Contrary to the common belief that “anyone with a smooth tongue can sell insurance” and “the threshold for the insurance industry is low, anyone can do it well,” insurance sales is not as simple as it seems.

In 2015, Google attempted to enter the online insurance sales market. At that time, Google launched a service called “Google Compare,” which allowed consumers to compare and purchase financial products such as car insurance, credit cards, and loans. However, in 2017, two years later, Google announced the closure of the service.

According to reports, Google Compare encountered some challenges in the market, including difficulties in negotiating with insurance companies, regulatory issues, and lower consumer acceptance of online insurance purchasing, especially the latter.

The core of insurance is risk assessment and management. Online sales may not be able to provide this kind of service. For example, online sales cannot provide face-to-face communication with customers, and it is difficult to provide personalized risk assessments and customized insurance products. In addition, online sales may also have security and privacy issues, which cannot provide customers with sufficient protection and a sense of trust.

So, what services can professional insurance practitioners offer?

1.Risk Assessment

Professional insurance practitioners need to comprehensively analyze factors such as customer needs, risk tolerance, financial status, family and health conditions, etc., and conduct detailed assessments of various risks to develop targeted solutions. Those who are not sufficiently trained may not be able to grasp customer needs and tolerance, leading to the purchase of inappropriate insurance products, which not only wastes resources but also increases risk, causing concern instead.

2.Insurance Product Knowledge

There is a wide variety of insurance products, each with its unique features and limitations. Insurance contracts often use professional jargon and complex language, making them difficult for ordinary people to understand. If insurance practitioners cannot clearly explain the details of the product terms, customers may misunderstand and purchase products that do not meet their needs.

3.Specialized Customer Service

Purchasing insurance is not a regular consumer product, but a long-term investment decision that may involve changes in health, finances, and family, requiring adjustments to the policy. In case of accidents or losses, customers need to apply for claims from the insurance company, which involves a complicated process requiring numerous documents and proofs. High-quality customer service is needed at this time. Professional insurance practitioners should pay attention to customer needs and demands, providing quick and accurate responses.

In Hong Kong, insurance brokers and insurance agents are two important roles for these professional insurance practitioners, both of which are insurance intermediaries.

In the past, there was no unified regulatory authority to oversee the entire insurance industry in Hong Kong. Insurance brokers and insurance agents were regulated by different organizations: insurance brokers were supervised by professional associations such as the Professional Insurance Brokers Association (PIBA) and the Hong Kong Confederation of Insurance Brokers (HKCIB), while insurance agents were regulated by the Hong Kong Federation of Insurers (HKFI). These organizations were responsible for registering and managing insurance brokers and agents and handling complaints related to them.

The Hong Kong Insurance Authority (IA) was established on December 7, 2015, with the enactment of the Insurance Companies (Amendment) Ordinance 2015. On June 26, 2017, it took over from the former government department, the Office of the Commissioner of Insurance, to regulate insurance companies. On September 23, 2019, it replaced PIBA, HKCIB, and HKFI to regulate insurance intermediaries.

The IA is independent of the government, aiming to comply with international standards, oversee the development of the insurance industry, and provide better protection for policyholders.

With the establishment of the Insurance Authority, the regulatory work of the insurance industry has become more stringent.

Now, the registration and management of insurance brokers and insurance agents are both handled by the Insurance Authority.

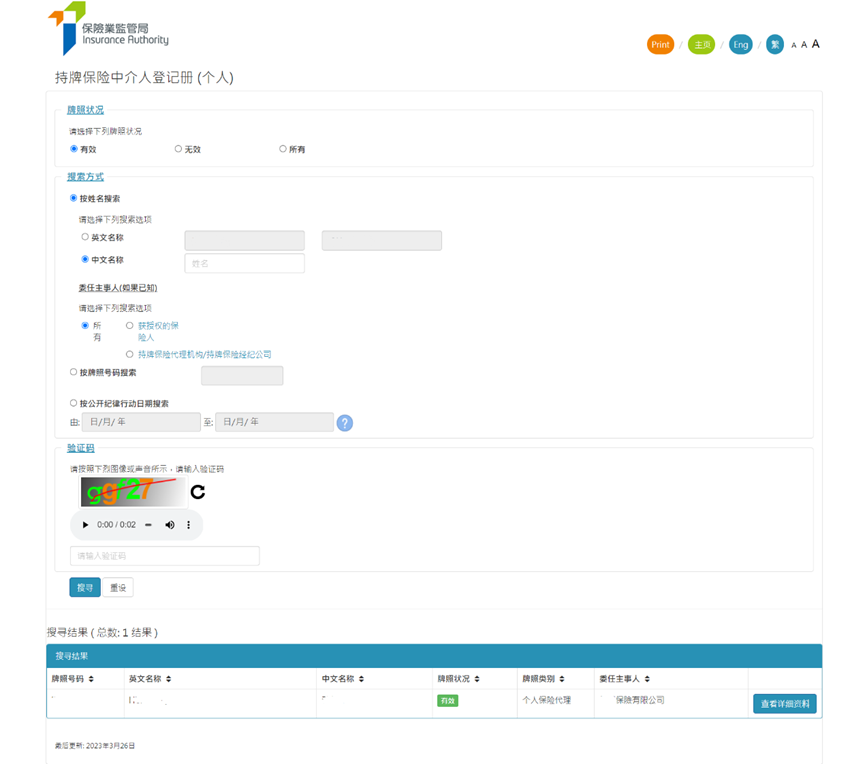

To search for insurance intermediaries who are still registered and valid since September 23, 2019, or who have been registered in the past, you can directly check and verify the “Licensed Insurance Intermediaries (Individual)” Register on the Insurance Authority website: https://iir.ia.org.hk/#/search/individual

If you want to inquire about the insurance intermediary license records that have expired before September 23, 2019, you can try the following two methods:

Method 1: Oral confirmation

Phone: 38999983

Please call the Insurance Authority during office hours (Monday to Friday, 8:45 am to 12:45 pm, and 1:45 pm to 6:00 pm) and provide the license number or ID number of the intermediary you want to inquire about from HKFI/PIBA/CIB.

Method 2: Written confirmation

Email: [email protected]

Provide the license number or ID number of the intermediary you want to inquire about from HKFI/PIBA/CIB in the email and ask the Insurance Authority about the relevant license records.

If you can’t find any information using the methods above, you may have encountered a scammer. In that case, there’s no need to say anything else – run!

How can we help?

2CExam provides HKSI LE, IIQE, EAQE and SQE related exam preparation materials. We sell mock question banks for HKSI LE Papers 1, 2, 3, 5, 6, 7, 8, 9, 12 in Chinese and English; and bibles for HKSI LE Papers 1, 2, 6, 7, 8 in Chinese. We also offer 1 on 1 tutorial services. Besides, we have also made free tutorial videos for HKSI LE Papers 1, 2, 6, 7, 8, 12 and posted on public channels such as Youtube/ Bilibili/ Tencent/ Iqiyi. 2CExam has been an exam training expert for years. Should you need any help please visit www.2cexam.com or contact us through:

Phone +852 2110 9644 Email: [email protected] Wechat: hk2cexam WhatsApp: +852 9347 2064

Please support us by leaving comments and likes if you think this article helps you!

You can scan or click on the QR codes to visit our social media.

Latest Article

Categories

過往文章

Contact US

-

Phone:

+852 2110 9644

-

Email:

-

WhatsApp

+852 9347 2064

-

WeChat

hk2cexam

Interesting Articles

Is the IIQE paper based exam or computer based exam easier? Which exam is better to partake in?

Many people are curious about the differences between the IIQE’s computer-based exam and the paper-based exam. As per the two exams’ content, they are pretty much identical. The two exams use the same Study Guide, the exam questions are drawn in the same question bank. Some people say that they have taken a…

Is the HKSI paper-based exam or the computer-based exam easier? Which is better to partake in?

Many people are curious about the differences between the HKSI LE’s computer-based exam and the paper-based exam. As per the two exams’ content, they are pretty much identical. The two exams use the same Study Guide, the exam questions are drawn in the same question bank. Some people say that they have taken…

What are the differences between a computer-based and paper-based exam for the Estate Agents / Salespersons Qualifying Examinations?

There are differences between the computer-based exam and the paper-based exam? Some people say that the computer-based exam / paper-based exam will be easier? Many people are curious about the differences between the EAQE/SQE’s computer- based exam and the paper- based exam. As per the two exams’ content, they are pretty much…

What is the difference between the computer-based exam and the paper-based exam of the Insurance Intermediaries Qualifying Examination

Many people are curious about the difference between the IIQE’s computer-based exam and the paper-based exam. First of all, IIQE does not hold many paper-based examinations. In many cases, it will only hold paper-based examinations for Paper 1. If you have special needs, such as not being proficient with computers, or having a vision…

What are the differences between the computer-based exam and the paper-based exam of the Licensing Examination for Securities and Futures Intermediaries (LE)?

There are differences between the computer-based exam and the paper-based exam? Some people say that the computer-based exam / paper-based exam will be easier? Many people are curious about the differences between the HKSI LE’s computer-based exam and the paper-based exam. First of all, HKSI does not hold many paper-based examinations. In many…

Which Licensing Examination for Securities and Futures Intermediaries exam paper should I partake in?

If you want to work in the front line of the securities industry, you have a good chance of needing to take The Licensing Examination for Securities and Futures Intermediaries. As for what test papers you need to take, first of all, you need to know that the number of the exam paper has…

If I have an overseas professional qualification, can I obtain a SFC securities license simply by recognising my prior qualification

Some students have worked in the securities finance industry outside of Hong Kong, and now they also need to obtain a securities business license in Hong Kong. Can work experience in the securities industry abroad help you waive the exam and allows a candidate to directly apply for the securities license from the Securities…

In order to obtain exemption from the HKSI LE exam or SFC’s academic requirement, how is relevant industry experience considered?

After reading the “Competency Guidelines” issued by the Securities Regulatory Commission, some students may have a big question mark on “Relevant Industry Experience”, “have X years of experience in the past X years”, and then ask us what kind of experience are counted as industry experience so they can be exempted from the Licensing Examination…

Which insurance intermediary qualifying examination paper should I take?

If you want to work in the front line of the insurance industry, you have a good chance of needing to take the Insurance Intermediaries Qualifying Examination (IIQE). As for what exam papers you need to take, first you can check whether you meet certain conditions to be exempted from specific exam paper combinations…

The difference between IA Responsible Officer(RO) and technical representative (TR)

Regulatory Organisation Before explaining the difference between Responsible Officer and Technical Representative, you must first know that there is only one regulatory agency that regulates companies engaging in insurance business: the Insurance Authority (IA). All the powers concerning licensing matters, supervision tasks, sanctions and investigations of intermediaries of insurance intermediaries, insurance companies and insurance…