Hong Kong Insurance Intermediary License Application Guide

According to the Insurance Ordinance (Chapter 41), one of the main functions of the Insurance Authority (IA) is to regulate and supervise the insurance industry by governing the conduct of insurance intermediaries through a licensing system.

Therefore, individuals who want to enter the insurance industry need to apply for a license from the IA after passing the insurance intermediary examination. Since the IA does not conduct examinations itself, aspiring Hong Kong insurance intermediaries need to take the entrance examination at the PEAK Continuing Education Center of the Vocational Training Council (VTC) in Hong Kong. VTC PEAK is only responsible for administering the examination and does not handle licensing matters.

How to apply for an IA Hong Kong insurance license?

To work in the Hong Kong insurance industry, one must hold a license. So, how can one apply for a Hong Kong insurance license?

The IA’s requirements for individual license applications are as follows:

1.Meet the educational requirements stipulated in the “Guidelines on the ‘Fit and Proper’ Criteria for Licensed Insurance Intermediaries under the Insurance Ordinance (Chapter 41)”, such as at least graduating from Form 5, achieving a pass in 5 subjects in the Hong Kong Certificate of Education Examination (HKCEE) or Diploma Examination (HKDSE), with 2 of the subjects including Chinese, Mathematics or English, Mathematics, etc.

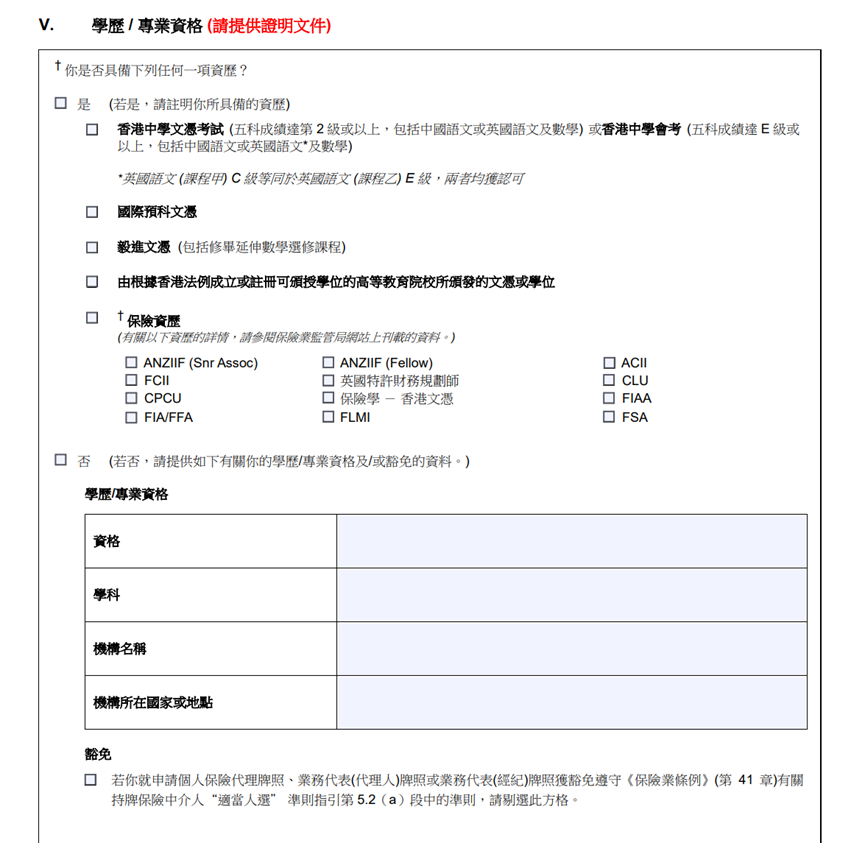

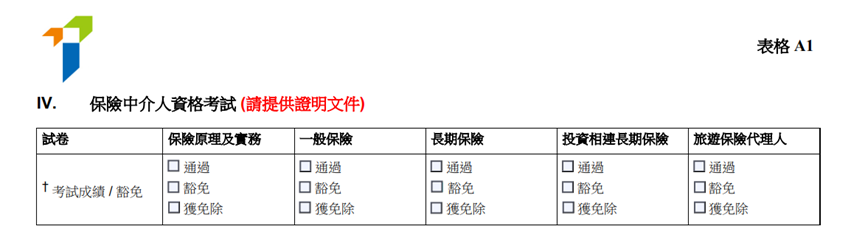

2.Meet the requirements for the insurance intermediary qualification examination, unless exempted;

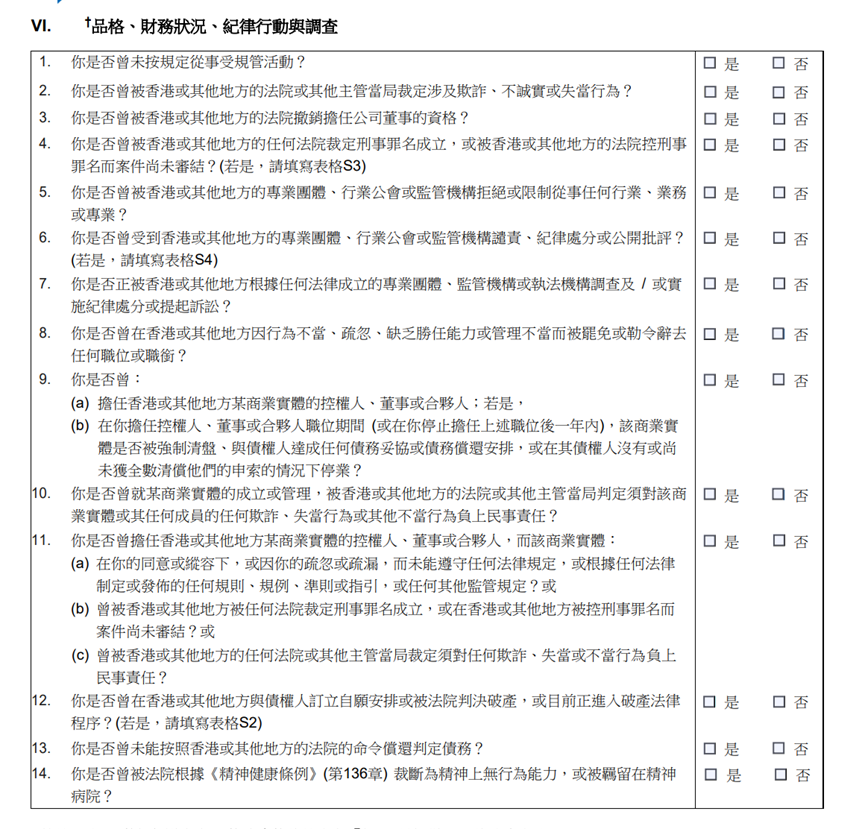

3.Have a credible reputation and financial status.

Generally, most license applicants can meet the educational and credit requirements, and only need to pass the insurance intermediary qualification examination administered by the Vocational Training Council. After passing the examination, the license applicant also needs to find an insurance company or insurance brokerage to act as their appointing principal, which is also known as “listing.”

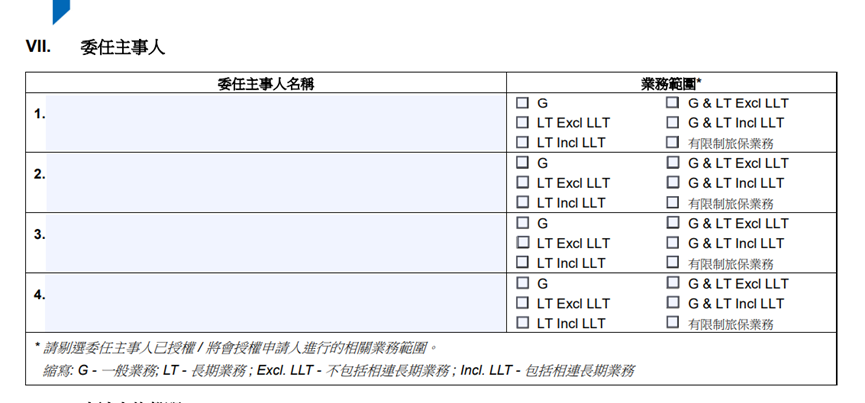

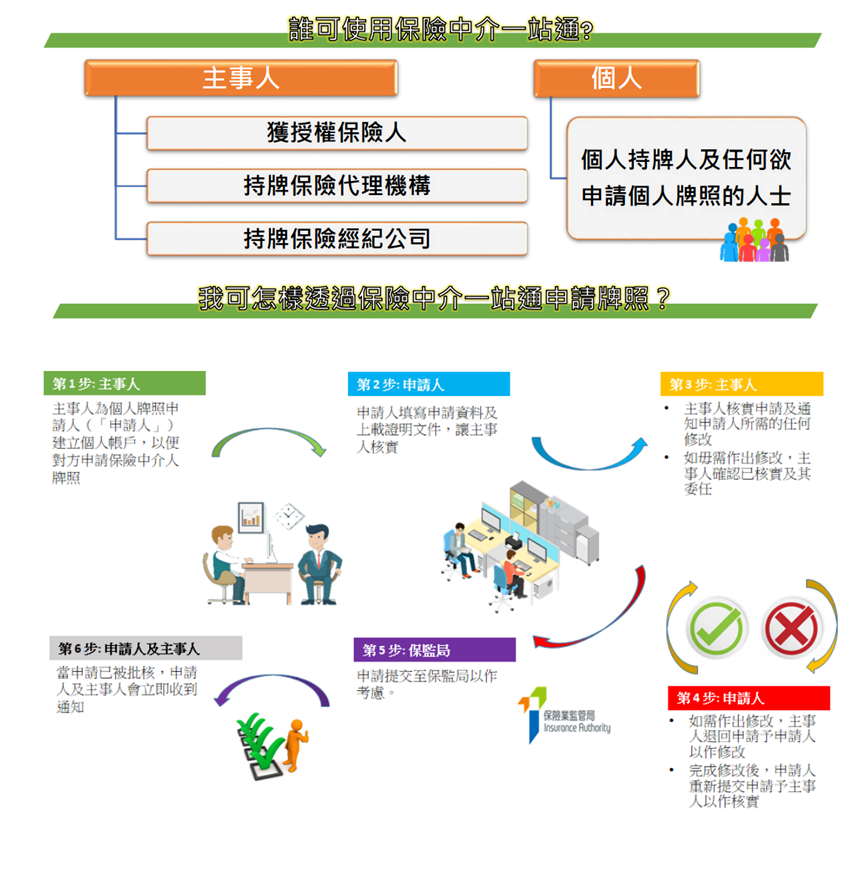

Once everything is ready, you can start preparing to apply for a license from the IA. The application process involves submitting the “Insurance Intermediary Form” in writing by the company or submitting the license application electronically to the IA through the online platform “Insurance Intermediary One-Stop Service” (currently only applicable to individual license applications).

Is the insurance license issued for a limited period? When do I need to retake the insurance intermediary qualification examination?

Once you pass the insurance intermediary qualification examination and successfully obtain a license, the license will remain valid as long as you do not leave the insurance company or brokerage that applied for the license on your behalf and meet the renewal requirements. You do not need to retake the Insurance Intermediary IIQE examination you have already passed.

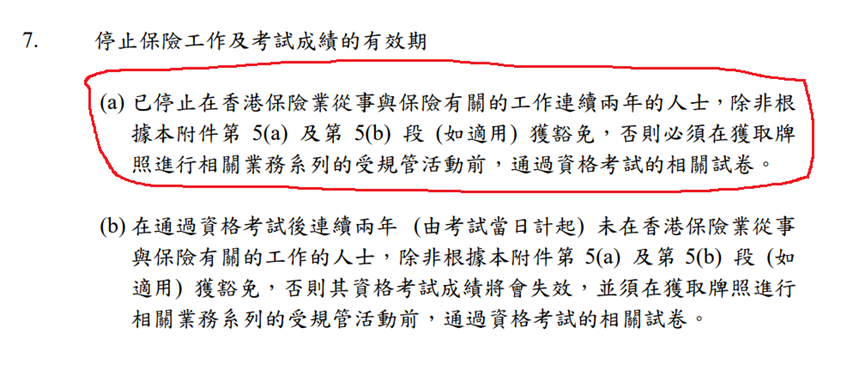

However, if you leave your affiliated insurance company or brokerage and do not find another insurance company or brokerage to list you within two years after leaving, you will need to retake the relevant insurance intermediary examination.

Is there a fee for applying for a license?

As the Hong Kong Insurance Authority took over the supervision of the insurance industry on September 23, 2019, the license application fees have been waived for the first five years (from September 23, 2019, to September 22, 2024) under the new insurance intermediary regulatory regime. The license fees for the subsequent period have not been announced yet.

How can we help?

2CExam provides HKSI LE, IIQE, EAQE and SQE related exam preparation materials. We sell mock question banks for HKSI LE Papers 1, 2, 3, 5, 6, 7, 8, 9, 12 in Chinese and English; and bibles for HKSI LE Papers 1, 2, 6, 7, 8 in Chinese. We also offer 1 on 1 tutorial services. Besides, we have also made free tutorial videos for HKSI LE Papers 1, 2, 6, 7, 8, 12 and posted on public channels such as Youtube/ Bilibili/ Tencent/ Iqiyi. 2CExam has been an exam training expert for years. Should you need any help please visit www.2cexam.com or contact us through:

Phone +852 2110 9644 Email: [email protected] Wechat: hk2cexam WhatsApp: +852 9347 2064

Please support us by leaving comments and likes if you think this article helps you!

You can scan or click on the QR codes to visit our social media.

Latest Article

Categories

過往文章

Contact US

-

Phone:

+852 2110 9644

-

Email:

-

WhatsApp

+852 9347 2064

-

WeChat

hk2cexam

Interesting Articles

What is the Use of an HKSI Notification of Result and Certificate? Do I Need to Submit Both for SFC/HKMA License Application?

HKSI’s notification of results and HKSI certificate are two different kinds of proof. The Hong Kong Securities and Investment Institute is responsible for organizing examinations and issuing certificates. Therefore, the notification of results and certificates are issued by HKSI. However, passing the HKSI LE exam and being issued a certificate is not necessarily related. Anyone…

Can a Masters degree graduate in Management, literature subjects graduate, top up degree graduate in finance and law or associate degree holder waive some of the HKSI LE securities exam papers?

Earlier we shared that there are some circumstances where students who wish to join the industry as securities practitioners can possibly be exempted from certain exams based on their academic qualifications and/or work experience. If you meet certain academic and/or work experience requirements, students may not have to take HKSI LE Papers 7-12. In other…

How can I verify the identity of past insurance brokers and insurance agents? How to check the insurance intermediary license records expired before September 23, 2019?

Where can I verify the identity of insurance brokers and insurance agents? For information on insurance intermediaries that are still valid after September 23, 2019, or newly applied after that day, you can find them on the public search on the website of Insurance Authority: https://iir.ia.org.hk/#/index The development history of insurance brokers and…

Can a holder of an original SFC type 1 license be a type 4 and the type 9 license R.O.?

Why do fund managers/asset management companies need to obtain a Type 4 license? There is a type 1 regulated activity (Dealing in Securities) license holder who has many years of experience. This person has passed the Paper 6 of the Licensing Examination for Securities and Futures Intermediaries (HKSI LE). Can he become the RO responsible…

What is the difference between an insurance agent and an insurance broker?

Isn’t every business that sells insurance policies called an insurance company? Can an insurance broker mean both an individual and a company? What are the main differences between insurance brokers and insurance agents? An insurance broker (Broker) selects suitable insurance products on behalf of the client. It can refer to an individual or a company.…

What is the difference between a licensed corporation and a registered institution?

Which licensing exam should a bank staff patake in? Is it regulated by the SFC or HKMA? What does it mean by the commonly mentioned term “SFC license”? The Securities and Futures Commission, also known as SFC, is the statutory regulator of the securities industry in Hong Kong.The Securities and Futures Commission was established…

What is the difference between an estate agent and a real estate salesperson?

Should I take EAQE or SQE to get into the real estate industry? The EAQE/SQE real estate examination result itself does not mean a license Passing the EAQE/SQE exam is just one of the conditions for applying for a license. Passing the exam does not mean obtaining a license, nor can you start your real…

How long is the validity period of the EAQE/SQE license?

Do I need to renew my license every year? Where should I apply for a license renewal? Huh? Isn’t the EAQE/SQE test result a license?! Passing the EAQE or SQE is one of the licensing conditions for obtaining a real estate agent/salesperson license. The EAQE and SQE exams are held by the Institute of Professional…

How long is the IA license valid for?

Do I need to renew my license every year? Where should I apply for a license renewal? Isn’t the IIQE exam score a license?! Obtaining passing results in the IIQE (Insurance Intermediaries Qualifying Examination) held by the Institute of Professional Education and Knowledge (VTC PEAK) is one of the requirements for applying for an insurance…

How long is the SFC license valid for?

Do I need to renew my license every year? Where should I apply for renewal? Will the SFC license become invalid? We often hear people mention the 178 license. What does that mean exactly? In fact, “178 license” is a common misnomer. 178 does not refer to a license, but a combination of exam papers…