR) of a licensed corporation and participate in securities trading, buying and selling securities products such as Hong Kong stocks, US stocks, bonds, etc. on behalf of clients, you may need to pass Papers 1, 7, and 8 of the HKSI exam.

To participate in futures contract trading, the required papers would be Papers 1, 7, and 9.

If you wish to work for an asset management company and handle products related to funds or discretionary accounts, you may need to take Papers 1, 7, and 12.

Paper 1 covers the “Basic Securities and Futures Regulations”, Paper 7 covers “Financial Markets”, Paper 8 covers “Securities”, Paper 9 covers “Derivatives”, and Paper 12 covers “Asset Management”.

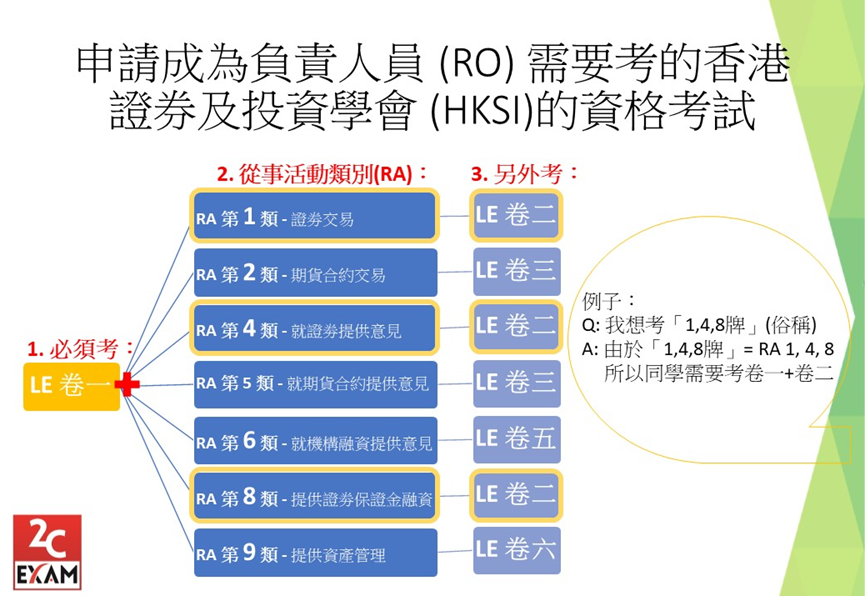

Responsible officers are senior management personnel of licensed corporations (LC), while executive officers are senior management personnel of registered institutions (RI).

Responsible officers/executive officers are responsible for supervising the regulated activities of the company to ensure compliance with SFC regulations and requirements.

To become a responsible officer/executive officer, at least 3 years of securities industry experience is required, including at least 2 years of experience in managing subordinates.

If you want to become a responsible officer (RO) or executive officer (EO) of a licensed corporation, you need to pass the following exams:

For example, if a responsible officer needs to supervise the securities trading operations of a company to ensure compliance with SFC regulations and requirements, they need to pass Papers 1 and 2, with Paper 2 covering the “Securities Regulations”.Unless exempted, responsible officers typically need to take more regulatory papers than licensed representatives.

If you already hold an SFC license for a regulated activity and apply for a license for another regulated activity, are your previous exam results still valid?

The answer is yes.

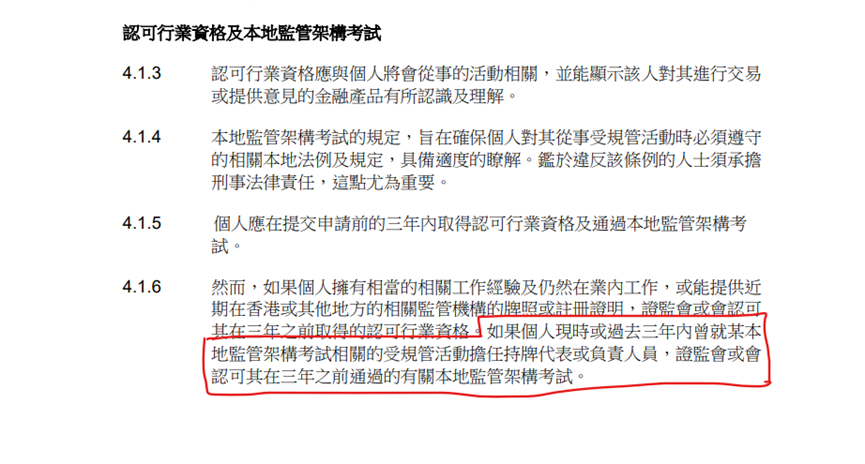

According to the SFC’s “Competency Guidelines”, “If an individual has been licensed as a licensed representative or responsible officer for a relevant regulated activity by a local regulatory regime and has passed the relevant local regulatory regime examinations within the preceding three years, the SFC will recognize the relevant local regulatory regime examinations passed by the individual within three years.”

For example, if student A passed Papers 1, 7, and 8 three years ago and obtained an SFC license for regulated activity Type 1 – Securities Trading within the past three years, they do not need to retake Papers 1 and 7 when applying for an SFC license for regulated activity Type 2 – Futures Contract Trading. Instead, they only need to take Paper 9.

Are there any exemptions for the HKSI exam?

Yes. If you have relevant academic qualifications, professional certifications, or industry experience, you may be exempted from taking Papers 7 to 12 of the HKSI exam. For details, please refer to “How to Apply for Exemption from HKSI LE?”

How can we help?

2CExam provides HKSI LE, IIQE, EAQE and SQE related exam preparation materials. We sell mock question banks for HKSI LE Papers 1, 2, 3, 5, 6, 7, 8, 9, 12 in Chinese and English; and bibles for HKSI LE Papers 1, 2, 6, 7, 8 in Chinese. We also offer 1 on 1 tutorial services. Besides, we have also made free tutorial videos for HKSI LE Papers 1, 2, 6, 7, 8, 12 and posted on public channels such as Youtube/ Bilibili/ Tencent/ Iqiyi. 2CExam has been an exam training expert for years. Should you need any help please visit www.2cexam.com or contact us through:

Phone +852 2110 9644 Email: [email protected] Wechat: hk2cexam WhatsApp: +852 9347 2064

Please support us by leaving comments and likes if you think this article helps you!

You can scan or click on the QR codes to visit our social media.

Latest Article

Categories

過往文章

Contact US

-

Phone:

+852 2110 9644

-

Email:

-

WhatsApp

+852 9347 2064

-

WeChat

hk2cexam

Interesting Articles

Minimum academic requirements for applying for an IA license

Is there a minimum education requirement for the insurance industry? The conditions for licensing in the insurance industry are included in the “Fit and Proper” Guidelines (GL23/Guideline 23) issued by the Insurance Authority. All intermediaries who wish to be licensed must abide by this guideline. IA listed the educational requirements for intermediaries…

Minimum academic requirements for applying for a SFC license

Is there a minimum education requirement for the securities industry? The licensing requirements for the securities industry are set by the Securities and Futures Commission (SFC) and compiled into the Guidelines on Competence. All intermediaries who wish to be licensed or registered for regulated activities are required to abide by this guideline. SFC lists…

How should I apply for a license if I want to engage in the real estate industry? What conditions must I meet?

First of all, to apply for a real estate intermediary license, you need to meet the “Fit and Proper” Guidelines issued by the Estate Agent Authority, such as passing EAQE or SQE. Secondly, The financial status of the applicant will also be reviewed, and the applicant cannot be under bankruptcy status or enter…

How do I apply for a license if I want to engage in the insurance industry? What conditions must I meet?

The insurance industry can not only help some people who may have urgent needs in the future, but also enables agents to possibly make a lot of money, as well as meet wealthy people, hence it is a very attractive profession. To go back to the basics, if a candidate wants to sell insurance…

How should I apply for a license if I want to engage in the securities industry? What conditions must I meet?

In the finance, banking, and securities industries, there are millions of assets flowing in and out everyday to say the least. Many people are eager to meet wealthy people, earn a generous amount of commission income, and even easily be in control of the stock market. However, to go back to the basics, if…

Who should I contact if I have questions about licensing in the real Estate industry? Why can’t I contact PEAK? Should I contact 2CEXAM?

Many students who want to become insurance intermediaries may have some questions regarding what exams to take and what to pay attention to when issuing licenses; with that, they might not know who to ask. Should candidates ask 2CExam? PEAK? Or the Estate Agents Authority ? In fact, PEAK is only responsible for…

Who should I contact if I have questions about licensing in the insurance industry? Why can’t I contact PEAK? Should I contact 2CEXAM?

Many students who want to become insurance intermediaries may have some questions regarding what exams to take and what to pay attention to when issuing licenses; with that, they might not know who to ask. Should candidates ask 2CExam? PEAK? Or the Insurance Authorities? In fact, PEAK is only responsible for organising exams,…

Who should I contact if I have questions about licensing in the securities industry? Why can’t I contact HKSI? Should I contact 2CEXAM?

Many students who want to become securities practitioners may have some questions regarding what exams to take and what to pay attention to when issuing licenses; with that, they might not know who to ask. Should candidates ask 2CExam? HKSI? Or the SFC? In fact, HKSI is only responsible for organising exams, issuing…

What is the difference with the IIQE examination after the Insurance Authority (IA) takes over the insurance industry?

The long-standing self-regulatory method of the insurance industry officially ended on September 23, 2019. Beginning on September 23, 2019, the Insurance Authority (IA) took over the management of all compliance, licensing, monitoring and disciplinary matters for the entire insurance industry. After taking over, the Insurance Authority (IA) has also made changes to some of…

Is the Estate Agents / Salespersons Qualifying Examinations paper-based exam or the computer-based exam easier? Which is better to partake in?

Many people are curious about the differences between the EAQE/SQE’s computer- based exam and the paper- based exam. As per the two exams’ content, they are pretty much identical. The two exams use the same Study Guide to Estate Agency Law and Practice and other study material, the exam questions are drawn in…