Three celebrities you never thought have worked in the insurance industry

In Hong Kong today’s society, with unaffordable rent and housing, how can ordinary labours find a way out? Want to enjoy your business with pleasure? Have you ever considered joining the insurance industry? The insurance industry may seem to have some negative comments, but if you uphold professionalism, understand your products before selling them to your clients, you will earn respect and career progression by word of mouth. More importantly, the insurance industry is assisting clients in getting through difficult times in their lives. Indeed, not just people that 2CExam often come into contact with, many successful professionals also started out selling insurance.

Let’s take a look at some famous celebrities, including the USA founding father, Hollywood star and some other people who have been a part of the insurance industry once in their lives.

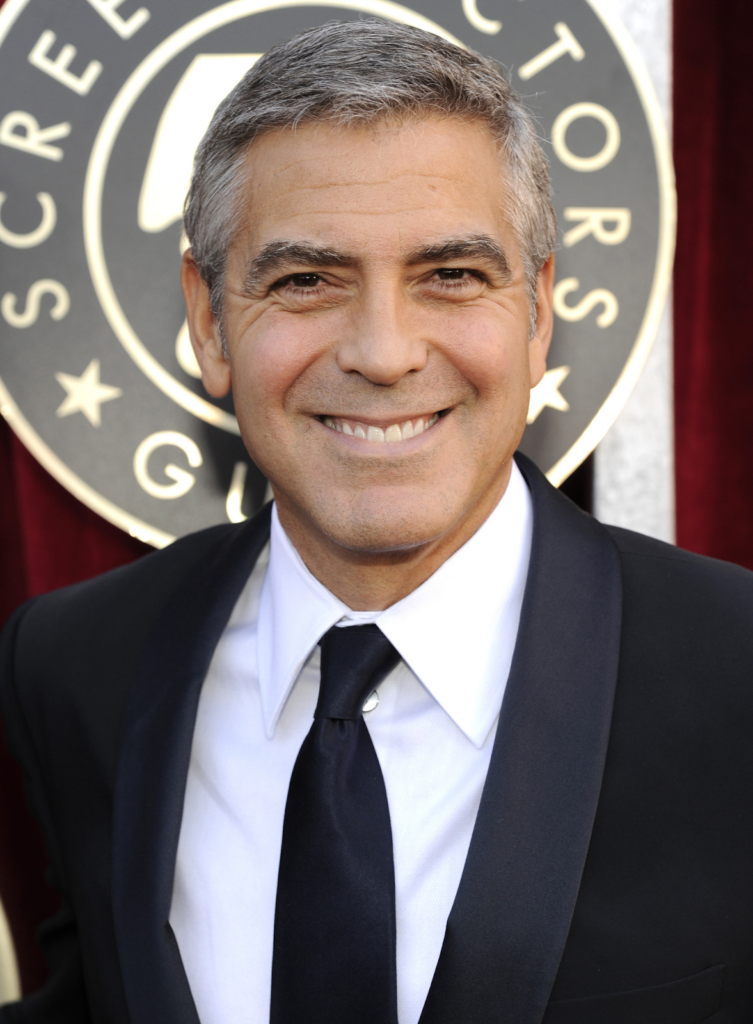

- George Clooney – The Famous Actor

George Clooney has acted in countless fantastic movies and TV shows, each of which has been a hit at the box office! Behind the fame, he has actually been through hard years. When he talked about his early hard years, he mentioned how he used to work as a door-to-door insurance salesman. In an interview with the Evening Standard, he said he was humbled by the experiences of selling insurance door-to-door.

At one point, George Clooney recounted his story of a commission he had received for selling a life insurance policy, but the man died. However, if you haven’t encountered challenges, how can you be as bright as now?

- Harland David Sanders – Founder of Kentucky Fried Chicken

Harland David Sanders is known by the name of his grandfather Kentucky Fried Chicken, and his likeness is sure to be seen whenever passing by the fast-food chain Kentucky Fried Chicken. Until now, his portrait is printed on the outer packaging of KFC merchandise. When Sanders’ father died when he was six while his mother was working, Sanders took on the responsibility of cooking for the family. Unfortunately, his mother later remarried and therefore he ran away from home after being abused by his stepfather.

In his youth, Sanders held multiple jobs, including, of course, insurance broker. Sanders traveled the country promoting his method of frying chickens. If the restaurant likes the taste of fried chicken, he would pay the colonel 5 cents for every piece of chicken that was contracted to sell. Sanders recalled that he had been turned down 1,009 times when trying to promote his fried chicken, not succeeding until the 1,010th attempt. It is believed that most of his perseverance comes from his work experience as an insurance broker. If you are constantly rejected, try harder!

- Benjamin Franklin – Founding Fathers of the United States

As a founding father of the United States, he was a writer, printer, Freemason, postmaster, inventor, statesman etc. Of course, he was also an insurance pioneer. In 1752, Franklin created the Philadelphia Fire Damage Insurance, the first property insurance company in the Americas. In his view, insurance is a gift to society: “whereby every man might help another, without any disservice to himself.”

It could also be said that Franklin was a strong proponent of risk management, aimed at reducing risks and accidents before happening, not just compensating victims after losses. In an impassioned letter to the Philadelphia Gazette, Franklin offered one of his most famous maxims: “An ounce of prevention is worth a pound of cure.” Franklin’s contributions to the field continue to this day, now as The Philadelphia Contributionship.

How can we help?

2CExam provides HKSI LE, IIQE, EAQE and SQE related exam preparation materials. We sell mock question banks for IIQE Papers 1, 2, 3, 5 and MPFE in Chinese and English; and bibles for IIQE Papers 1, 2, 3, MPFE in Chinese. We also offer 1 on 1 tutorial services. Besides, we have also made free tutorial videos for IIQE Papers 1, 2, 3 and MPFE and posted on public channels such as Youtube/ Bilibili/ Tencent/ Iqiyi. 2CExam has been an exam training expert for years. Should you need any help please visit www.2cexam.com.hk or contact us through:

Phone +852 2110 9644 Email: [email protected]

Wechat: hk2cexam WhatsApp: +852 9347 2064

Please support us by leaving comments and likes if you think this article helps you!

You can scan or click on the QR codes to visit our social media.

Latest Article

Categories

過往文章

Contact US

-

Phone:

+852 2110 9644

-

Email:

-

WhatsApp

+852 9347 2064

-

WeChat

hk2cexam

Interesting Articles

Is the IIQE paper based exam or computer based exam easier? Which exam is better to partake in?

Many people are curious about the differences between the IIQE’s computer-based exam and the paper-based exam. As per the two exams’ content, they are pretty much identical. The two exams use the same Study Guide, the exam questions are drawn in the same question bank. Some people say that they have taken a…

Is the HKSI paper-based exam or the computer-based exam easier? Which is better to partake in?

Many people are curious about the differences between the HKSI LE’s computer-based exam and the paper-based exam. As per the two exams’ content, they are pretty much identical. The two exams use the same Study Guide, the exam questions are drawn in the same question bank. Some people say that they have taken…

What are the differences between a computer-based and paper-based exam for the Estate Agents / Salespersons Qualifying Examinations?

There are differences between the computer-based exam and the paper-based exam? Some people say that the computer-based exam / paper-based exam will be easier? Many people are curious about the differences between the EAQE/SQE’s computer- based exam and the paper- based exam. As per the two exams’ content, they are pretty much…

What is the difference between the computer-based exam and the paper-based exam of the Insurance Intermediaries Qualifying Examination

Many people are curious about the difference between the IIQE’s computer-based exam and the paper-based exam. First of all, IIQE does not hold many paper-based examinations. In many cases, it will only hold paper-based examinations for Paper 1. If you have special needs, such as not being proficient with computers, or having a vision…

What are the differences between the computer-based exam and the paper-based exam of the Licensing Examination for Securities and Futures Intermediaries (LE)?

There are differences between the computer-based exam and the paper-based exam? Some people say that the computer-based exam / paper-based exam will be easier? Many people are curious about the differences between the HKSI LE’s computer-based exam and the paper-based exam. First of all, HKSI does not hold many paper-based examinations. In many…

Which Licensing Examination for Securities and Futures Intermediaries exam paper should I partake in?

If you want to work in the front line of the securities industry, you have a good chance of needing to take The Licensing Examination for Securities and Futures Intermediaries. As for what test papers you need to take, first of all, you need to know that the number of the exam paper has…

If I have an overseas professional qualification, can I obtain a SFC securities license simply by recognising my prior qualification

Some students have worked in the securities finance industry outside of Hong Kong, and now they also need to obtain a securities business license in Hong Kong. Can work experience in the securities industry abroad help you waive the exam and allows a candidate to directly apply for the securities license from the Securities…

In order to obtain exemption from the HKSI LE exam or SFC’s academic requirement, how is relevant industry experience considered?

After reading the “Competency Guidelines” issued by the Securities Regulatory Commission, some students may have a big question mark on “Relevant Industry Experience”, “have X years of experience in the past X years”, and then ask us what kind of experience are counted as industry experience so they can be exempted from the Licensing Examination…

Which insurance intermediary qualifying examination paper should I take?

If you want to work in the front line of the insurance industry, you have a good chance of needing to take the Insurance Intermediaries Qualifying Examination (IIQE). As for what exam papers you need to take, first you can check whether you meet certain conditions to be exempted from specific exam paper combinations…

The difference between IA Responsible Officer(RO) and technical representative (TR)

Regulatory Organisation Before explaining the difference between Responsible Officer and Technical Representative, you must first know that there is only one regulatory agency that regulates companies engaging in insurance business: the Insurance Authority (IA). All the powers concerning licensing matters, supervision tasks, sanctions and investigations of intermediaries of insurance intermediaries, insurance companies and insurance…